Case Studies

FileForms FBAR Project

Introduction

Client Background

FileForms is a compliance and regulatory filings platform focused on simplifying complex reporting requirements. To strengthen its offerings, FileForms engaged NextGen Coding Company to design and implement a fully integrated Foreign Bank and Financial Accounts Report (FBAR) filing solution. The objective was to deliver automation, security, and compliance at scale, ensuring users could manage FBAR filings efficiently within the platform.

The Problem

FBAR filing presents unique challenges due to strict FinCEN and IRS requirements, heavy data entry needs, and significant penalties for filing errors. FileForms needed a solution that would:

- Provide an intuitive FBAR initiation and completion workflow directly inside the existing platform.

- Automate financial data aggregation using trusted integrations.

- Ensure secure and transparent payment handling for filing fees.

- Auto-generate compliance-ready documents aligned with official FinCEN 114 formatting.

- Maintain compliance with FinCEN, IRS, and GDPR regulations.

- Scale to support thousands of concurrent users during peak tax filing periods.

Our Solution

NextGen designed and delivered a fully integrated FBAR module for FileForms, combining automation, financial integrations, and compliance-driven workflows.

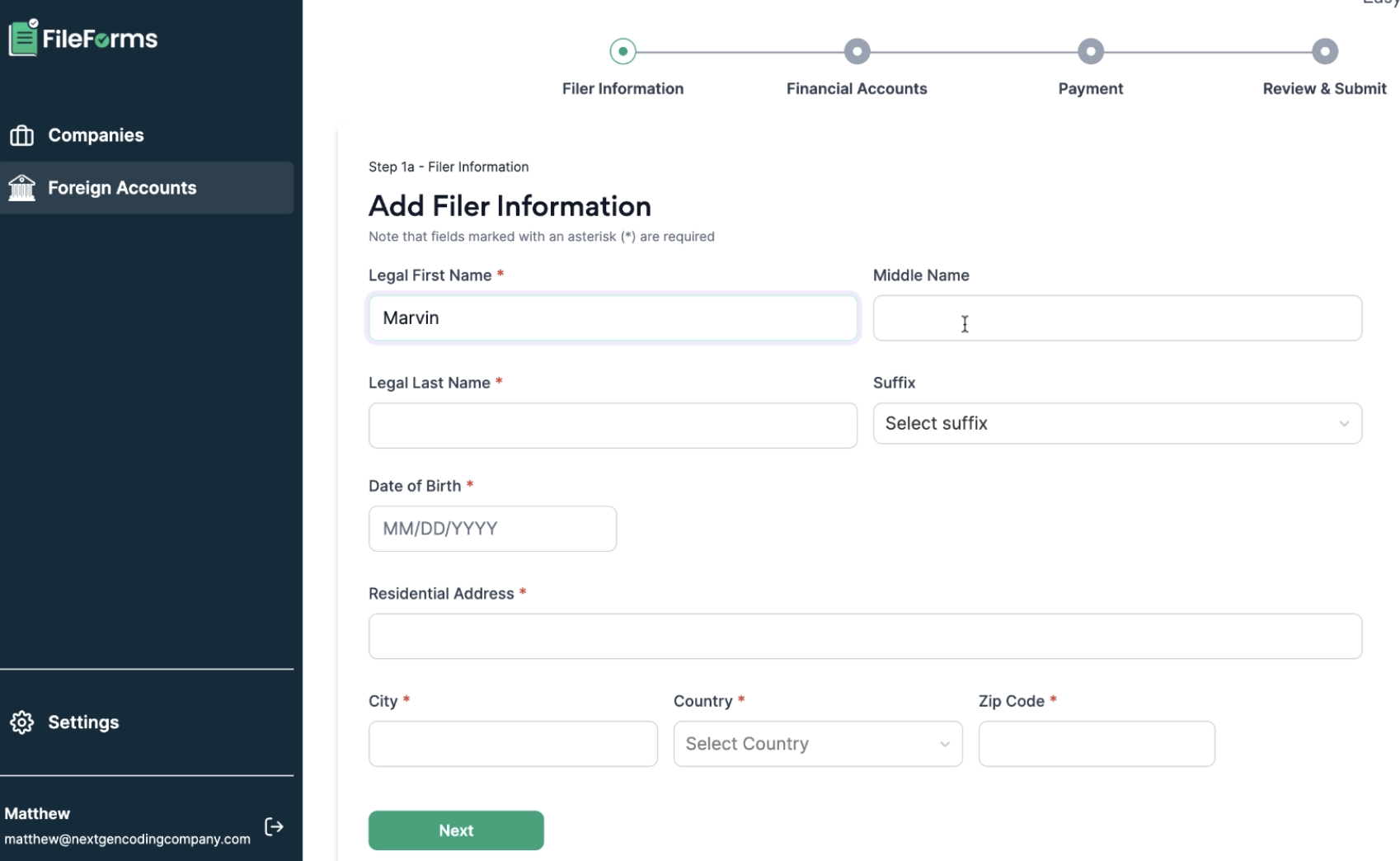

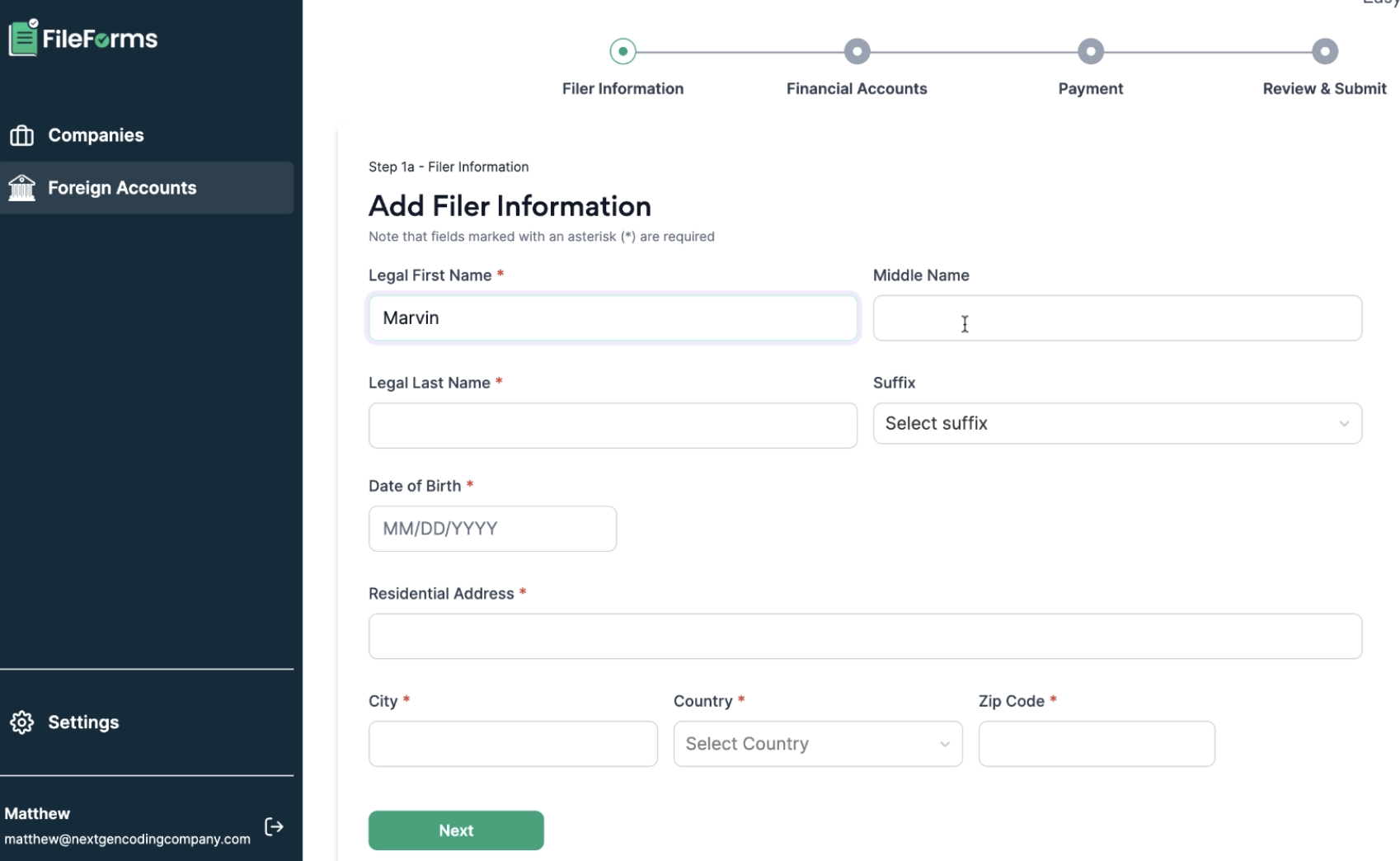

- FBAR Workflow with Next.js: A new initiation flow was embedded seamlessly into the platform interface, enabling users to start FBAR filings directly from their dashboard.

- Unified User and Company Data View: Extended user accounts with FBAR-specific data fields, consolidating form management in a single location.

- Step-by-Step Form Process: Implemented guided completion across all five FBAR sections, leveraging React Hook Form and Zod for real-time validation and regulatory alignment.

