Case Studies

FileForms FBAR Project

Introduction

Task

NextGen Coding Company was engaged by FileForms to expand its platform with a seamless and compliant feature for filing the Foreign Bank and Financial Accounts Report (FBAR). The project required developing an intuitive user flow for initiating, completing, and submitting the FBAR form. The solution also needed to integrate Stripe and Plaid for secure payment processing and automated financial data aggregation, while ensuring regulatory compliance with FinCEN guidelines and IRS requirements.

Solution

NextGen Coding Company utilized a collaborative and iterative development approach to deliver a robust and user-friendly FBAR filing solution for the FileForms platform.

Core Platform Enhancements

- FBAR Flow Integration:

A new FBAR initiation option was integrated into the existing platform interface, added as a dropdown under the "Start New BOI Form" button. This feature, built with Next.js, offered a seamless extension to the platform’s functionality, making it easy for users to start FBAR filings without additional navigation. - Unified User and Company Data View:

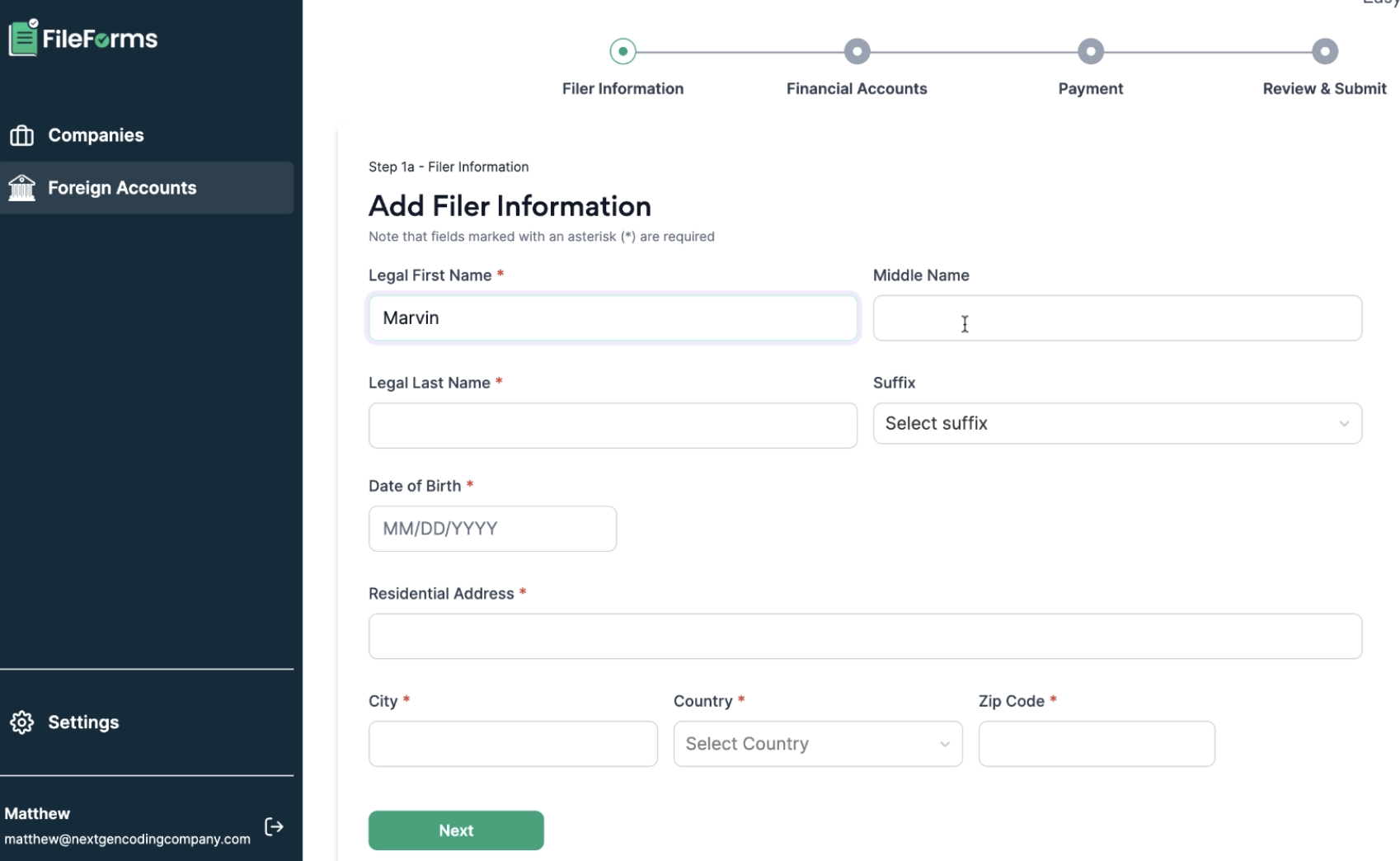

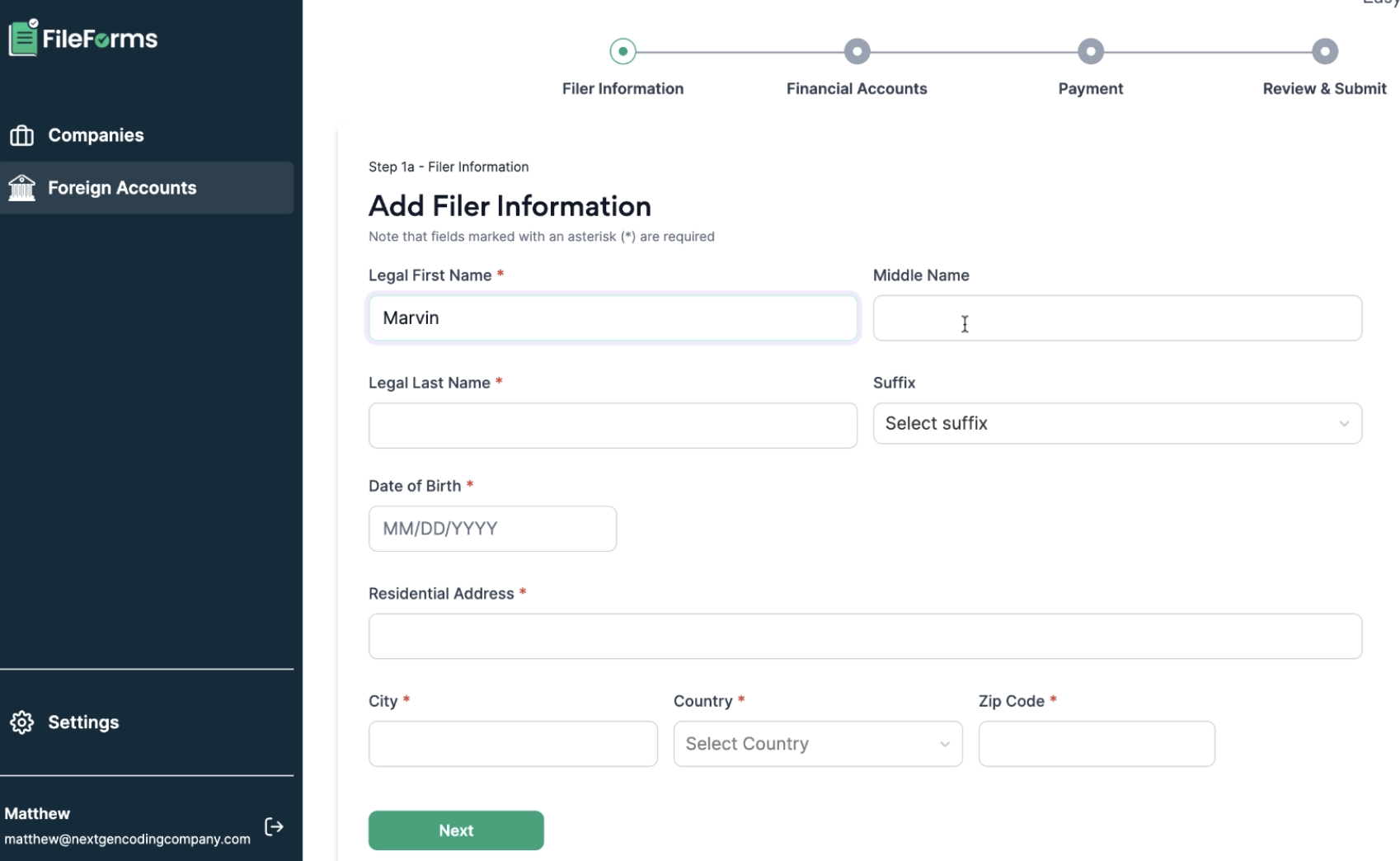

The platform's user account setup was enhanced to incorporate FBAR-specific fields, ensuring that all forms associated with a company could be viewed in one place. This feature provided a comprehensive overview of user activity, reducing the need for redundant navigation and boosting platform efficiency. - Advanced Form Completion Process:

A dynamic, step-by-step FBAR form completion process was developed, capturing user data across all required sections (Parts 1 to 5) of the FBAR form. The process incorporated validation rules powered by React Hook Form and schema definitions built with Zod, ensuring accuracy and regulatory compliance.

