Case Studies

Optimizing Financial Management for FileForms with Stripe and Plaid

Introduction

Client Background

FileForms is a digital platform focused on financial compliance and tax reporting. Its users include individuals, small businesses, and enterprises needing automated workflows to manage filings such as FBAR, IRS forms, and international reporting requirements. FileForms sought to modernize its financial management capabilities to support growing transaction volumes, improve user experience, and reduce regulatory risks.

The Problem

FileForms faced significant challenges in streamlining its financial operations. Payment processing required manual oversight, financial data aggregation from user accounts was slow and inconsistent, and reporting lacked real-time accuracy. Compliance with IRS and GDPR standards was mandatory but difficult to scale.

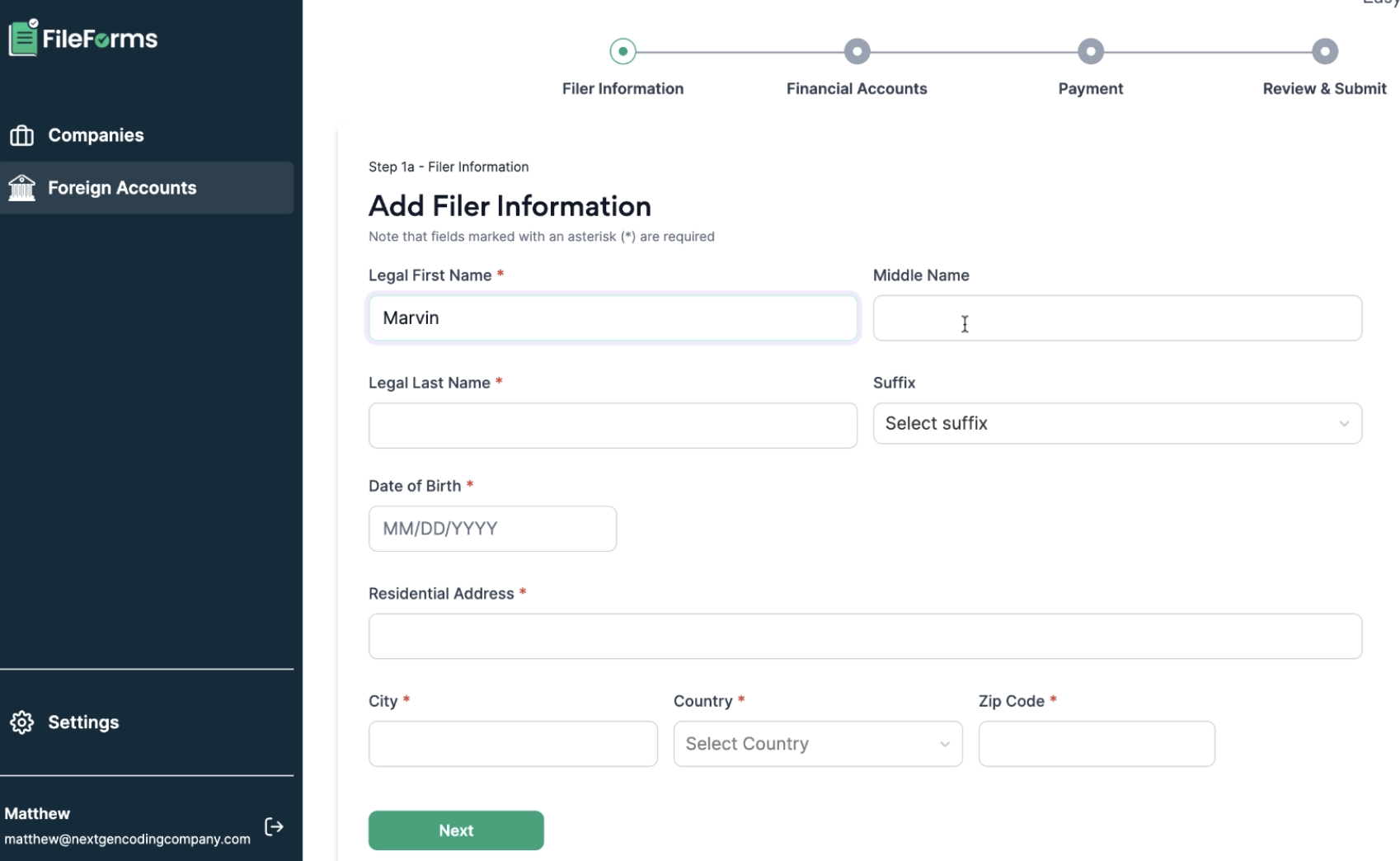

The platform needed a unified financial system with the following capabilities:

- Automated payment processing supporting multiple methods and secure transactions.

- Real-time financial data aggregation across thousands of financial institutions.

- Integrated compliance workflows to reduce manual errors.

- Advanced reporting and analytics to give users actionable insights.

Scalable architecture to support peak filing seasons with millions of transactions.

Our Solution

NextGen designed a comprehensive financial management system for FileForms, powered by Stripe, Plaid, and Google Cloud technologies.

- Integrated Stripe to manage payments across credit cards, ACH, Apple Pay, and Google Pay.

- Enabled automated invoice generation, payment tracking, and subscription renewals.

- Ensured full PCI-DSS compliance for encrypted, fraud-resistant transactions.