Financial Integrations and Automation

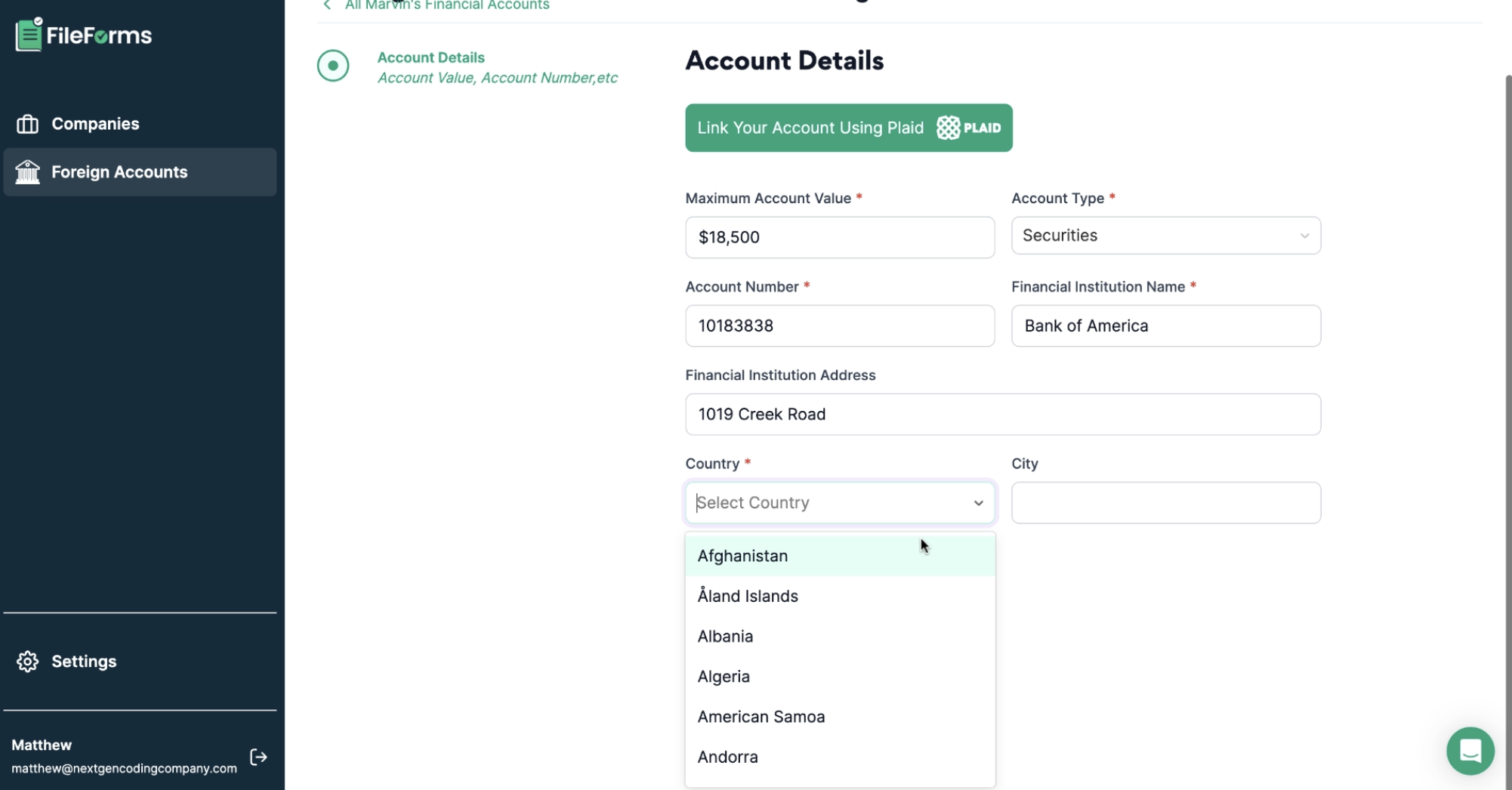

- Plaid Integration: Users securely linked financial institutions to auto-populate account details, reducing manual entry errors and ensuring real-time data accuracy.

