Case Studies

Develop Complete WOTC Reporting Dashboard For Sagemont Advisors

Introduction

Client Background

Sagemont Advisors is a leading consultancy that helps employers manage Work Opportunity Tax Credit (WOTC) programs and maximize federal tax incentives. The company needed a modern reporting dashboard that simplified the entire WOTC workflow—from eligibility verification to credit calculation—while maintaining strict compliance with IRS and GDPR standards.

The Problem

The manual processes behind Sagemont Advisors’ WOTC program made it difficult to scale operations efficiently. Employers struggled with fragmented document handling, delayed credit calculations, and limited visibility into compliance readiness. The platform required:

- Automated eligibility screening to replace manual evaluation.

- Centralized document management and reporting capabilities.

- Integration with IRS TIN Matching APIs for compliance validation.

- Secure, serverless architecture capable of handling large-scale employer data.

The goal was to deliver a unified system that automated complex workflows and provided actionable insights for employers and administrators.

Our Solution

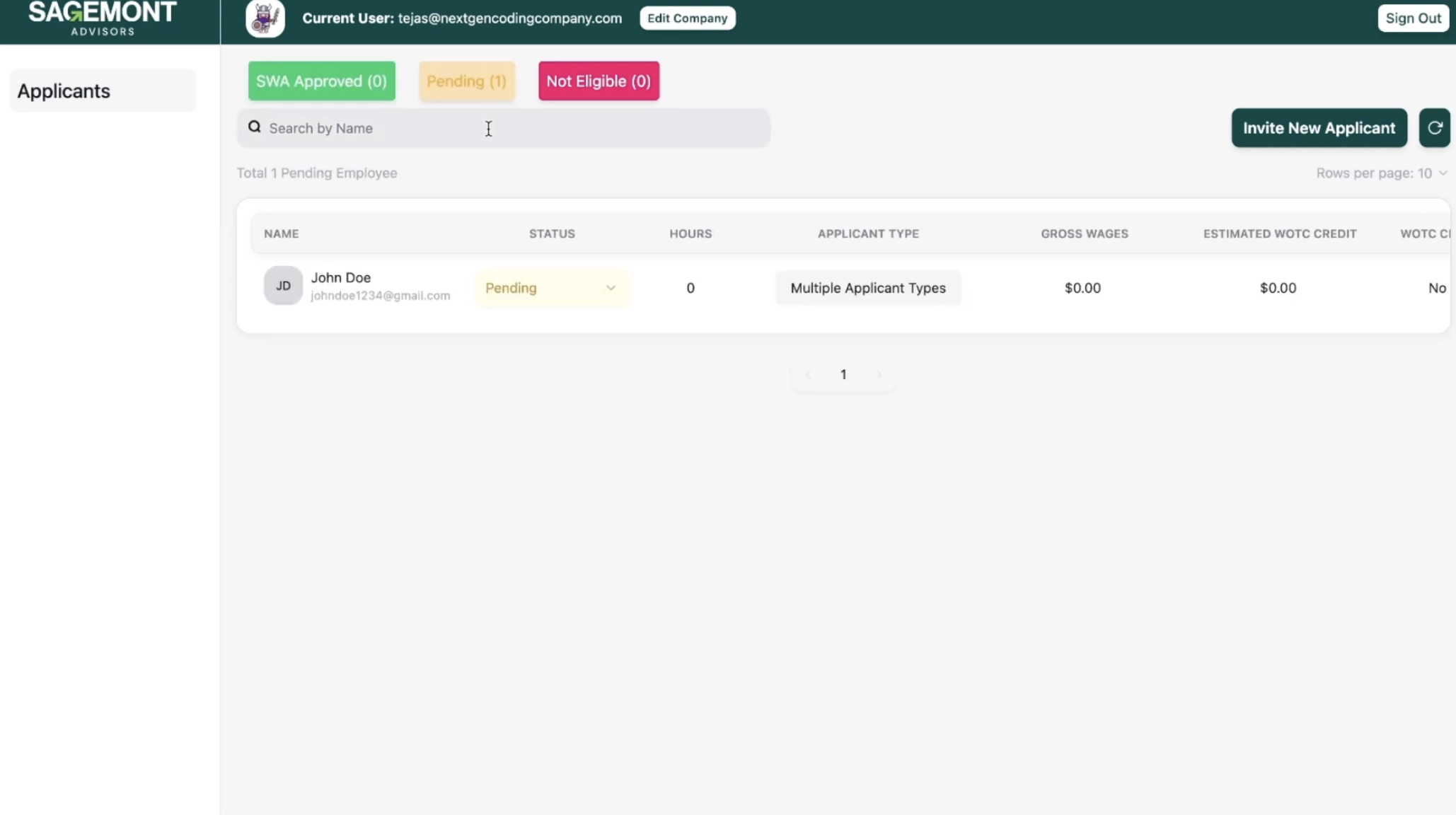

NextGen Coding Company designed and deployed a comprehensive WOTC management and reporting dashboard built on a serverless architecture, integrating automation, compliance, and real-time data visibility.

