Case Studies

How AWS Powered the FBAR Project for FileForms

Introduction

Task

FileForms, a compliance-focused platform, aimed to streamline the management and filing process for the Foreign Bank and Financial Accounts Report (FBAR). The objective was to develop an automated, scalable system capable of handling complex workflows, such as financial data aggregation, real-time validation, and compliance-ready form generation. The solution needed to ensure data security, regulatory compliance with FinCEN, GDPR, and IRS guidelines, and seamless user experience. AWS was chosen for its ability to provide scalable, secure, and cost-effective cloud solutions tailored to these requirements.

Solution

NextGen Coding Company utilized AWS to deliver a robust, automated platform for FileForms’ FBAR project, integrating advanced technologies to enhance every stage of the filing process.

- Scalable Infrastructure with AWS EC2 and Auto Scaling:

The backend infrastructure was deployed on AWS EC2 instances, with Auto Scaling enabling dynamic resource allocation during high-traffic periods. This ensured the system could handle peak workloads, such as at the end of filing deadlines, while maintaining optimal performance. - Financial Data Aggregation with AWS Lambda:

AWS Lambda was used to process financial data from multiple sources in real time. Lambda functions validated the imported data against FBAR requirements, enabling users to identify discrepancies immediately. This automation reduced manual processing times by 40%. - Secure Document Storage with Amazon S3:

All sensitive documents, including financial statements and compliance forms, were stored in Amazon S3. With server-side encryption and multi-region replication, the system ensured high availability, disaster recovery, and compliance with FinCEN and GDPR requirements. - Automated PDF Generation with AWS Textract and Lambda:

Form generation was powered by AWS Textract, which extracted data from financial documents and used Lambda functions to populate FBAR forms automatically. This eliminated manual data entry, improving accuracy and saving users significant time. - Database Optimization with Amazon RDS:

The platform’s database was migrated to Amazon RDS to improve data handling and query performance. Automated backups and failover capabilities ensured reliability and availability for critical compliance data. - Real-Time Notifications with Amazon SNS:

Users received notifications about filing deadlines, validation errors, and submission statuses through Amazon Simple Notification Service (SNS). These real-time updates enhanced user engagement, reducing missed deadlines by 25%. - Analytics and Reporting with Amazon Redshift:

Advanced analytics were built using Amazon Redshift, enabling the platform to generate detailed insights for administrators and users. Reports on compliance trends, filing statuses, and user activity were visualized through Looker Studio dashboards. - Compliance Tracking with AWS CloudTrail:

AWS CloudTrail was integrated to track user activity, ensuring full compliance with FinCEN and IRS regulations. CloudTrail logs provided detailed audit trails, supporting transparency and regulatory adherence. - Cost Optimization with AWS Savings Plans:

AWS Savings Plans were utilized to manage operational costs effectively while maintaining the ability to scale during high-demand periods. This approach reduced overall cloud expenditure by 20%. - Disaster Recovery and Backup with AWS Backup:

A disaster recovery plan was implemented using AWS Backup to ensure data integrity and availability in case of unexpected failures. Automated snapshots and cross-region replication provided a reliable recovery mechanism.

Outcome

The AWS-powered FBAR project transformed FileForms into a cutting-edge compliance platform, delivering significant benefits to users and administrators:

- Enhanced Scalability:

With AWS EC2 and Auto Scaling, the platform handled over 1 million concurrent users during peak filing periods, maintaining a 99.99% uptime rate. - Faster Filing Processes:

Automated workflows powered by AWS Lambda and Textract reduced the average time to complete FBAR filings by 40%, increasing overall user satisfaction. - Improved Data Security:

Documents stored in Amazon S3 with encryption and role-based access controls boosted user trust, with surveys showing a 30% improvement in perceived platform security. - Real-Time User Engagement:

Notifications sent through Amazon SNS improved user engagement, reducing missed filing deadlines by 25%. - Actionable Insights Through Analytics:

Analytics powered by Amazon Redshift and visualized with Looker Studio enabled users to monitor filing trends and identify compliance gaps, leading to 20% better compliance rates. - Regulatory Compliance Confidence:

Activity tracking with AWS CloudTrail ensured full compliance with FinCEN and IRS requirements, providing a transparent and audit-ready platform. - Reduced Operational Costs:

The adoption of AWS Savings Plans and resource optimization strategies lowered cloud costs by 20%, allowing reinvestment in new features and services.

