Case Studies

Implementing An Automated OCR Processing System for FileForms

Introduction

Task

FileForms, a digital platform specializing in tax and compliance solutions, aimed to revolutionize its workflow for managing the Foreign Bank and Financial Accounts Report (FBAR). The challenge was to automate manual data entry, ensure compliance with stringent regulatory requirements, and create a seamless user experience. Key objectives included integrating OCR (Optical Character Recognition) technology to automate data extraction from uploaded documents, streamlining payment processes with Stripe and Plaid, and offering real-time financial data aggregation. The platform also required a secure and scalable infrastructure to handle high volumes of sensitive financial data while maintaining compliance with global standards like GDPR and IRS guidelines.

Solution

NextGen Coding Company implemented a state-of-the-art automated OCR processing system, leveraging advanced technologies to transform FileForms’ platform into a streamlined and efficient solution for managing FBAR submissions.

- OCR Integration for Automated Data Extraction:

FileForms adopted Tesseract OCR for optical character recognition, enabling the automated extraction of data from scanned financial documents such as bank statements and tax forms. The OCR system was integrated with AWS Textract for enhanced accuracy, processing high volumes of structured and unstructured data in real time. - Real-Time Data Validation and Aggregation:

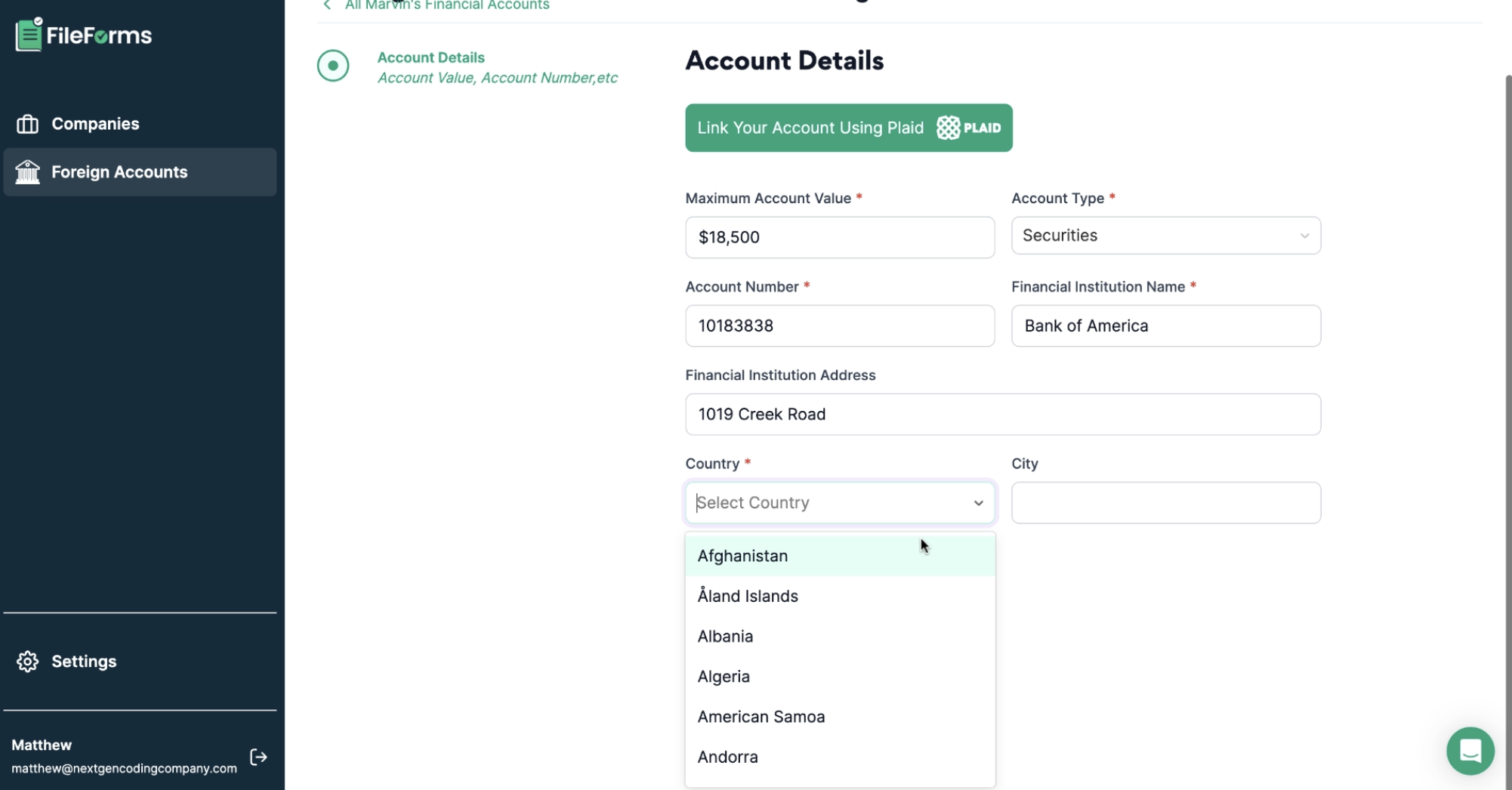

Extracted data was validated using Google Cloud Dataflow pipelines to ensure accuracy and consistency. Real-time aggregation features allowed users to consolidate financial data across multiple accounts, providing an up-to-date view of their compliance status. - Secure Payment Integration with Stripe and Plaid:

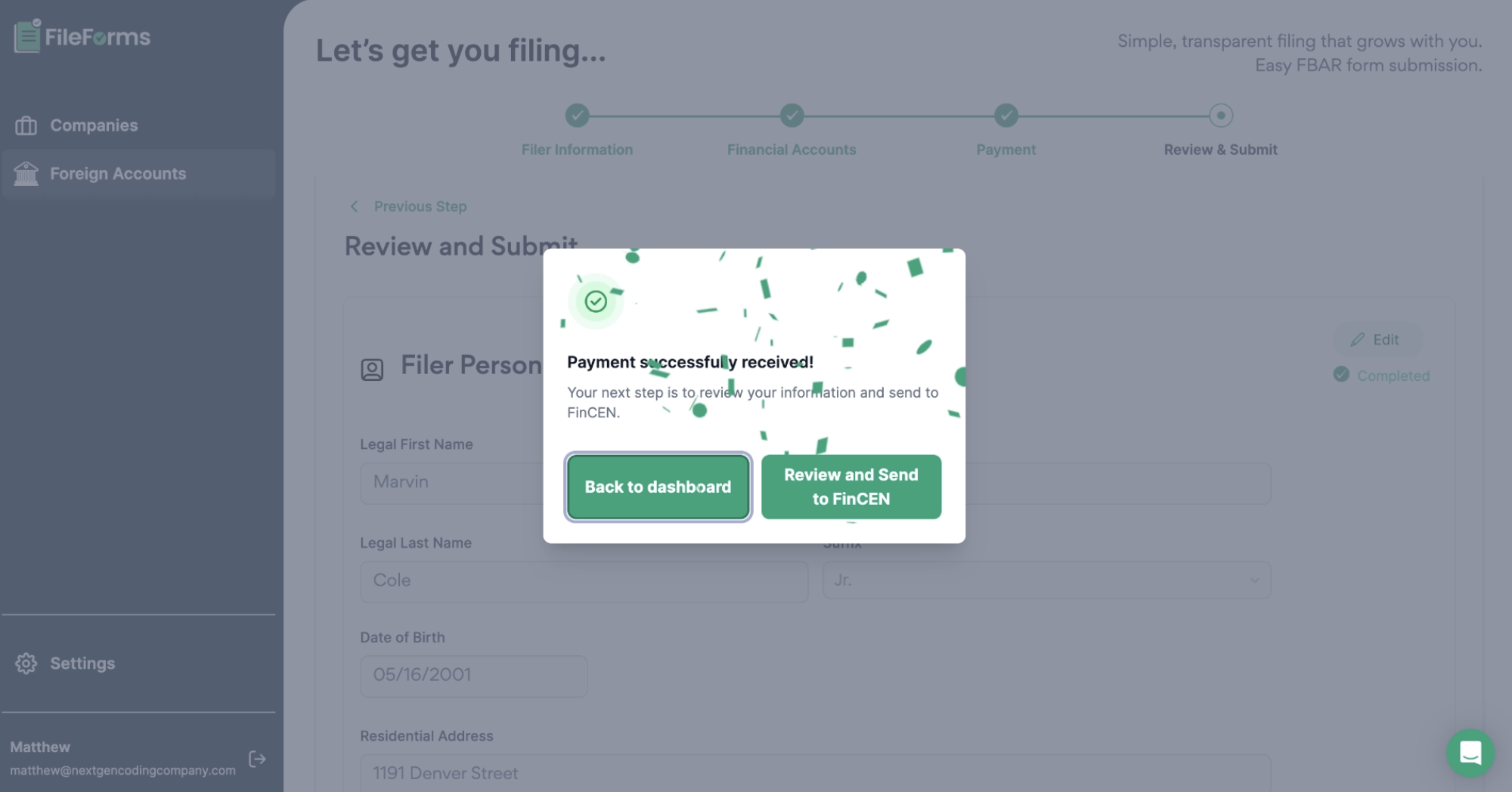

The platform integrated Stripe for secure payment processing and Plaid for automated financial data intake. Users could link their bank accounts securely to fetch transactional data, reducing manual entry errors and ensuring a smooth payment experience. - Compliant PDF Generation for Submission:

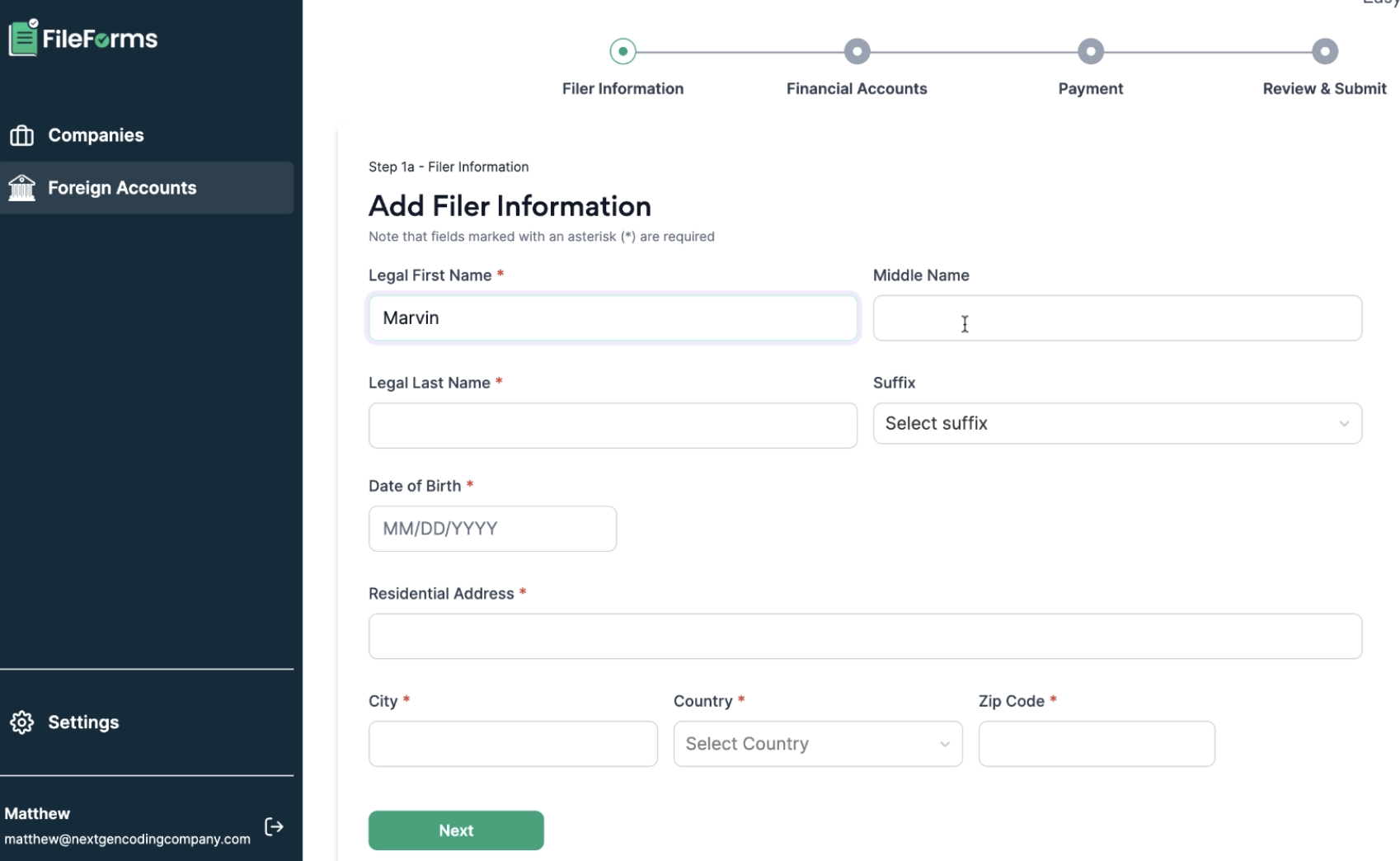

A PDF generation module was built using PDFKit, automatically formatting the extracted data into compliant FBAR-ready PDFs. This feature ensured that users could directly submit their forms to the appropriate regulatory agencies without additional processing. - User-Friendly Interface with Next.js and Figma:

The platform’s front end was redesigned using Next.js for high-performance server-side rendering, ensuring fast load times and responsiveness. Prototypes and designs created in Figma delivered a modern, intuitive user experience, making it easier for users to navigate the FBAR filing process. - Scalable Infrastructure with AWS:

The system was hosted on AWS, using services like AWS Lambda for serverless computing and AWS S3 for secure document storage. Auto-scaling ensured the platform could handle spikes in user activity during tax filing deadlines. - Regulatory Compliance and Security:

Data encryption using AWS Key Management Service (KMS) ensured compliance with GDPR and IRS regulations. Role-based access control was implemented with Firebase Authentication to restrict access to sensitive data, enhancing platform security. - Automated Error Detection with AI Models:

Machine learning models were integrated using AWS SageMaker to detect anomalies in the data extraction process, reducing manual review times by identifying potential errors or discrepancies.

Outcome

The automated OCR processing system delivered transformative results for FileForms, significantly improving efficiency, accuracy, and user satisfaction:

- Increased Accuracy and Reduced Errors:

OCR-powered data extraction and validation eliminated 95% of manual errors, ensuring accurate financial data entry for FBAR submissions. - Enhanced Processing Speed:

The integration of real-time data pipelines reduced average processing times by 40%, allowing users to complete their filings faster and with greater confidence. - Scalable Performance During Filing Deadlines:

Hosted on AWS, the platform successfully handled over 500,000 concurrent users during peak filing periods, maintaining a 99.99% uptime rate. - Simplified Payment Experience:

Secure payment integrations with Stripe and Plaid resulted in a 25% increase in successful transactions, streamlining the overall user experience. - User Satisfaction and Engagement:

Surveys reported a 30% increase in user satisfaction scores, with users praising the platform’s intuitive interface and real-time capabilities built using Next.js. - Compliance Confidence:

Automated PDF generation and secure data handling ensured full compliance with IRS and GDPR standards, leading to a 20% boost in user trust. - Reduced Operational Costs:

The automation of data entry and error detection reduced manual review efforts by 50%, enabling FileForms to allocate resources more efficiently.

Through the implementation of an advanced OCR processing system, NextGen Coding Company empowered FileForms to deliver a streamlined, secure, and user-friendly experience, setting a new standard for tax and compliance platforms.

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!