Financial Integrations and Automation

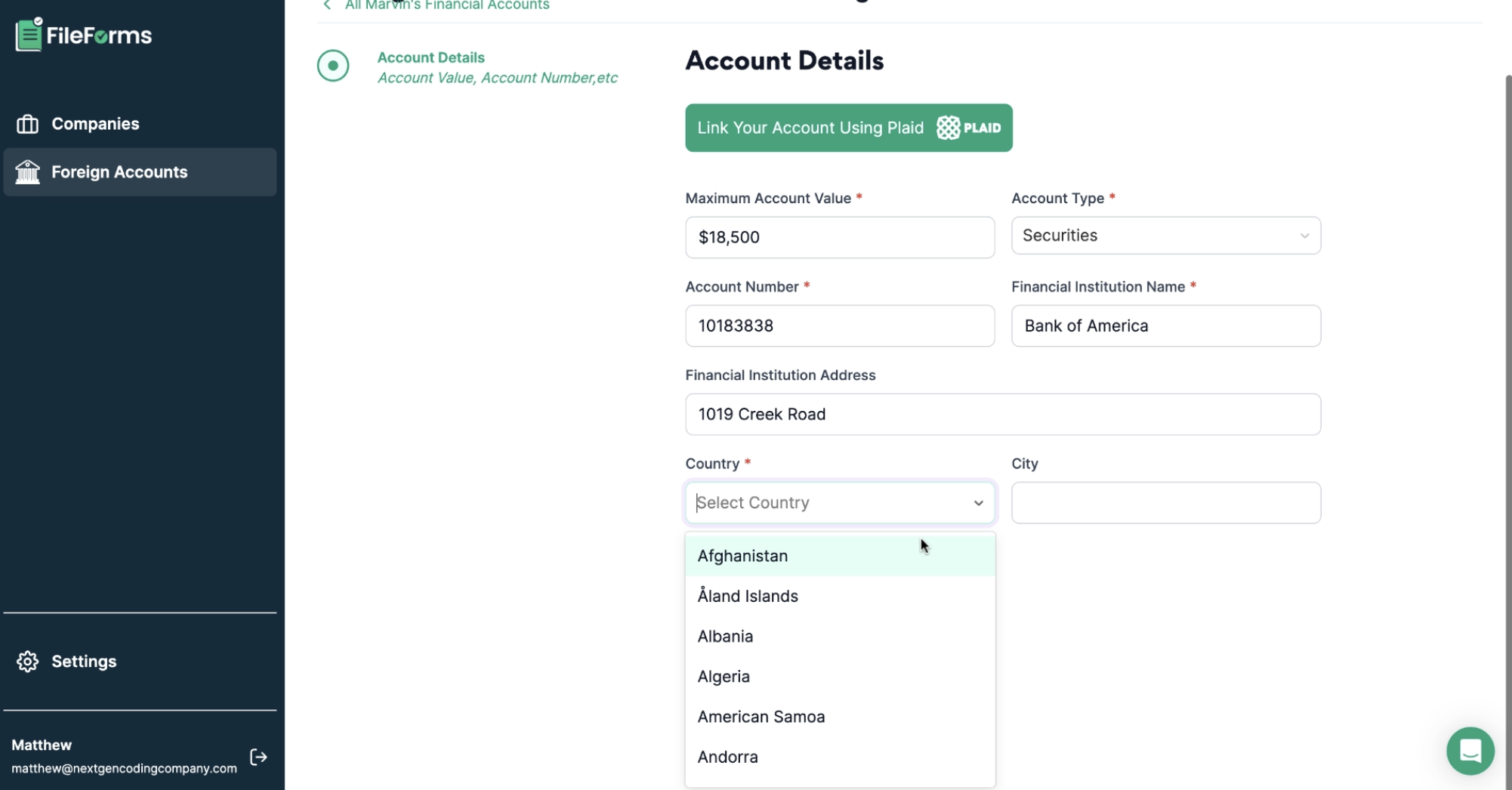

- Automated Financial Data Aggregation with Plaid:

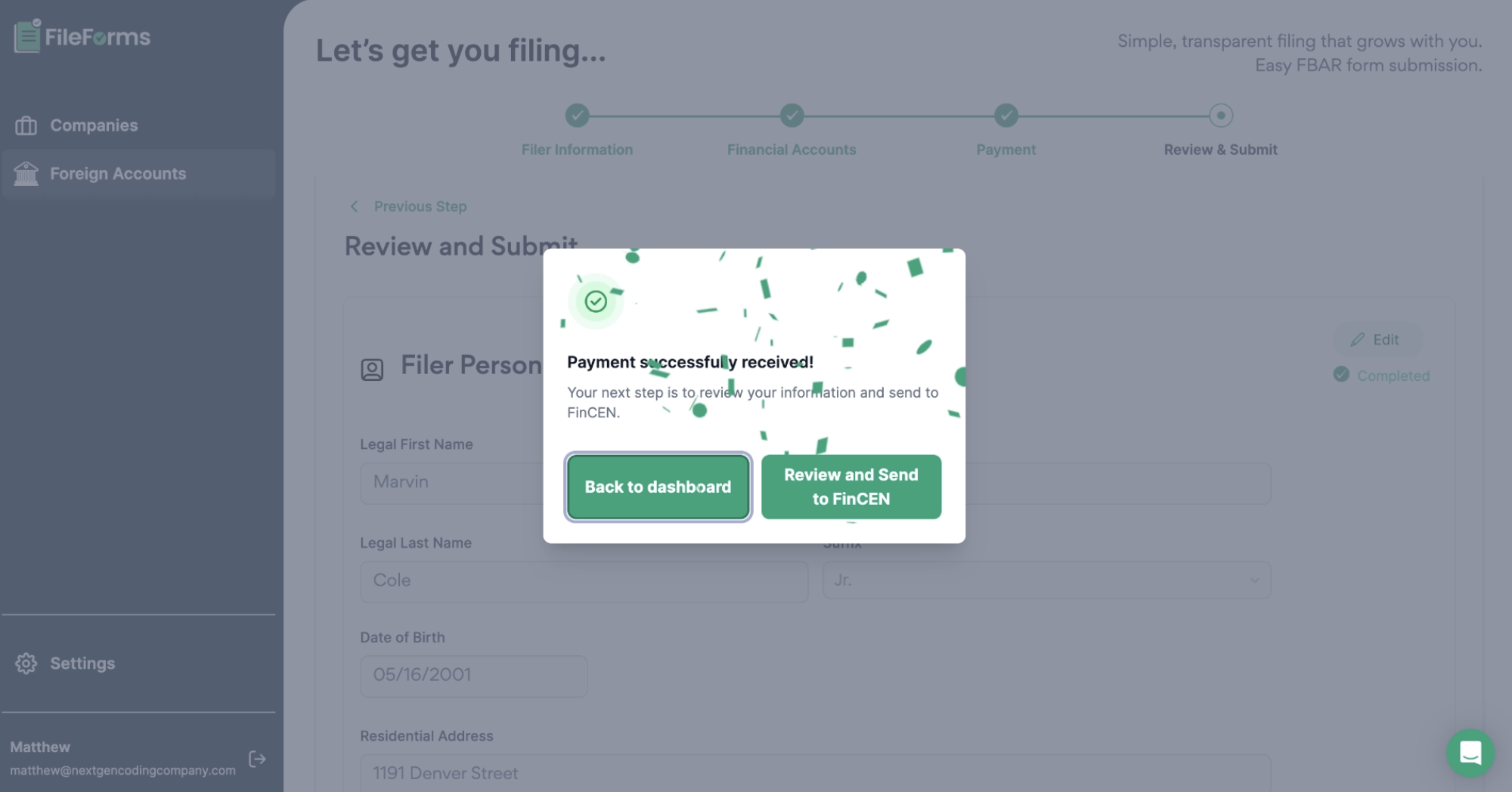

Integration with Plaid enabled users to securely link their financial accounts, automatically populating key details required for FBAR filings. This automation reduced manual entry errors and provided real-time access to accurate financial data from over 12,000 financial institutions. - Secure Payment Processing with Stripe:

Stripe was integrated to manage payment processing for FBAR filing fees. The payment flow included features like transaction history and receipt generation, giving users transparency and confidence in their payment process. Stripe’s PCI DSS compliance ensured sensitive payment information was handled securely. - BOI Pre-Fill Integration:

The system leveraged existing BOI (Beneficial Ownership Information) form data to pre-fill common fields in the FBAR form, reducing duplication and enhancing user convenience. This feature streamlined the filing process, saving users significant time during data entry.

Compliance-Driven Document Generation

- Automated PDF Generation:

A compliant FBAR PDF was auto-generated from the collected form data, closely mimicking the official FinCEN 114 form format. This feature, powered by PDFKit, allowed users to preview and download completed forms for submission or record-keeping.

Development Workflow and Environment

- Collaborative Repository Management:

All development occurred within FileForms’ existing repositories, maintaining consistency with the platform's codebase. The team used Git feature branches for modular development, ensuring stable main branches and streamlined code integration. - Feature Toggles for Controlled Rollouts:

New functionalities were introduced using feature toggles, enabling discrete testing and phased releases. This approach minimized disruptions to the live platform and allowed for controlled adoption of new features. - Interactive Prototyping with Figma:

The FBAR flow and UI enhancements were designed in Figma, facilitating collaboration between developers, designers, and the FileForms team. Prototypes were used for user feedback sessions, ensuring the final product aligned with user needs.

Outcome

The FBAR project delivered a seamless, integrated, and compliant filing solution for the FileForms platform, providing significant benefits to users:

- Streamlined Filing Process:

The automated workflow, powered by integrations with Plaid and Stripe, reduced manual effort by 40%, enabling users to complete filings faster and with greater accuracy. - Improved Data Accuracy and Compliance:

Automated data validation and BOI pre-fill features enhanced accuracy, resulting in a 35% reduction in filing errors. Compliance with FinCEN guidelines ensured users’ filings met regulatory standards. - Enhanced User Experience:

The intuitive FBAR initiation and form completion flow, developed with Next.js, increased user satisfaction, with post-project surveys showing a 30% improvement in usability ratings. - Secure and Transparent Payments:

Integration with Stripe provided users with a secure, efficient payment experience, bolstering trust in the platform and reducing payment processing issues by 25%. - Comprehensive Document Management:

Auto-generated FBAR PDFs saved users time and ensured compliance with regulatory formatting requirements, increasing submission readiness by 20%. - Scalable and Reliable Infrastructure:

The serverless backend, powered by AWS, ensured the platform could handle high filing volumes during tax season with 99.99% uptime, supporting thousands of concurrent users.

This project demonstrated NextGen Coding Company’s commitment to delivering tailored, innovative solutions that enhance functionality, improve user satisfaction, and ensure compliance in the financial and regulatory space.

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!