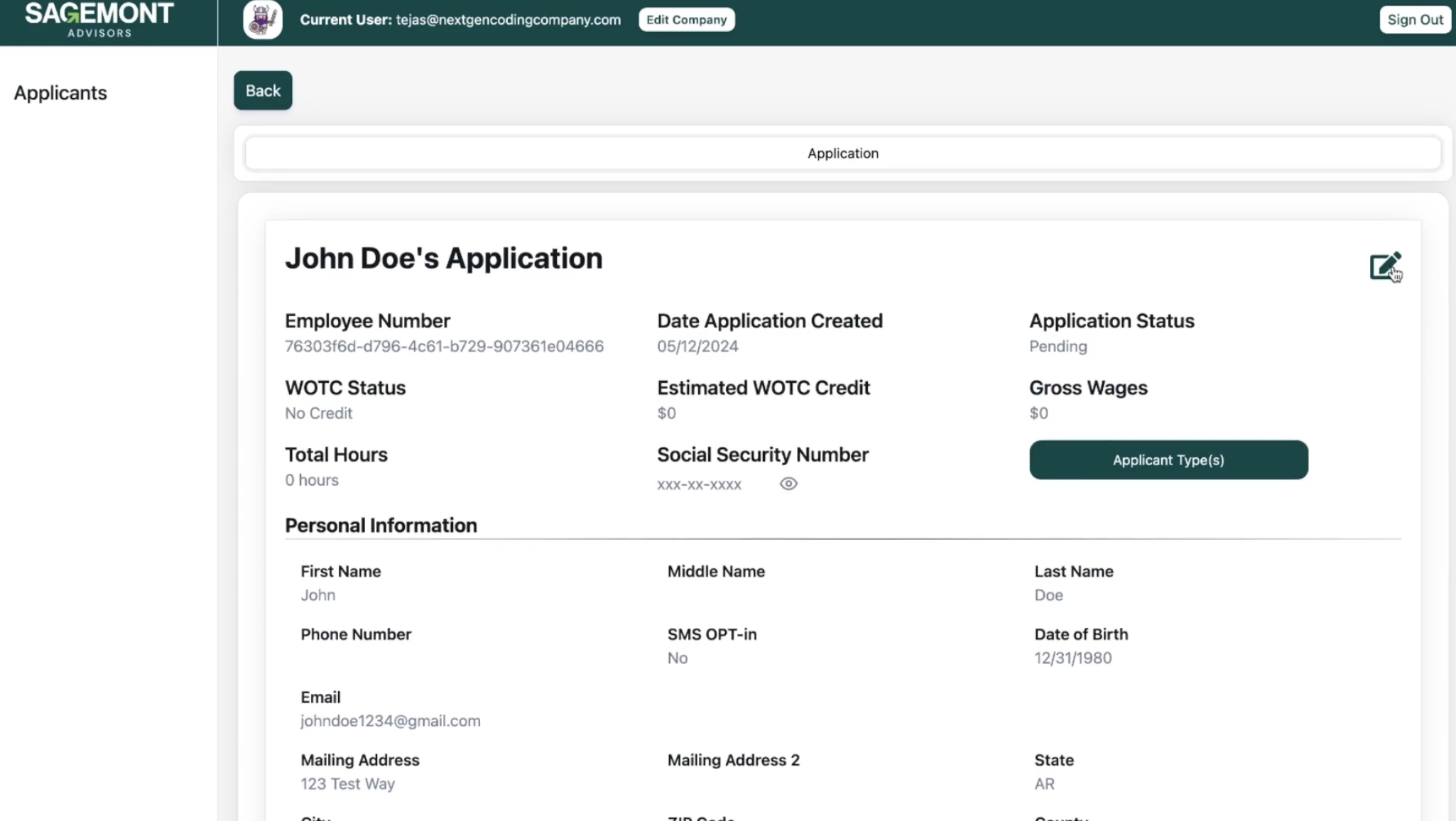

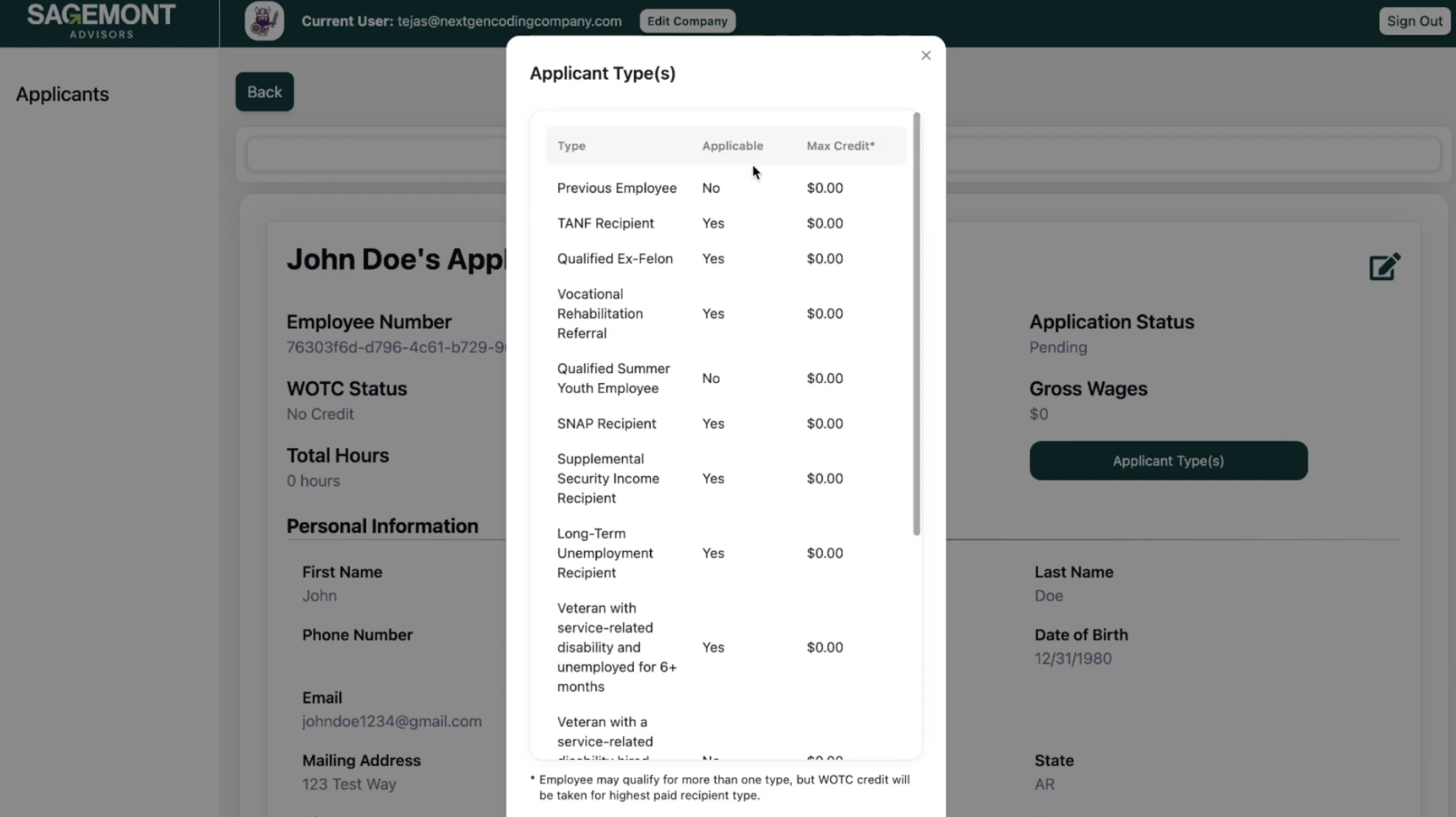

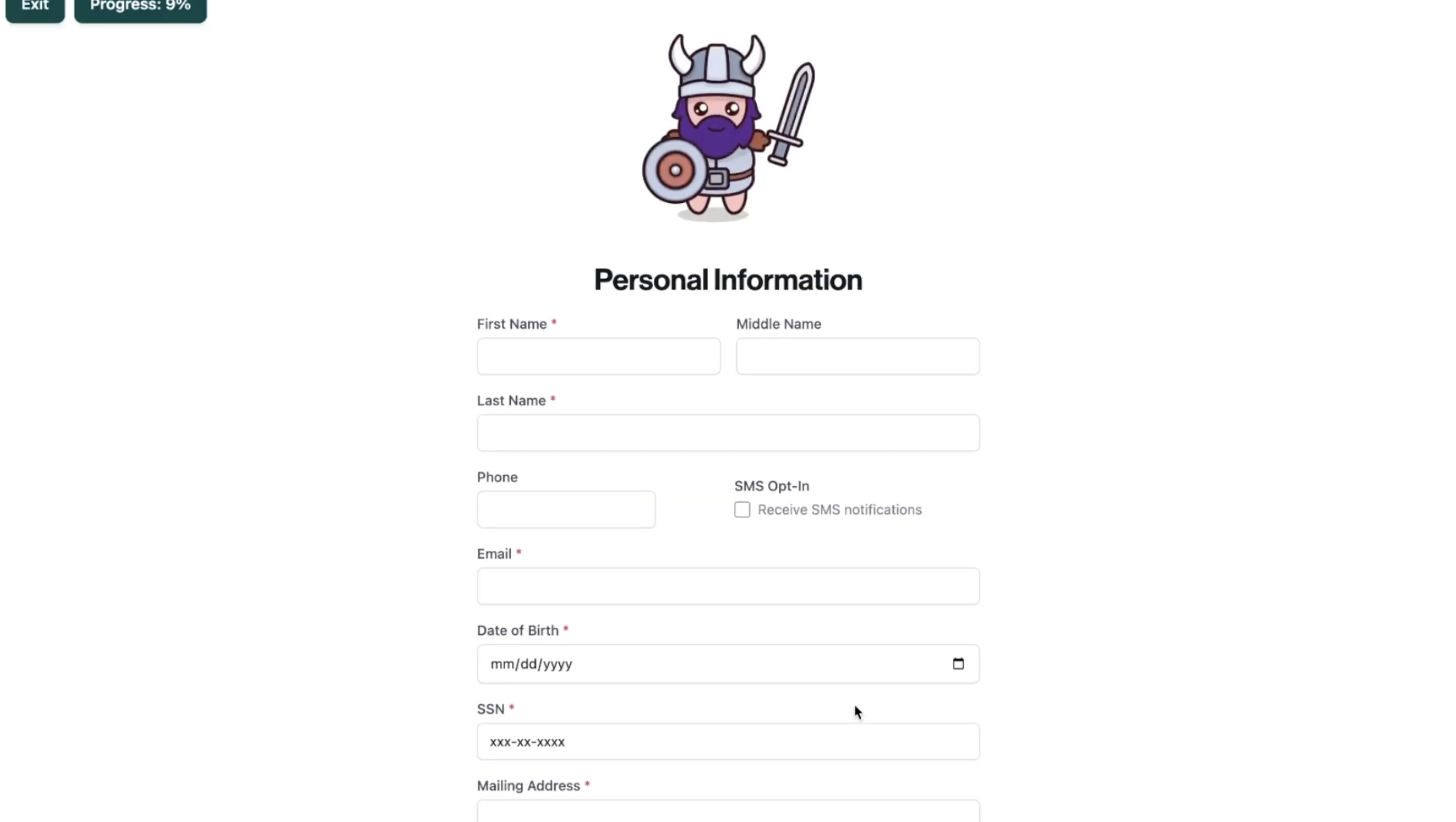

- Dynamic Eligibility Screening: Implemented with React, Next.js, and Zod schema validation, enabling applicants to answer guided questions and receive instant eligibility feedback. This automation reduced screening times by 40%.