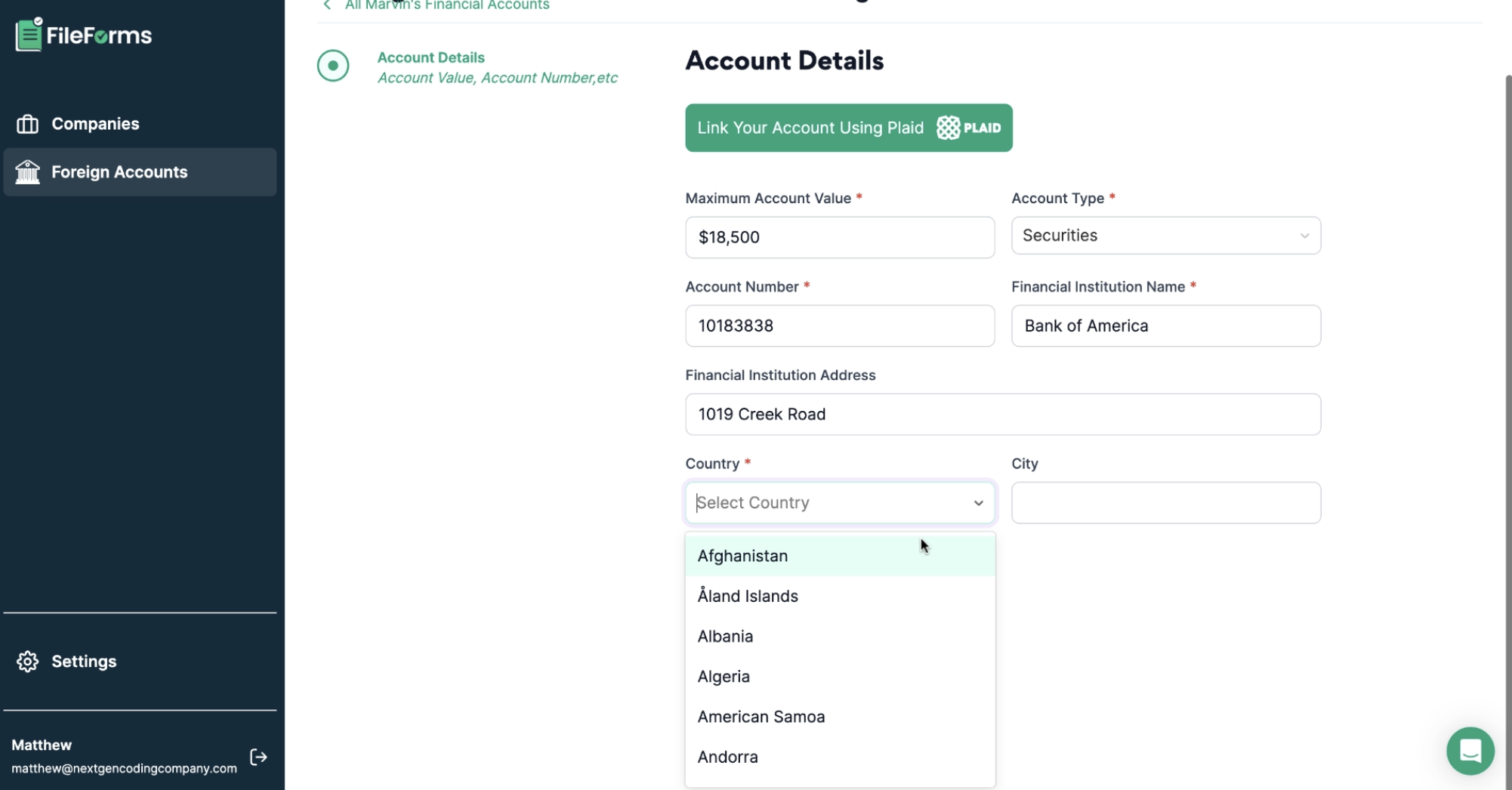

Automated Financial Data Aggregation with Plaid

- Connected Plaid to aggregate data from over 12,000 banks and institutions.

- Enabled seamless import of transaction data for FBAR and IRS filings.

- Applied OAuth connections to ensure security without exposing sensitive credentials.

Dynamic Compliance Workflows

- Processed Plaid financial data using Google Cloud Dataflow.

- Implemented real-time validation to flag inconsistencies and reduce manual review time by 50%.

- Ensured compliance with IRS guidelines through automated workflows.

Customizable Dashboards for Users

- Built a financial dashboard using Next.js and Chart.js.

- Delivered interactive charts for cash flow, spending trends, and compliance readiness.

- Allowed advanced filtering, search, and custom export options.