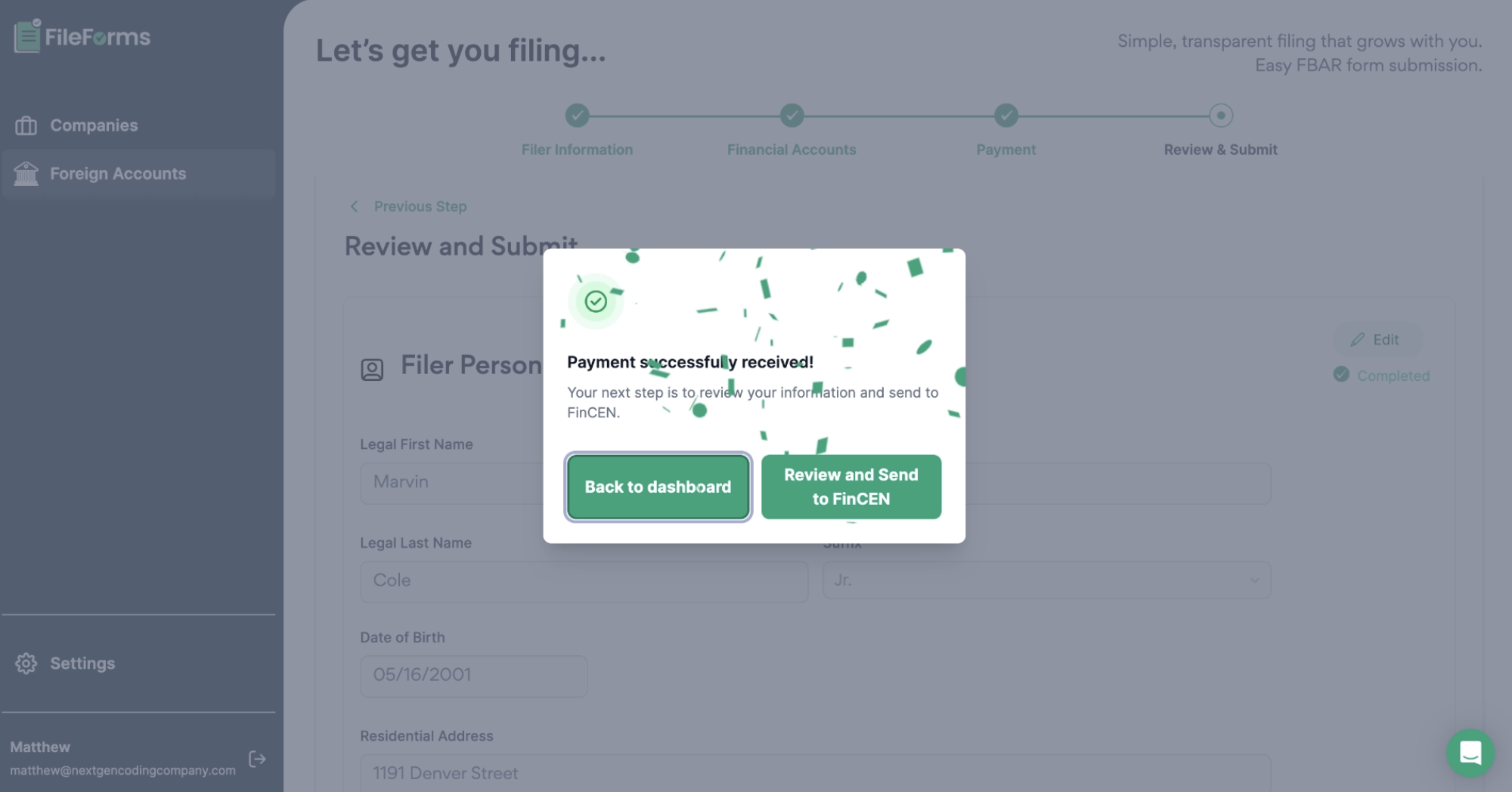

- Stripe Integration: Managed all payments with Stripe’s PCI DSS–compliant infrastructure, providing transparent history, receipts, and secure handling of sensitive financial data.

- BOI Pre-Fill: Leveraged existing Beneficial Ownership Information data to pre-populate overlapping FBAR fields, cutting filing time significantly.

Compliance-Driven Document Generation

- Automated PDF Output with PDFKit: Generated FBAR-ready PDFs mirroring FinCEN 114 formatting, allowing users to preview, download, and submit directly.

Development Workflow and Environment

- Collaborative Repository Management: All work aligned with FileForms’ existing repositories, using Git feature branches to ensure modular, stable development.

- Feature Toggles for Controlled Rollouts: Enabled discrete testing and phased deployment, reducing disruption to the live system.

- Prototyping with Figma: UI flows were designed in Figma and validated with stakeholder feedback before implementation.

Infrastructure and Security

- Serverless Backend with AWS: Ensured scalability and 99.99% uptime during filing deadlines.

- Role-Based Access with Firebase Authentication: Restricted sensitive data to authorized users.

- End-to-End Encryption: Implemented secure handling of financial and personal data with AWS KMS.

Results

The FBAR filing module transformed FileForms into a comprehensive compliance platform, delivering:

- 40% faster filing completion: Automated workflows and Plaid integrations reduced manual effort.

- 35% fewer filing errors: Real-time validation and BOI pre-fill improved data accuracy.

- 30% increase in usability ratings: Surveys reflected higher satisfaction with the new guided form experience.

- 25% reduction in payment issues: Stripe’s secure integration improved transparency and reliability.

- 20% higher submission readiness: Auto-generated PDFs aligned with regulatory standards.

Scalable compliance infrastructure: AWS serverless design supported thousands of concurrent users at peak.

Why It Matters

Compliance filings like FBAR demand precision, security, and efficiency. By combining automation with secure integrations, FileForms reduced compliance burdens, minimized risks of penalties, and delivered a user experience that aligned with the highest regulatory standards. The result is a scalable, future-ready solution that improves both user satisfaction and platform adoption.

Call to Action

NextGen partners with compliance-driven platforms to deliver automation, financial integrations, and secure workflows that align with global regulatory requirements. Our expertise in scaling regulated platforms ensures performance, trust, and measurable business outcomes.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!