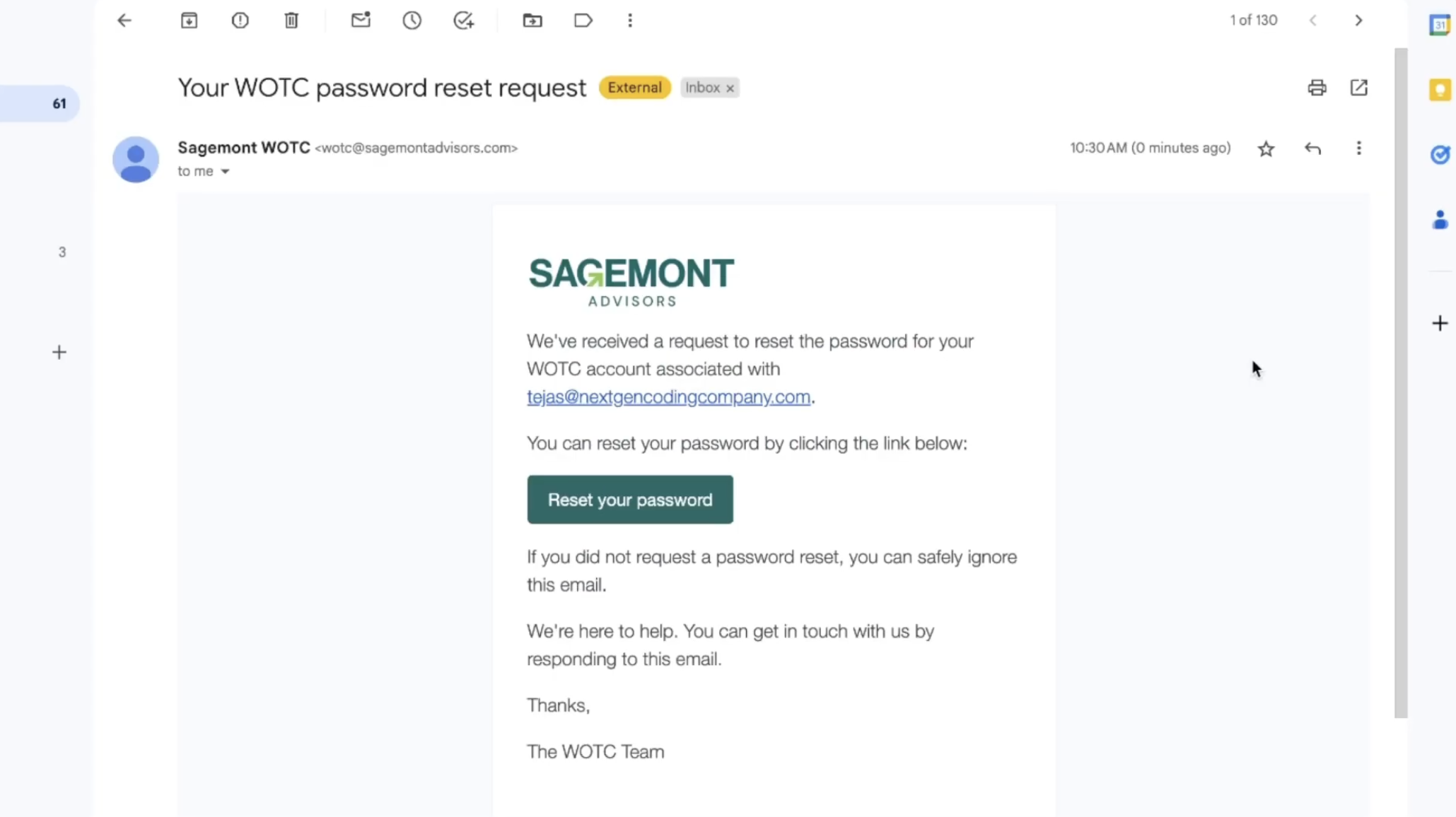

- Self-Service Application Submission: Built with React Hook Form and Next.js, allowing applicants to securely submit data via custom URLs generated in Node.js, minimizing HR intervention and improving accuracy.

