Case Studies

Leveraging AWS to Revolutionize WOTC Tracking For Sagemont Advisors

Introduction

Client Background

Sagemont Advisors is a compliance and tax credit management consultancy serving employers nationwide. To improve efficiency in processing Work Opportunity Tax Credit (WOTC) applications, Sagemont required a next-generation tracking system that could automate eligibility screening, securely manage sensitive documents, and provide real-time insights to businesses.

The Problem

The existing WOTC tracking process was constrained by manual workflows and lacked the scalability needed to handle large application volumes during peak filing deadlines. Employers faced:

- Delays in eligibility screening and tax credit calculations.

- High error rates from manual document processing.

- Limited visibility into credit utilization and application status.

- Compliance risks under IRS guidelines and GDPR standards.

Sagemont Advisors needed a cloud-native platform capable of streamlining WOTC management end-to-end, providing automation, scalability, and enhanced user experience without compromising on security.

Our Solution

NextGen Coding Company designed and implemented a cloud-based WOTC tracking system using AWS technologies, ensuring automation, compliance, and high performance.

- AWS EC2 with Auto Scaling: Deployed backend services with dynamic resource allocation to handle filing surges seamlessly.

- AWS Elastic Beanstalk: Simplified backend deployment and scaling while reducing infrastructure overhead.

- Amazon DynamoDB: Implemented a serverless, high-speed database for real-time application tracking.