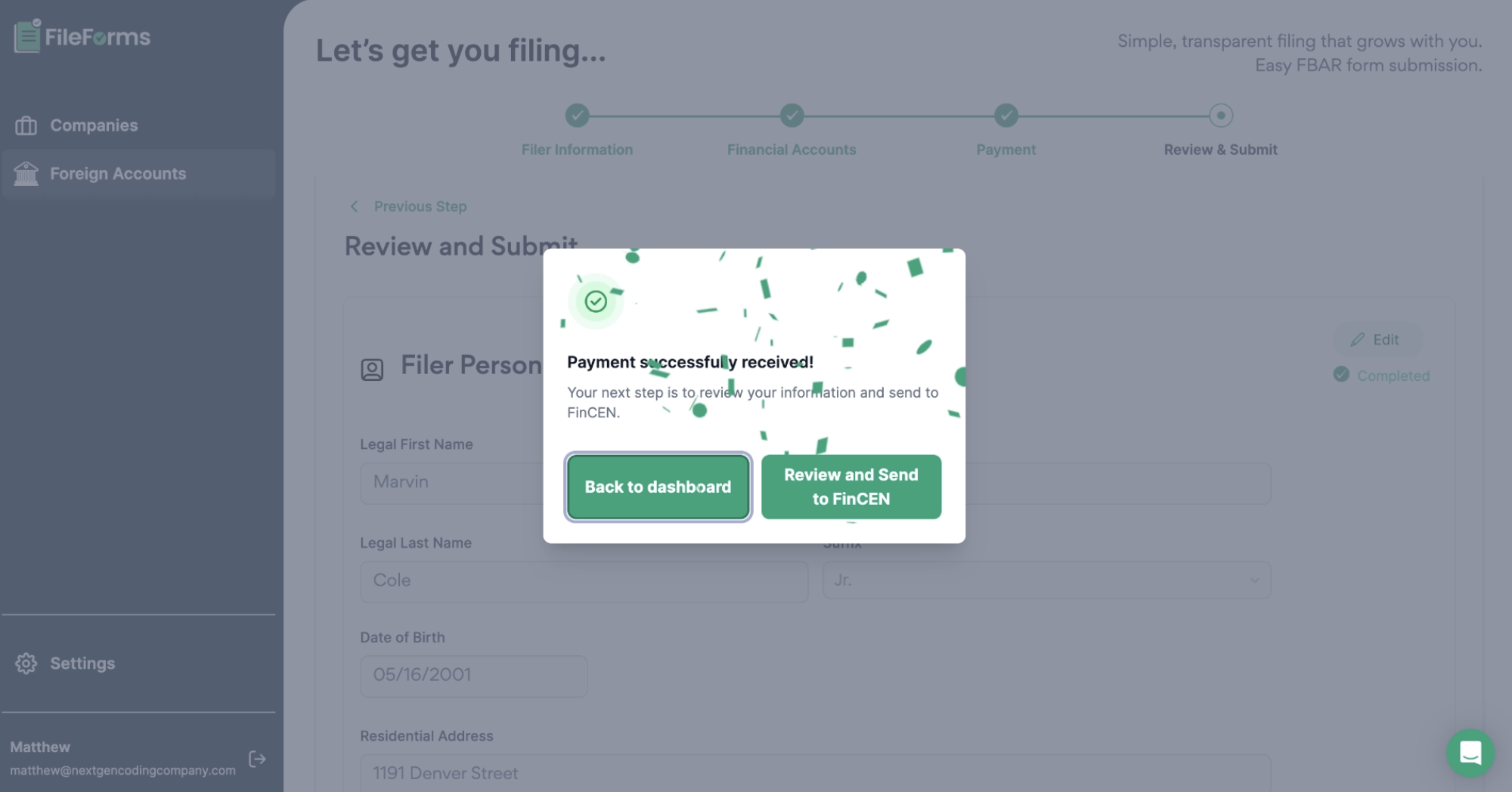

Real-Time Payment Notifications

- Integrated Firebase Cloud Messaging to notify users of payments, renewals, and compliance deadlines.

- Ensured users had immediate visibility into their financial status.

Automated Billing and Invoicing

- Deployed Stripe Billing API to generate recurring invoices, reminders, and flexible billing cycles.

- Reduced late transactions by 25% with automated reminders.

Enhanced Security Protocols

- Applied Google Cloud KMS for encryption of financial data.

- Integrated Firebase Authentication with MFA to protect accounts.

- Achieved compliance with GDPR and IRS financial handling standards.

Scalable Backend Infrastructure

- Deployed the system on Google Kubernetes Engine (GKE) for automatic scaling.

- Supported thousands of concurrent transactions per minute during tax deadlines.

Advanced Reporting with Looker Studio

- Integrated Looker Studio for customizable financial reports.

- Allowed exports in PDF, Excel, and CSV for sharing with auditors and stakeholders.

- Provided admin dashboards with metrics on transaction success rates and user activity.

Results

The implementation of Stripe and Plaid into FileForms delivered measurable improvements across financial operations:

- 45% reduction in manual tasks, as workflows for payments and data aggregation were automated.

- 99.9% accuracy in financial data, reducing filing errors and avoiding penalties.

- 35% increase in user satisfaction, with higher engagement in financial dashboards.

- 20% boost in subscription renewals through automated billing and flexible payments.

- Over 1 million transactions processed during peak filing periods with 99.99% uptime.

- 25% increase in user trust, with strong encryption and MFA driving confidence in data safety.

- Actionable financial insights from Looker Studio reports, improving business decisions and cash flow management.

Why It Matters

In the compliance sector, financial management must balance speed, accuracy, and security. By leveraging Stripe for payments, Plaid for data aggregation, and GCP for infrastructure, FileForms transformed its workflows into an automated, scalable system. The result is a platform that empowers businesses to meet compliance requirements while reducing friction in financial operations.

Call to Action

Businesses managing compliance and financial filings need secure, automated systems that scale with demand. NextGen builds advanced financial infrastructure that integrates seamlessly with payment processors, data aggregators, and compliance tools.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!