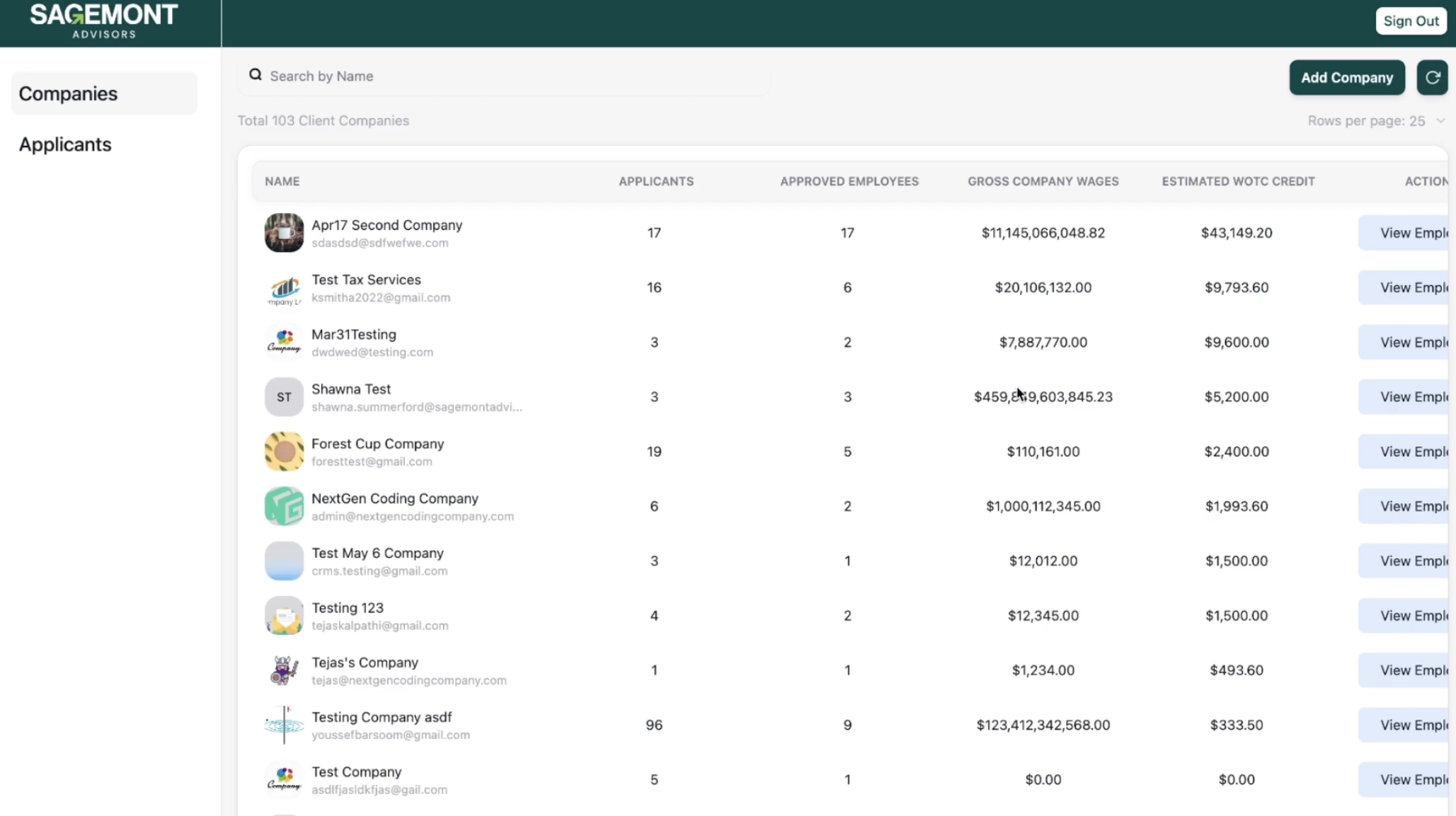

