Case Studies

Optimizing Financial Management for FileForms with Stripe and Plaid

Introduction

Task

FileForms, a compliance and financial filing platform, sought to optimize its financial management processes to enhance user experience and operational efficiency. The goal was to integrate Stripe and Plaid to automate payment processing and financial data aggregation for seamless compliance and reporting workflows. This system required secure, real-time payment and financial data handling while ensuring compliance with GDPR and IRS guidelines. Additionally, the platform needed advanced reporting capabilities, intuitive user interfaces, and a scalable architecture to support high volumes of transactions and financial data.

Solution

NextGen Coding Company implemented a comprehensive financial management system for FileForms, leveraging Stripe and Plaid integrations to automate workflows and improve efficiency.

- Secure Payment Processing with Stripe:

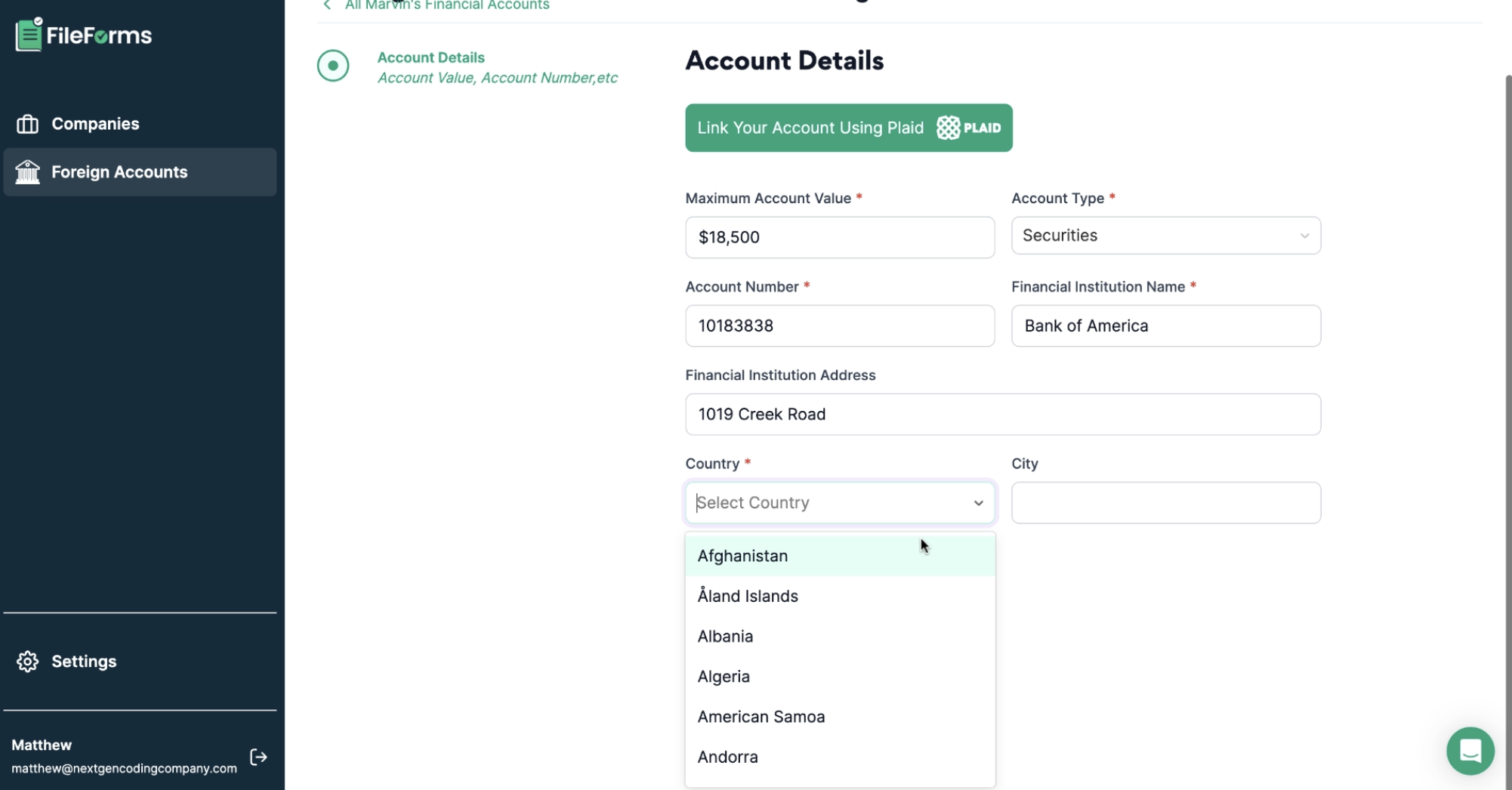

FileForms integrated Stripe to handle all payment transactions securely and efficiently. The integration supported multiple payment methods, including credit cards, ACH transfers, and digital wallets like Apple Pay and Google Pay. Stripe’s PCI-DSS compliance ensured that sensitive payment data was encrypted and securely transmitted, reducing the risk of fraud. Features like automated invoice generation and payment tracking were added to streamline the user experience, enabling users to track their transactions in real time. - Automated Financial Data Aggregation with Plaid:

Plaid was integrated to automate the aggregation of financial data from linked bank accounts. This allowed users to seamlessly import transaction data for compliance filings, such as FBAR and other financial reports. Real-time synchronization with over 12,000 financial institutions ensured that users always had the most up-to-date financial records. Plaid’s OAuth-based secure connections provided a trusted and safe way to link accounts without exposing sensitive login credentials. - Dynamic Compliance Workflows:

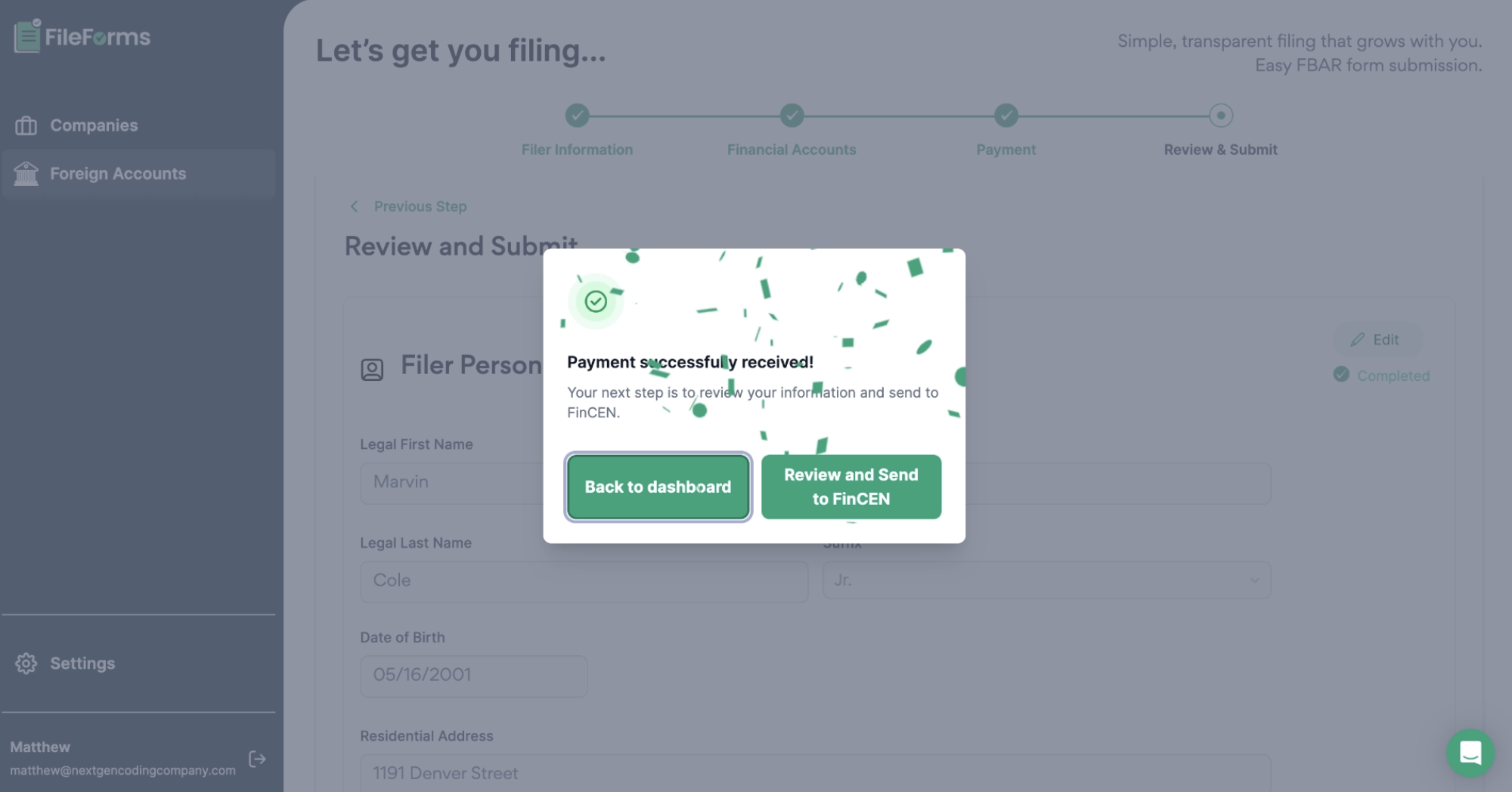

Financial data from Plaid was processed in real time using Google Cloud Dataflow to ensure accuracy and alignment with IRS reporting requirements. The system auto-validated imported data to flag inconsistencies and missing information, reducing manual review times by 50%. Automated workflows ensured that users could complete compliance filings, such as FBAR or other IRS forms, with minimal effort. - Real-Time Payment Notifications and Status Updates:

Users were notified of payment statuses and account updates through Firebase Cloud Messaging. Notifications included payment confirmations, subscription renewals, and compliance deadlines, ensuring users stayed informed at every step of their financial management process. - Customizable Financial Dashboards:

A financial management dashboard built with Next.js provided users with a comprehensive overview of their transactions, financial data, and compliance statuses. Interactive charts and tables powered by Chart.js allowed users to analyze spending trends, payment histories, and cash flow projections. Filters and search functionalities were added to help users drill down into specific financial records. - Enhanced Security for Data Handling:

Financial data and payment information were encrypted using Google Cloud Key Management Service (KMS) to ensure end-to-end security. Multi-factor authentication (MFA) was implemented through Firebase Authentication to protect user accounts from unauthorized access. Compliance with GDPR and IRS guidelines ensured that sensitive data was handled according to industry standards. - Automated Billing and Invoicing:

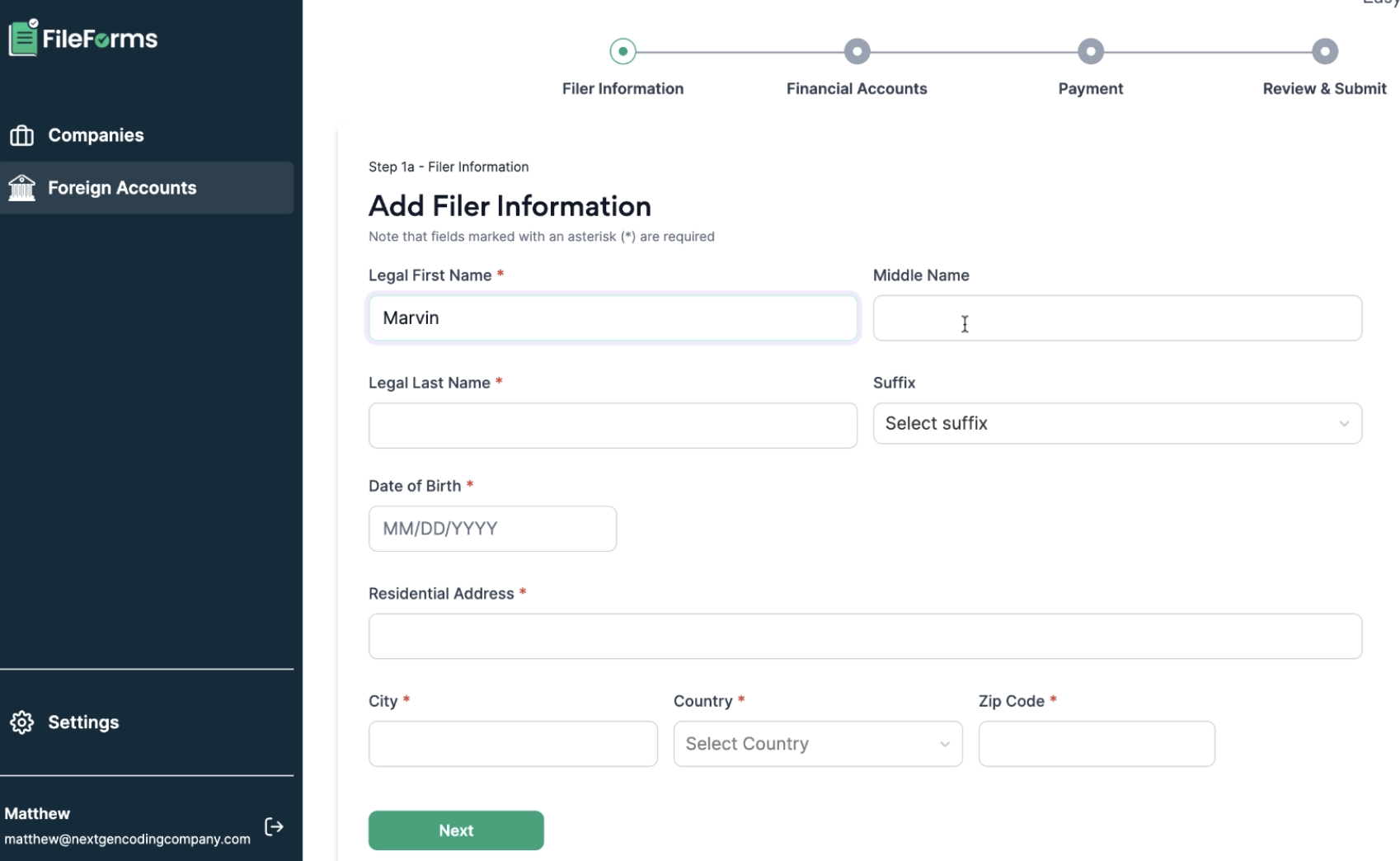

Using Stripe’s Billing API, the platform automated the generation and delivery of invoices. Users could customize billing cycles and receive automated reminders for upcoming payments, reducing late transactions by 25%. The system also supported prorated billing, ensuring flexibility for users managing multiple subscriptions or services. - Seamless User Onboarding for Payments and Financial Data:

The integration included a guided onboarding process for new users, simplifying the setup of linked bank accounts via Plaid and payment methods via Stripe. This reduced onboarding times by 30%, allowing users to start managing their finances immediately. - Scalable Backend with Google Kubernetes Engine (GKE):

The backend was hosted on Google Kubernetes Engine, ensuring scalability during peak filing periods. Auto-scaling capabilities allowed the platform to process thousands of payments and transactions per minute without performance degradation, maintaining 99.99% uptime. - Advanced Reporting Capabilities with Looker Studio:

Users could generate detailed financial reports through Looker Studio. These reports included transaction summaries, payment histories, and compliance statuses, which were customizable based on user needs. Export options in formats like PDF and Excel allowed users to share reports with auditors and stakeholders easily. - Real-Time Analytics for Admins:

Admin users were provided with a monitoring dashboard that included metrics on payment success rates, user activity, and financial trends. Google Analytics 4 was integrated to provide insights into user behavior, enabling the platform to optimize workflows and enhance user experience.

Outcome

The integration of Stripe and Plaid into FileForms’ platform delivered transformative results, significantly improving financial management for users and administrators:

- Streamlined Payment and Data Workflows:

Automated payment processing and financial data aggregation reduced manual tasks by 45%, enabling businesses to focus on strategic priorities rather than administrative work. - Enhanced Data Accuracy and Compliance:

Real-time validation and synchronization with Plaid ensured that financial data was 99.9% accurate, reducing errors in compliance filings and preventing penalties from regulatory agencies. - Improved User Engagement and Satisfaction:

The intuitive financial dashboard and seamless payment experiences built with Stripe and Next.js resulted in a 35% increase in user satisfaction scores, with users praising the platform’s simplicity and reliability. - Increased Platform Revenue:

Automated billing and invoicing through Stripe’s Billing API contributed to a 20% increase in subscription renewals, as users benefited from timely reminders and flexible payment options. - Scalable and Reliable Performance:

The platform processed over 1 million transactions during peak filing periods, maintaining high performance and 99.99% uptime with the help of Google Kubernetes Engine (GKE). - Actionable Insights for Better Decision-Making:

Advanced reporting tools powered by Looker Studio provided businesses with detailed financial insights, improving cash flow management and helping users identify cost-saving opportunities. - Secure and Trusted Platform:

Robust security measures, including encryption and multi-factor authentication, boosted user trust, with surveys indicating a 25% improvement in confidence regarding data safety and privacy.

By integrating Stripe and Plaid, NextGen Coding Company enabled FileForms to deliver a seamless, secure, and highly efficient financial management experience, setting new standards in compliance and payment processing.

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!