Case Studies

Implementing An Automated OCR Processing System for FileForms

Introduction

Client Background

FileForms is a digital platform focused on simplifying tax and compliance reporting. Its solutions are designed to handle high volumes of sensitive financial data, with a specific emphasis on the Foreign Bank and Financial Accounts Report (FBAR) process. Manual data entry created risks of inefficiency, errors, and compliance failures. FileForms engaged NextGen to modernize workflows with automation, intelligent document processing, and secure financial integrations.

The Problem

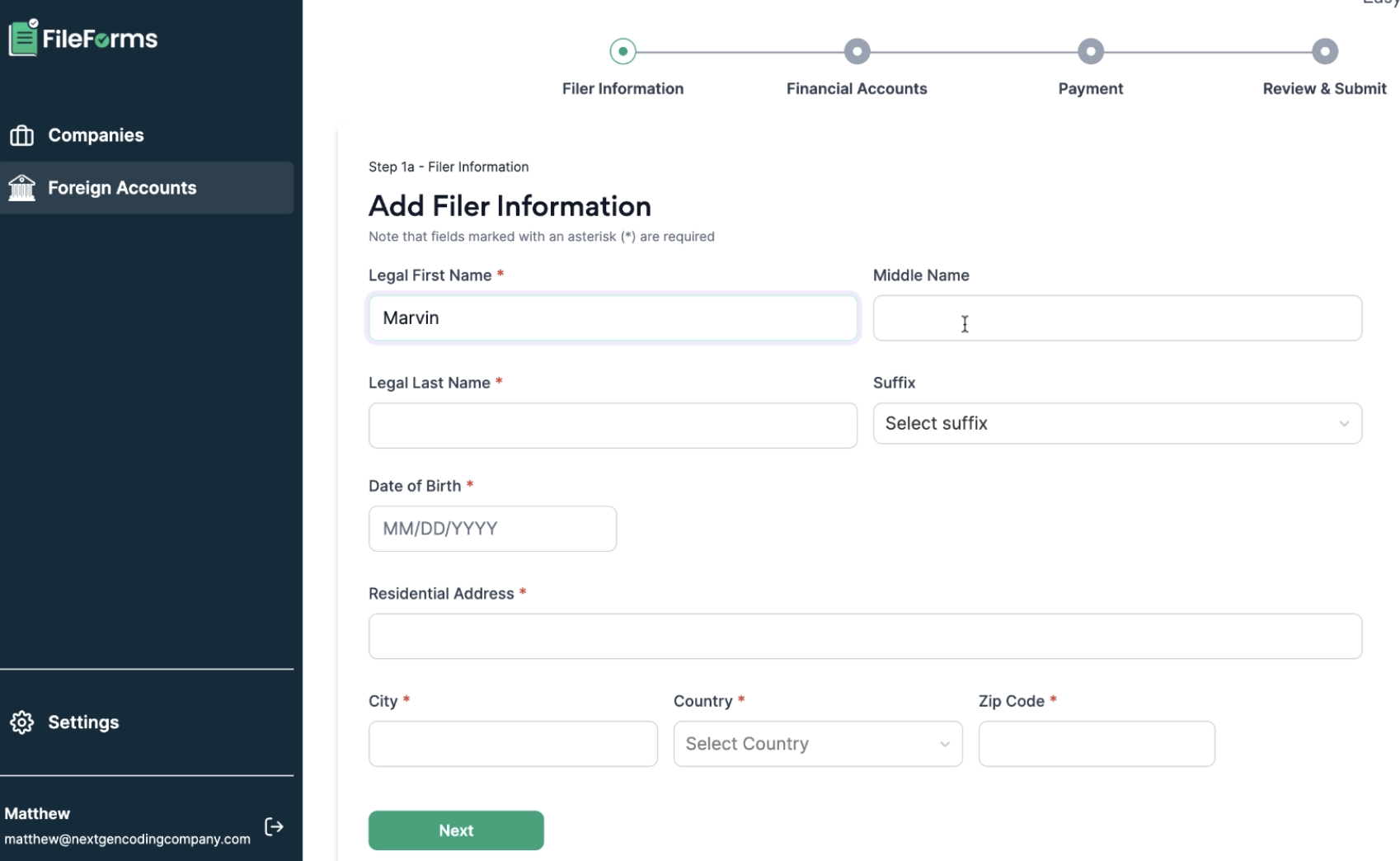

Managing FBAR submissions presented several challenges for FileForms:

- Heavy reliance on manual data entry across scanned bank statements and tax forms.

- High risk of human error during compliance reporting.

- Need for OCR-based automation to process structured and unstructured data.

- Requirement for secure payment integrations to streamline user transactions.

- A system capable of handling peak loads during tax filing deadlines.

- Full compliance with IRS guidelines, GDPR, and financial data privacy regulations.

To remain competitive, FileForms needed an automated solution capable of transforming raw document uploads into validated, compliant, and submission-ready reports.

Our Solution

NextGen developed a scalable OCR processing system for FileForms, integrating advanced cloud services, secure payment APIs, and compliance automation.

- Used Tesseract OCR to extract data from scanned financial documents.

- Enhanced accuracy with AWS Textract, processing high volumes of structured and unstructured content in real time.

Real-Time Data Validation and Aggregation

- Applied Google Cloud Dataflow pipelines to validate extracted data.

- Enabled real-time financial data aggregation across multiple accounts, giving users consolidated compliance views.

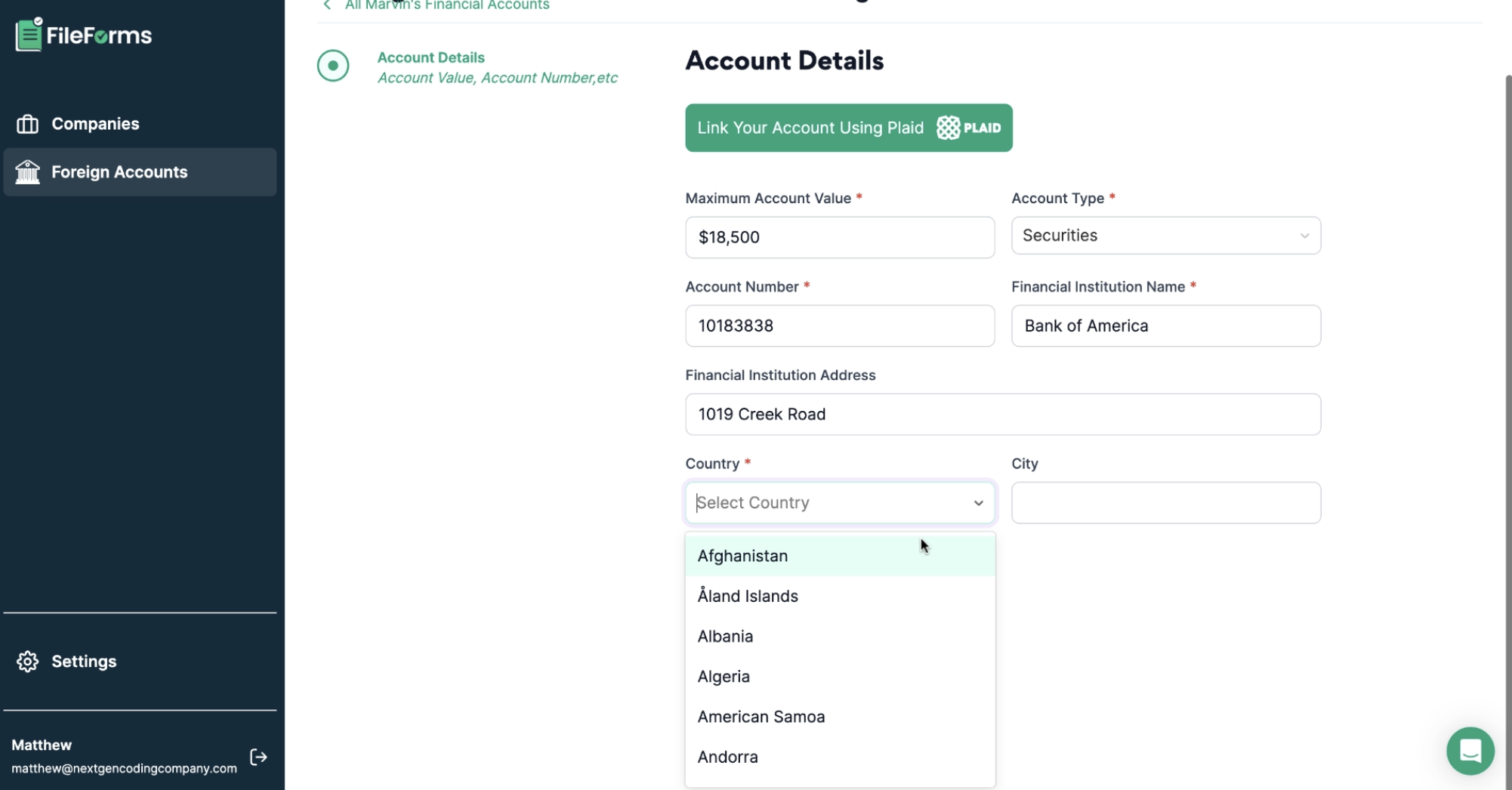

Secure Payment Integration

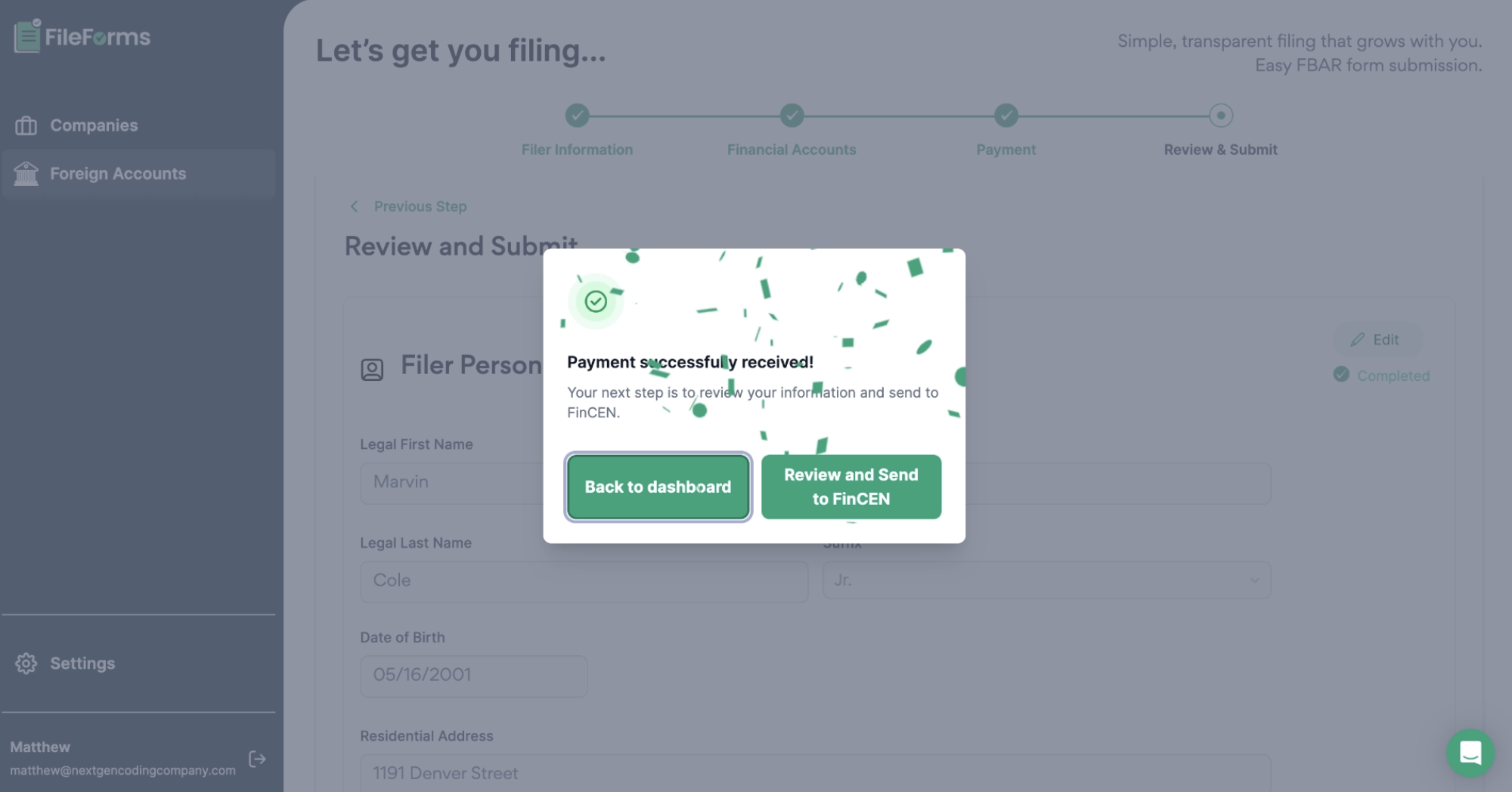