Automation and Data Processing

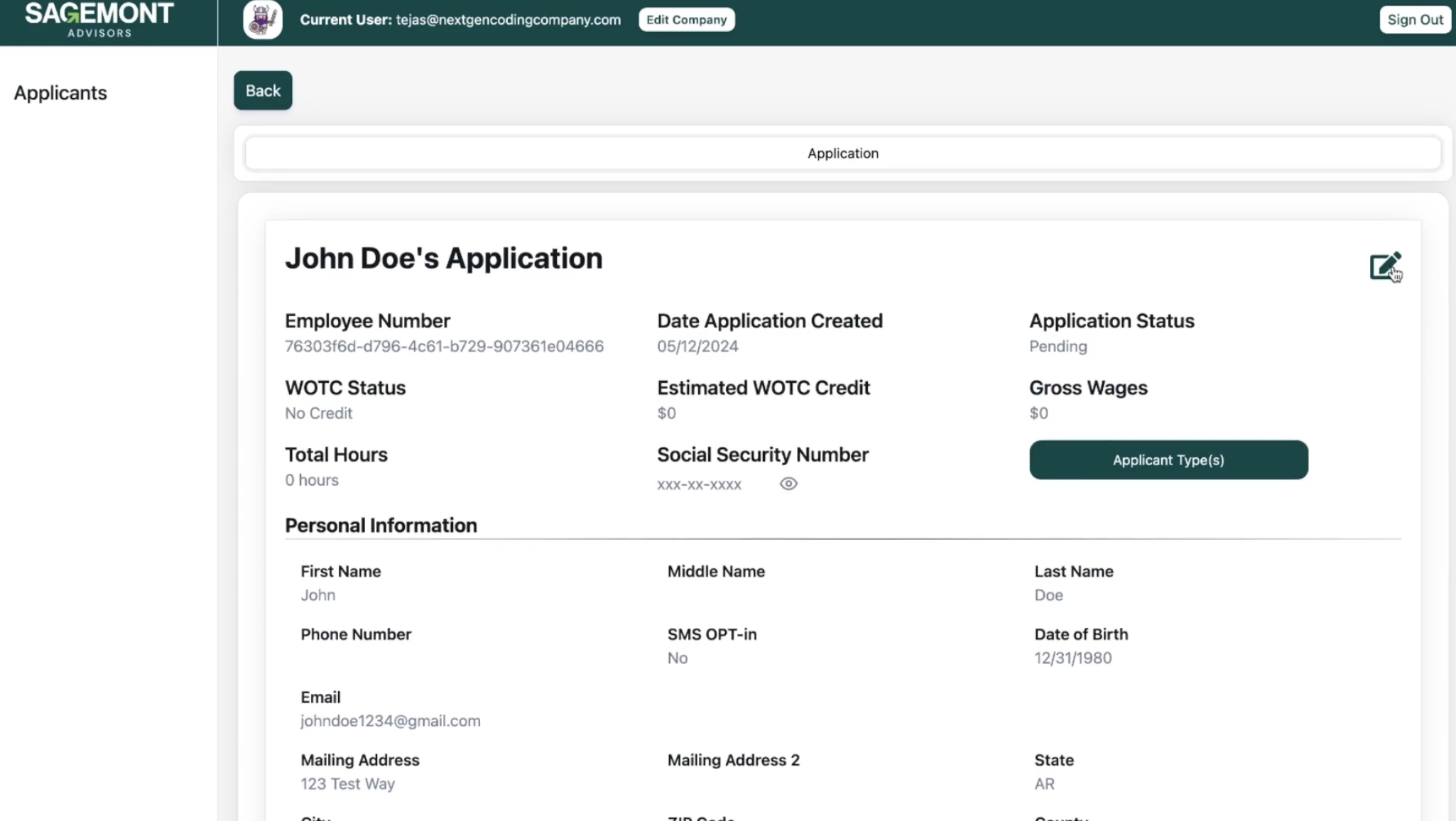

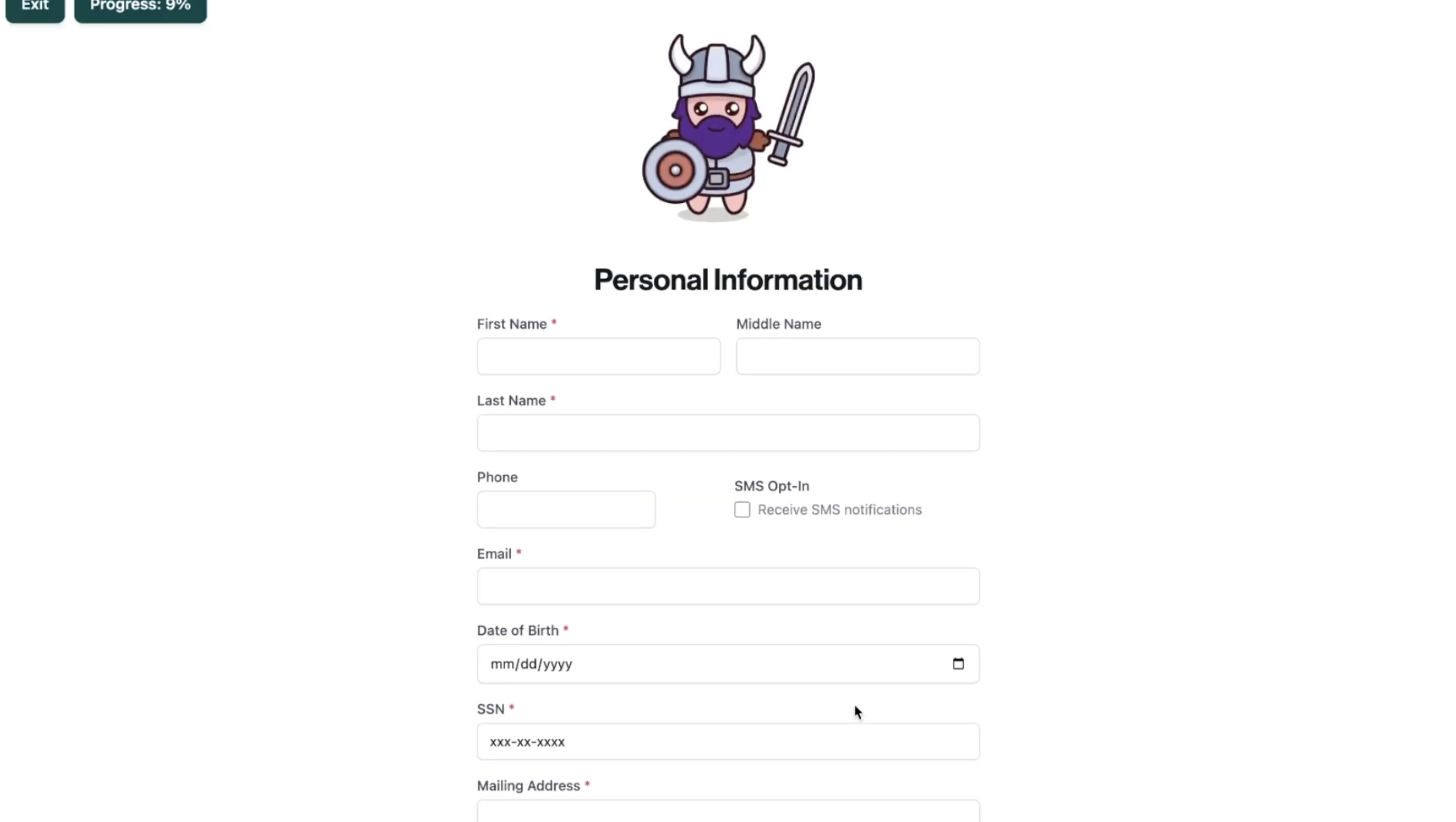

- AWS Lambda: Automated eligibility screenings, validating applicants against WOTC requirements in real time, reducing screening time by 50%.