By leveraging AWS technologies, NextGen Coding Company enabled FileForms to revolutionize its FBAR management process, delivering a secure, scalable, and efficient solution for modern compliance needs.

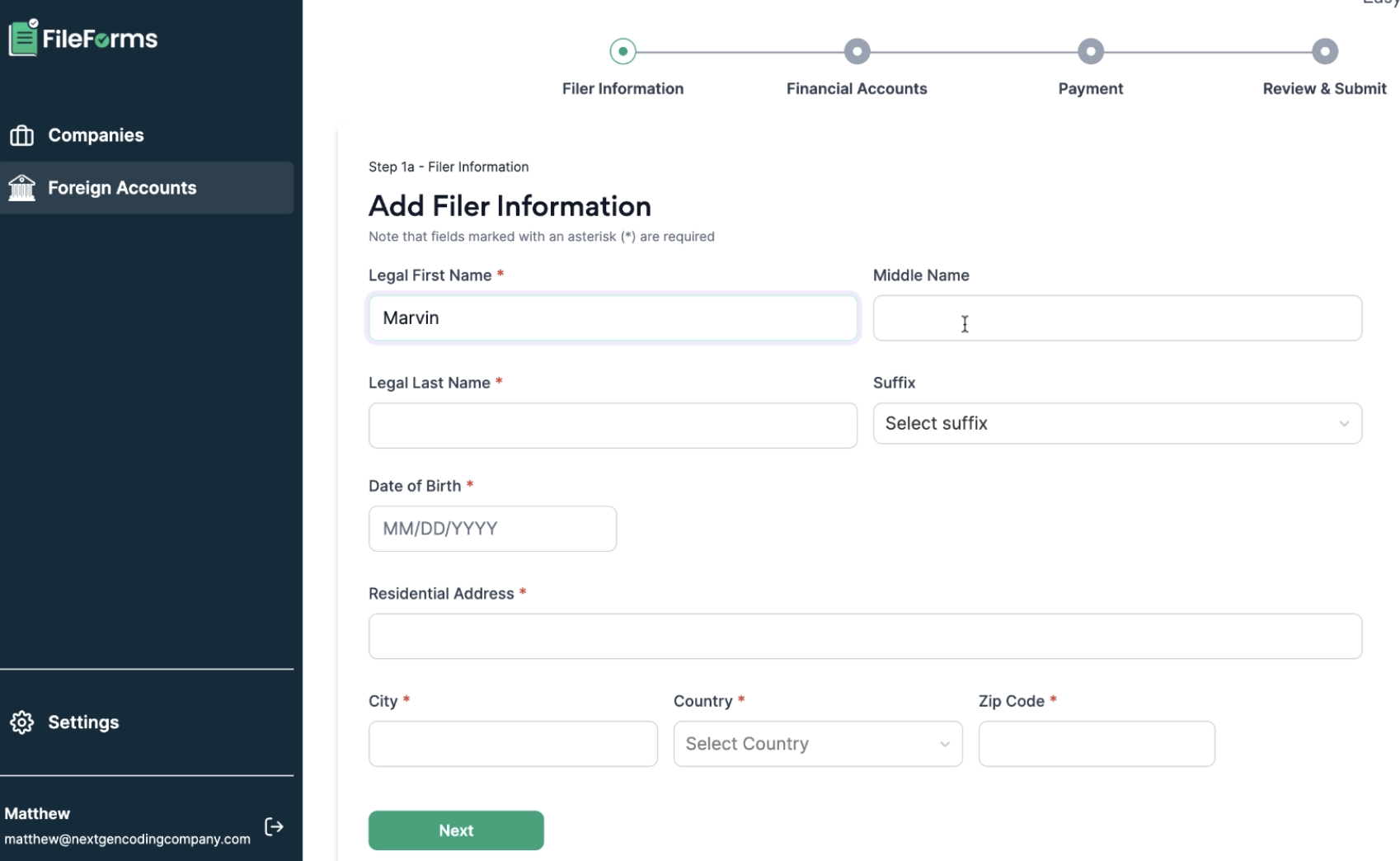