- Implemented Stripe for payment processing.

- Integrated Plaid to securely link user bank accounts and fetch transactional data.

Automated PDF Generation for Compliance

- Built a module with PDFKit to automatically format and generate FBAR-ready PDF reports.

- Allowed direct submission of compliant forms to regulatory agencies.

User Interface and Experience

- Designed a Next.js-powered front end for responsive performance and server-side rendering.

- Delivered modern prototypes using Figma, improving navigation and ease of use.

Scalable Infrastructure on AWS

- Hosted on AWS with AWS Lambda for serverless scaling.

- Used AWS S3 for secure storage of uploaded and processed documents.

Data Security and Compliance

- Applied encryption via AWS Key Management Service (KMS) for data at rest and in transit.

- Enforced role-based access control (RBAC) with Firebase Authentication.

- Aligned architecture with GDPR and IRS data protection requirements.

Automated Error Detection with Machine Learning

- Deployed AWS SageMaker models to detect anomalies during OCR extraction.

- Reduced manual review by flagging inconsistent or incomplete records.

Results

The automated OCR solution delivered significant improvements for FileForms and its users:

- 95% error reduction in financial data entry.

- 40% faster processing times, enabled by real-time pipelines and automated validations.

- 500,000+ concurrent users supported during peak filing periods, with 99.99% uptime on AWS.

- 25% increase in successful transactions, following Stripe and Plaid integrations.

- 30% higher user satisfaction scores, supported by an intuitive Next.js interface.

- 20% increase in trust metrics, thanks to IRS/GDPR compliance and secure data handling.

- 50% reduction in operational costs, due to reduced manual review and streamlined workflows.

Why It Matters

Tax and compliance platforms succeed by minimizing user friction while maximizing accuracy and regulatory compliance. NextGen’s solution positioned FileForms as a trusted leader in digital FBAR compliance, offering automation at scale without compromising on data privacy or security. By combining OCR, AI-driven anomaly detection, secure payments, and scalable AWS infrastructure, the project demonstrated how intelligent automation can modernize complex financial reporting systems.

Call to Action

Compliance platforms that integrate OCR and automation improve accuracy, reduce costs, and strengthen user trust. NextGen designs scalable systems that blend cloud infrastructure, AI, and compliance-ready workflows to transform tax and regulatory services.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!