- AWS Textract: Extracted applicant and employer data directly from WOTC forms, reducing manual entry errors by 70%.

- Google Looker Studio (integrated with Amazon Redshift): Delivered interactive dashboards for applicant trends, credit success rates, and workflow bottlenecks.

Secure Data and Compliance

- Amazon S3: Provided encrypted, compliant storage for sensitive applicant documents with multi-region replication for disaster recovery.

- AWS CloudTrail: Enabled comprehensive activity logging and audit trails to ensure IRS and GDPR compliance.

- AWS KMS: Protected sensitive financial data with end-to-end encryption.

Engagement and User Experience

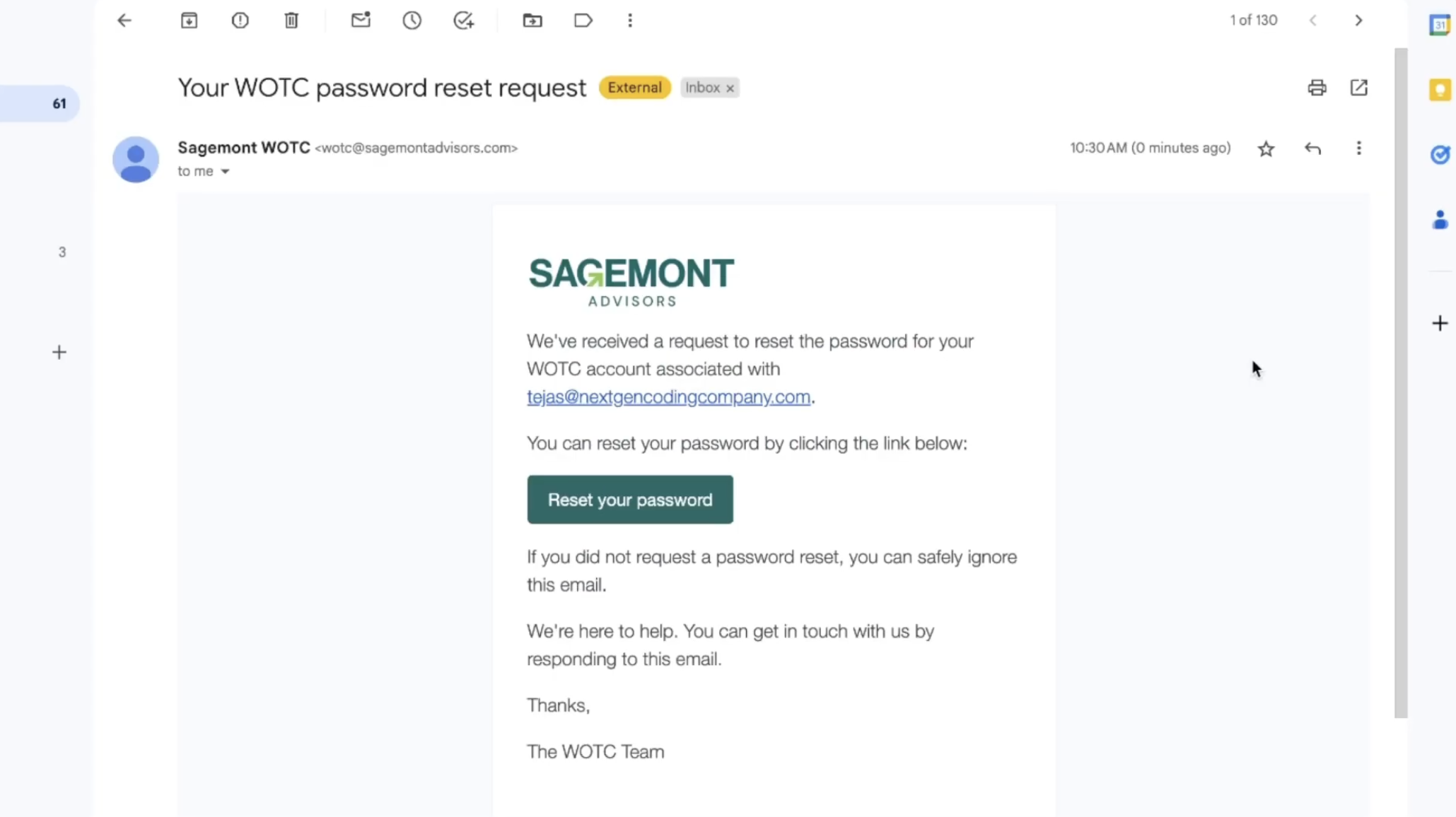

- Amazon SNS: Delivered real-time alerts to applicants and employers for status updates, filing deadlines, and documentation needs.

- Stripe via AWS API Gateway: Integrated secure payment processing for WOTC application services.