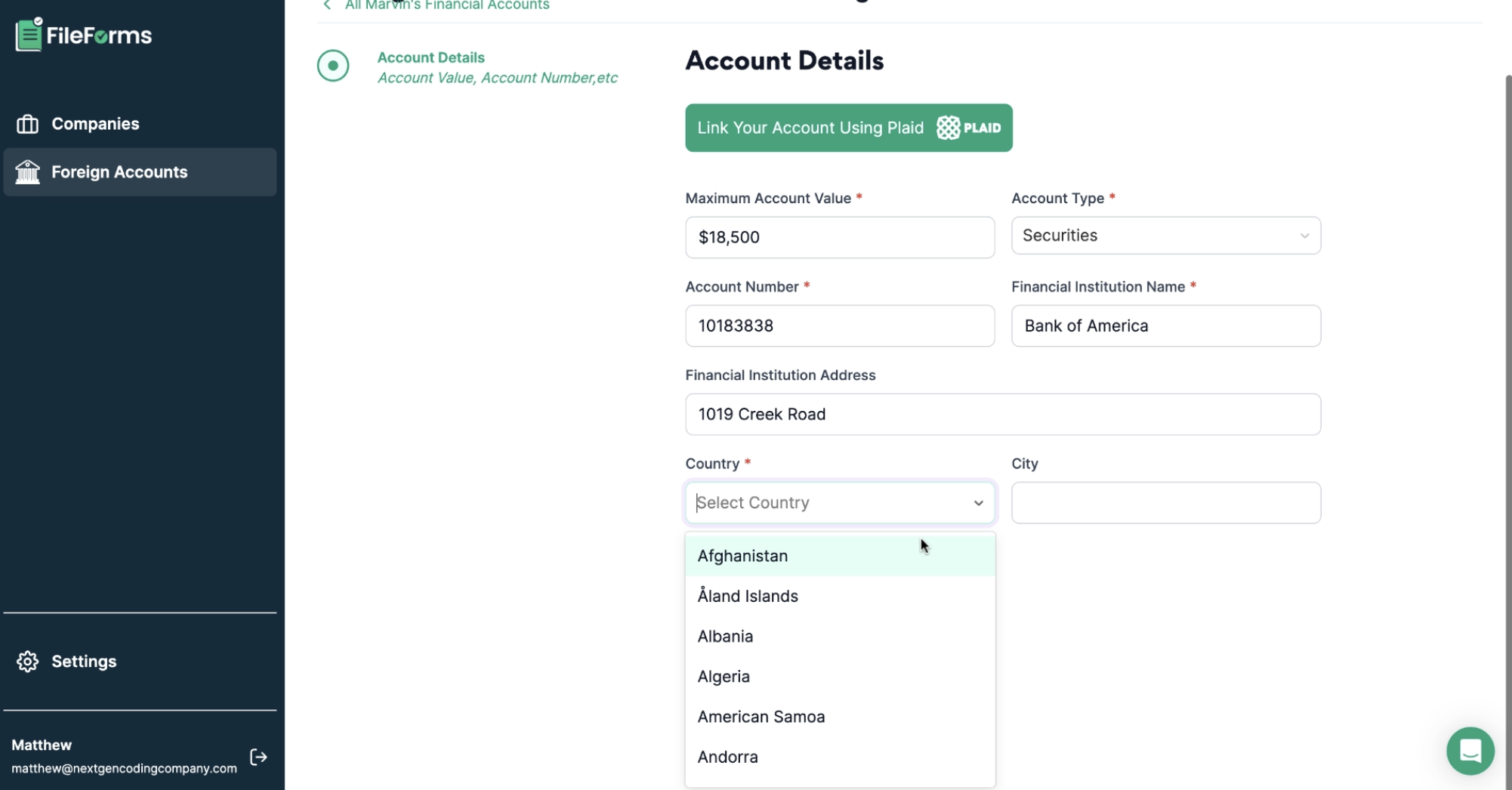

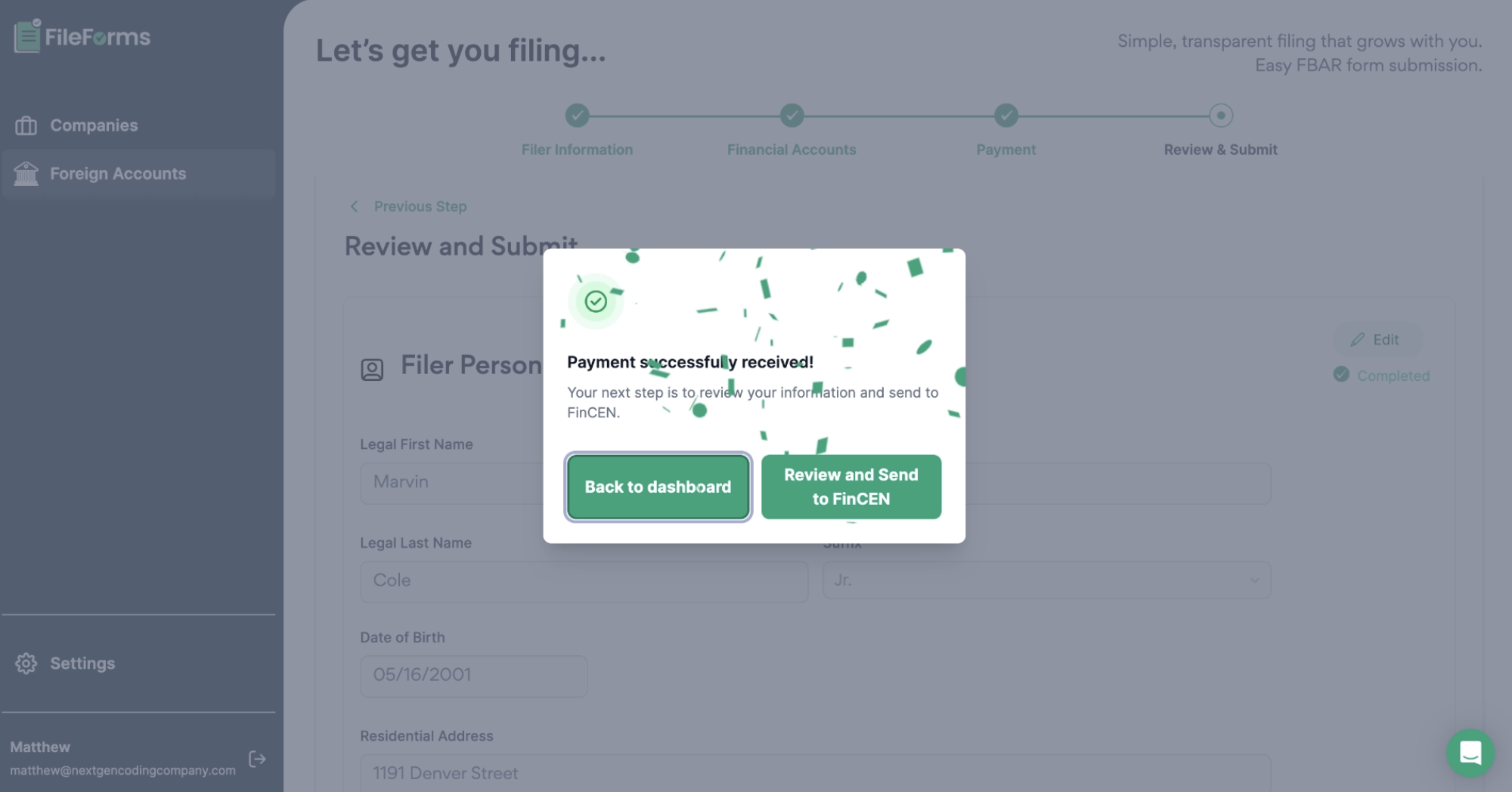

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!