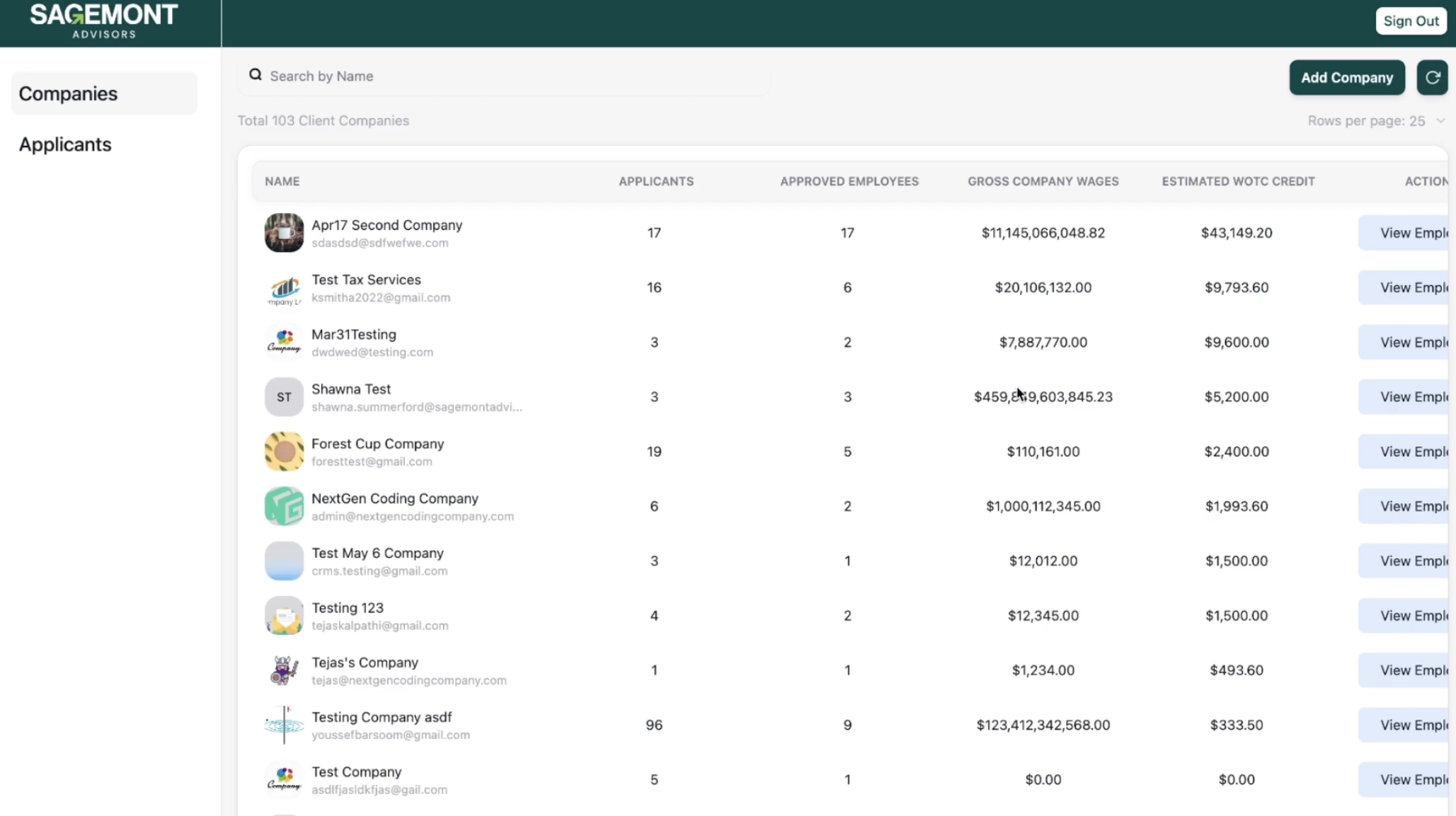