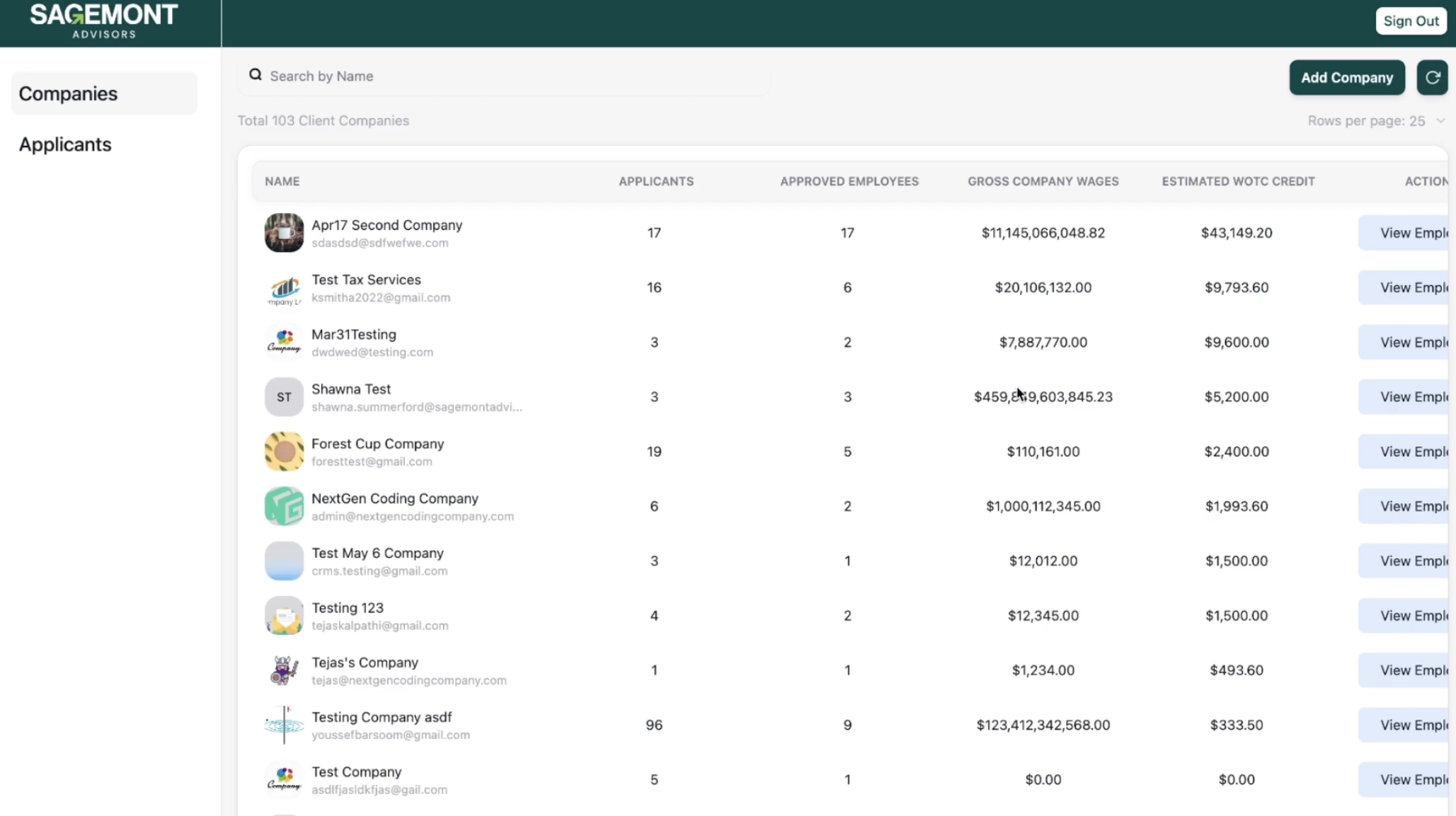

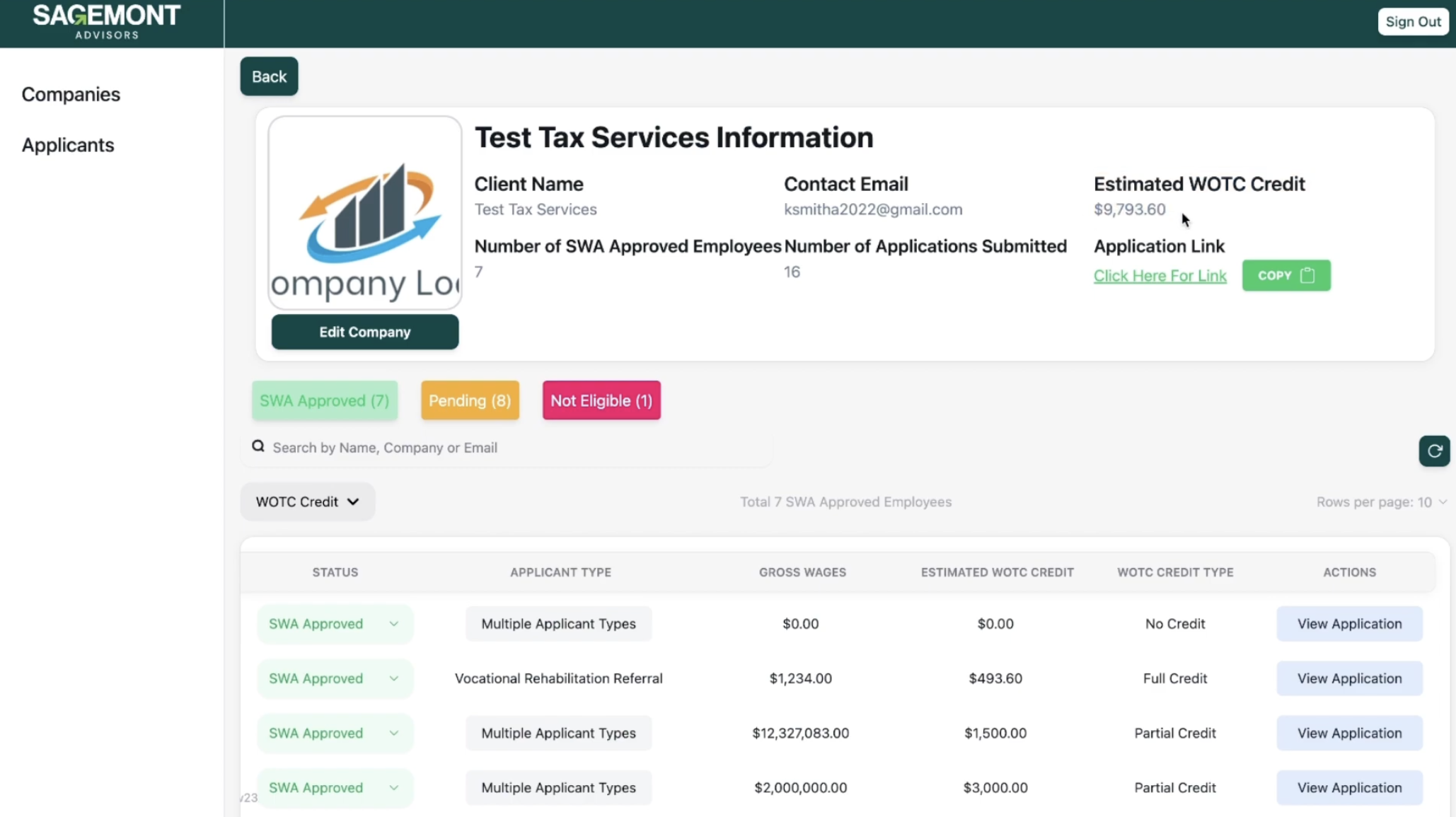

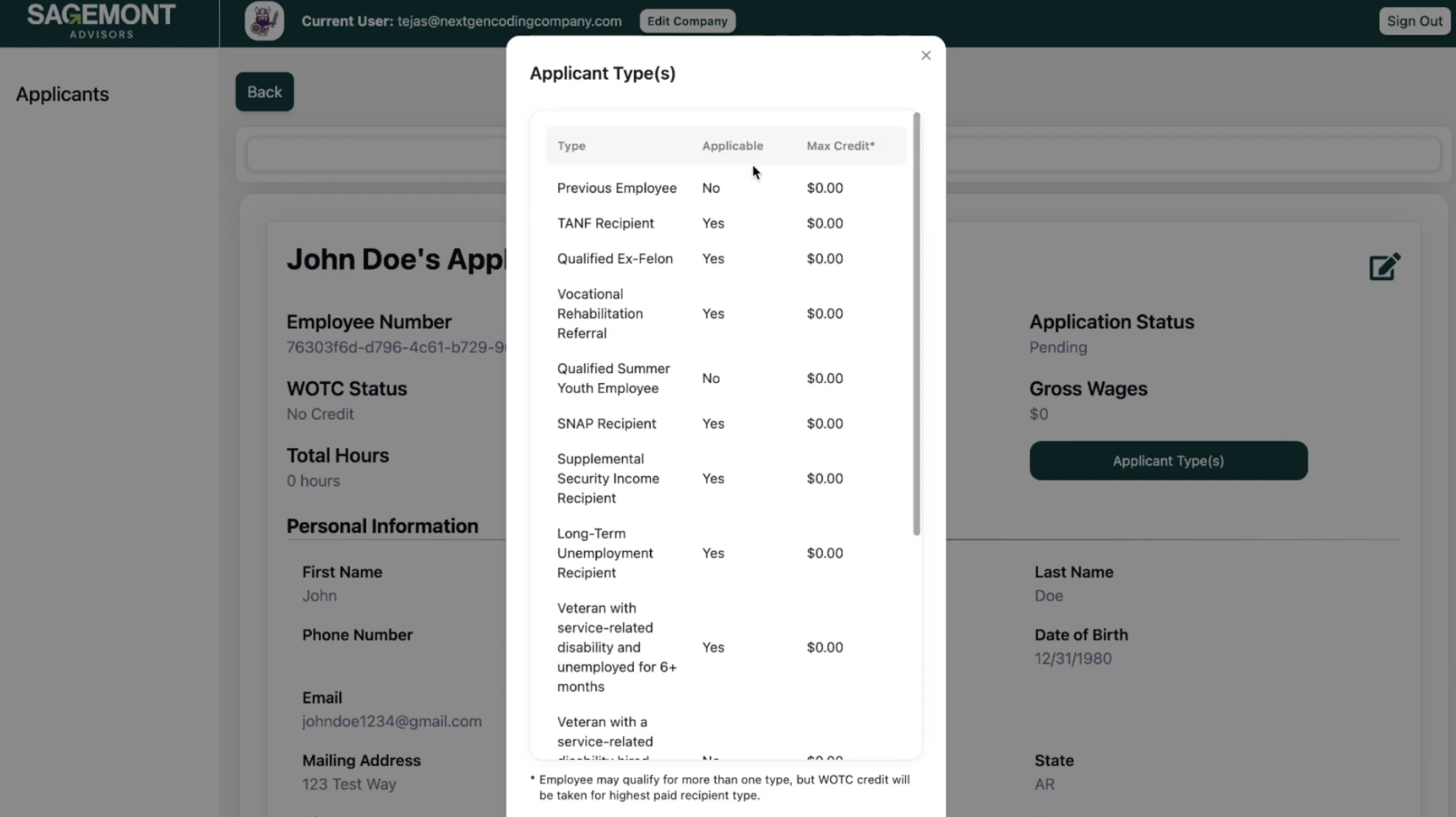

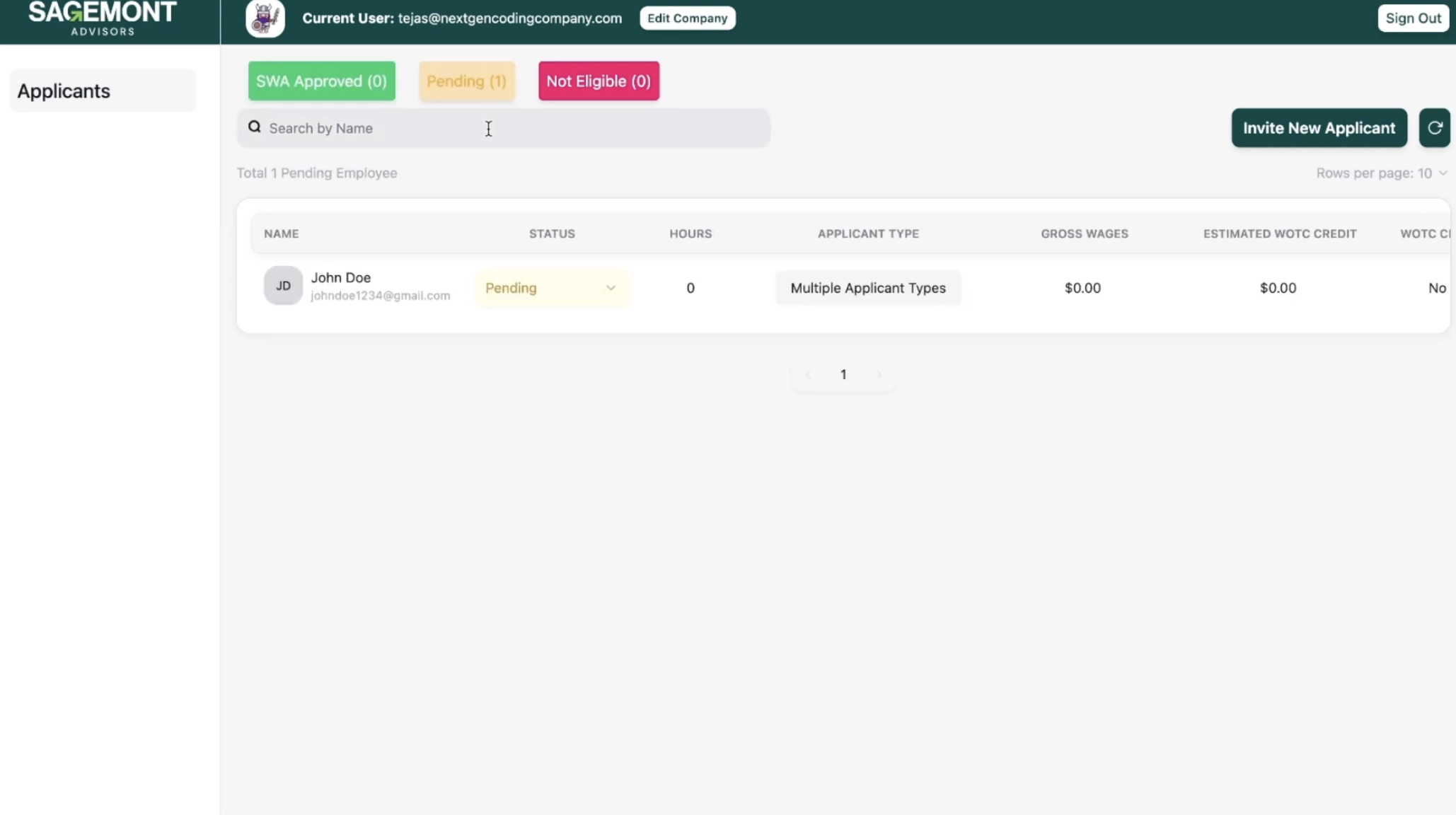

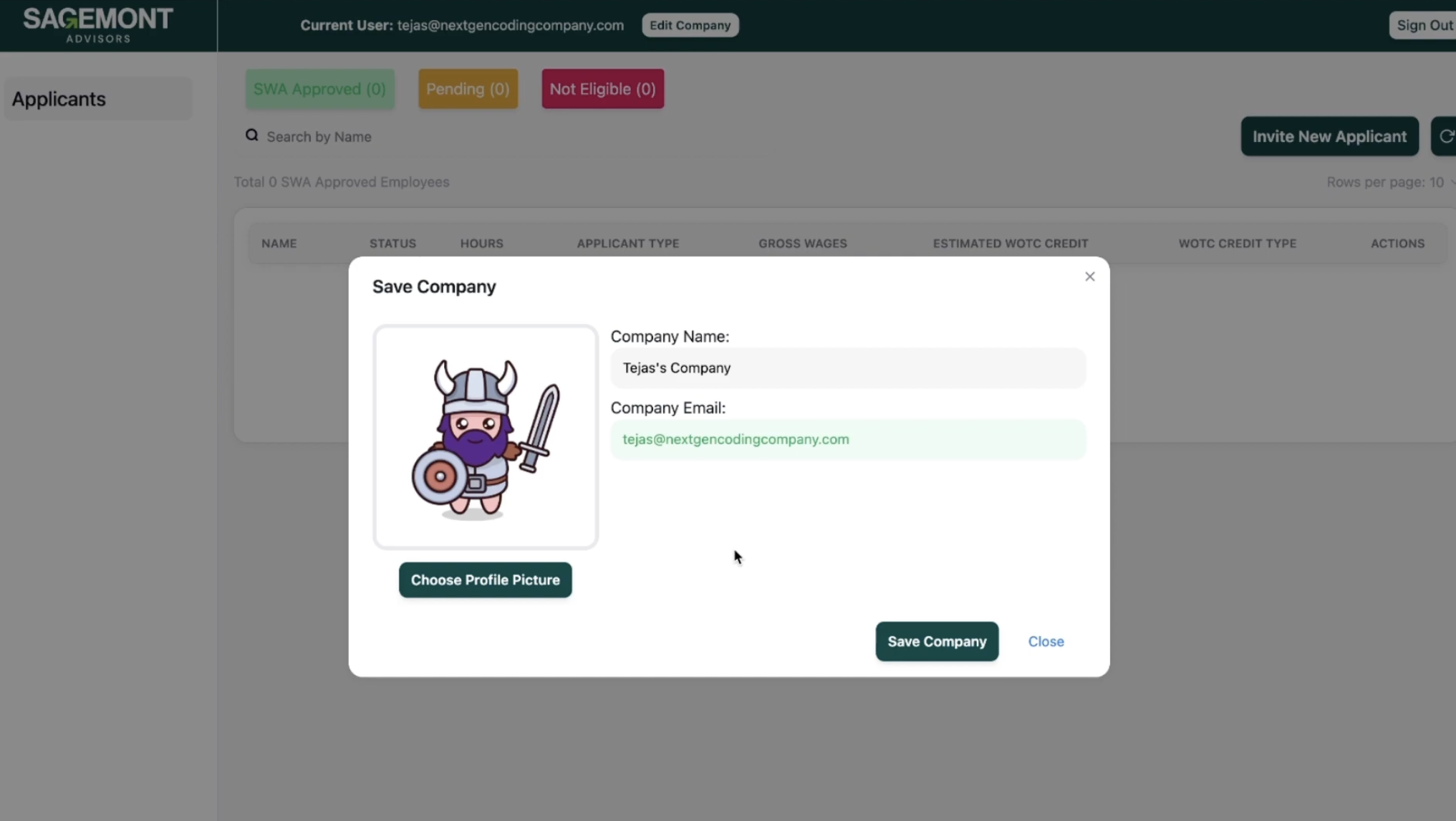

- Centralized Access Dashboards: Allowed businesses to monitor application status, tax credit utilization, and filing progress.

Results

The AWS-powered platform produced measurable improvements for Sagemont Advisors and their clients:

- 250,000+ concurrent users supported: Maintained 99.99% uptime during peak periods.

- 50% faster eligibility screening: Automated workflows accelerated applicant validation.

- 70% reduction in manual data errors: AWS Textract ensured accuracy in form processing.

- 20% improved employer tax savings: Optimized through advanced analytics and insights.

- 30% increase in user engagement: Real-time notifications via Amazon SNS drove timely responses.

- 25% faster checkout experience: Secure payments streamlined through AWS API Gateway and Stripe.

- 100% compliance with IRS and GDPR: Validated via AWS CloudTrail activity logs.

- 35% faster processing time: Interactive dashboards empowered decision-making and workflow optimization.

Why It Matters

Tax credit opportunities such as WOTC can be underutilized without the right infrastructure. By integrating automation, compliance-driven workflows, and AWS-powered scalability, Sagemont Advisors transformed how employers manage applications. The solution not only improved credit recovery rates but also established a secure, reliable foundation for long-term growth.

Call to Action

NextGen delivers compliance-ready platforms built on AWS to help organizations automate workflows, reduce errors, and achieve scalable performance. Whether modernizing tax credit tracking or deploying new data intelligence systems, our team ensures security and efficiency at every step.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!