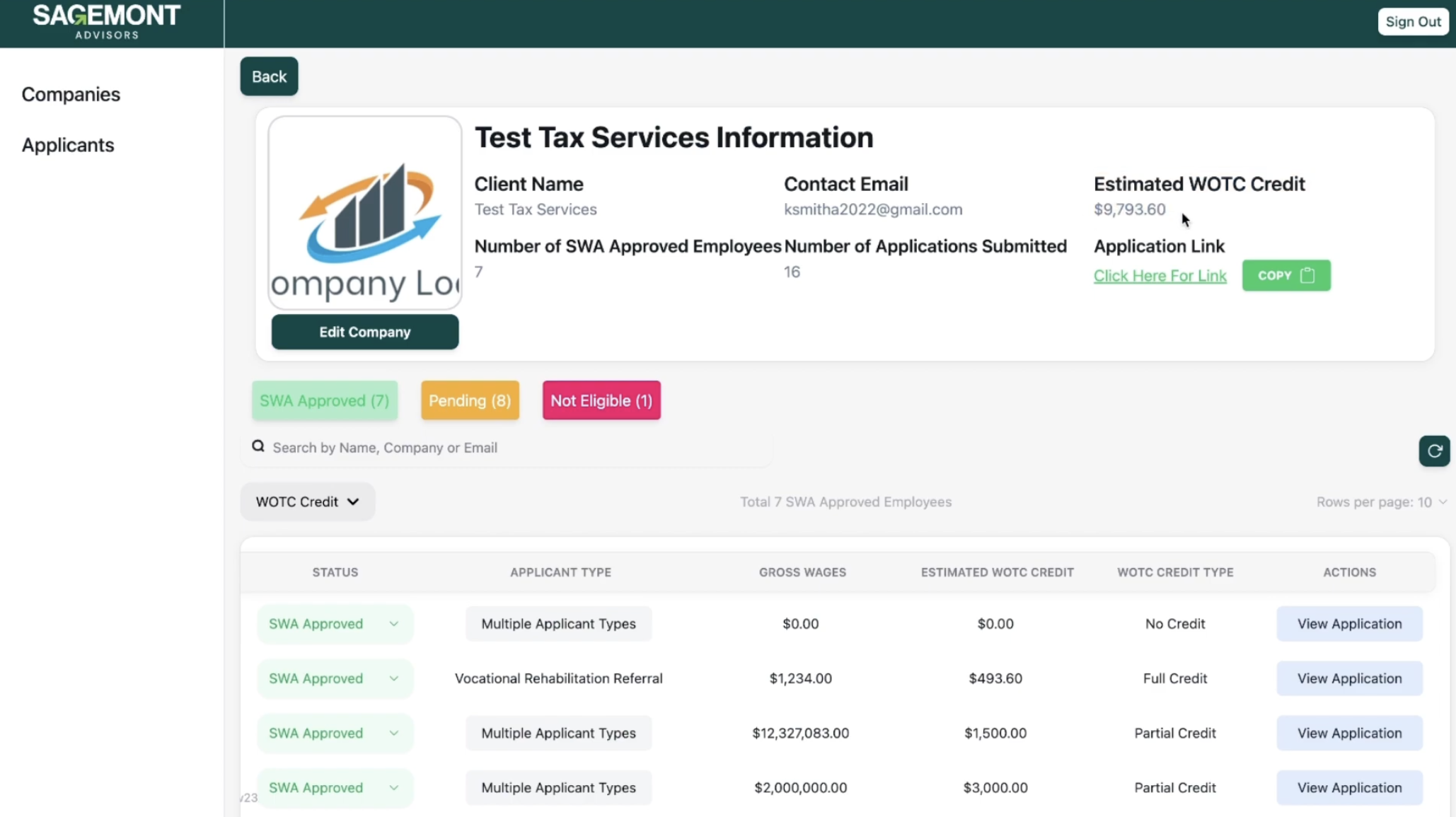

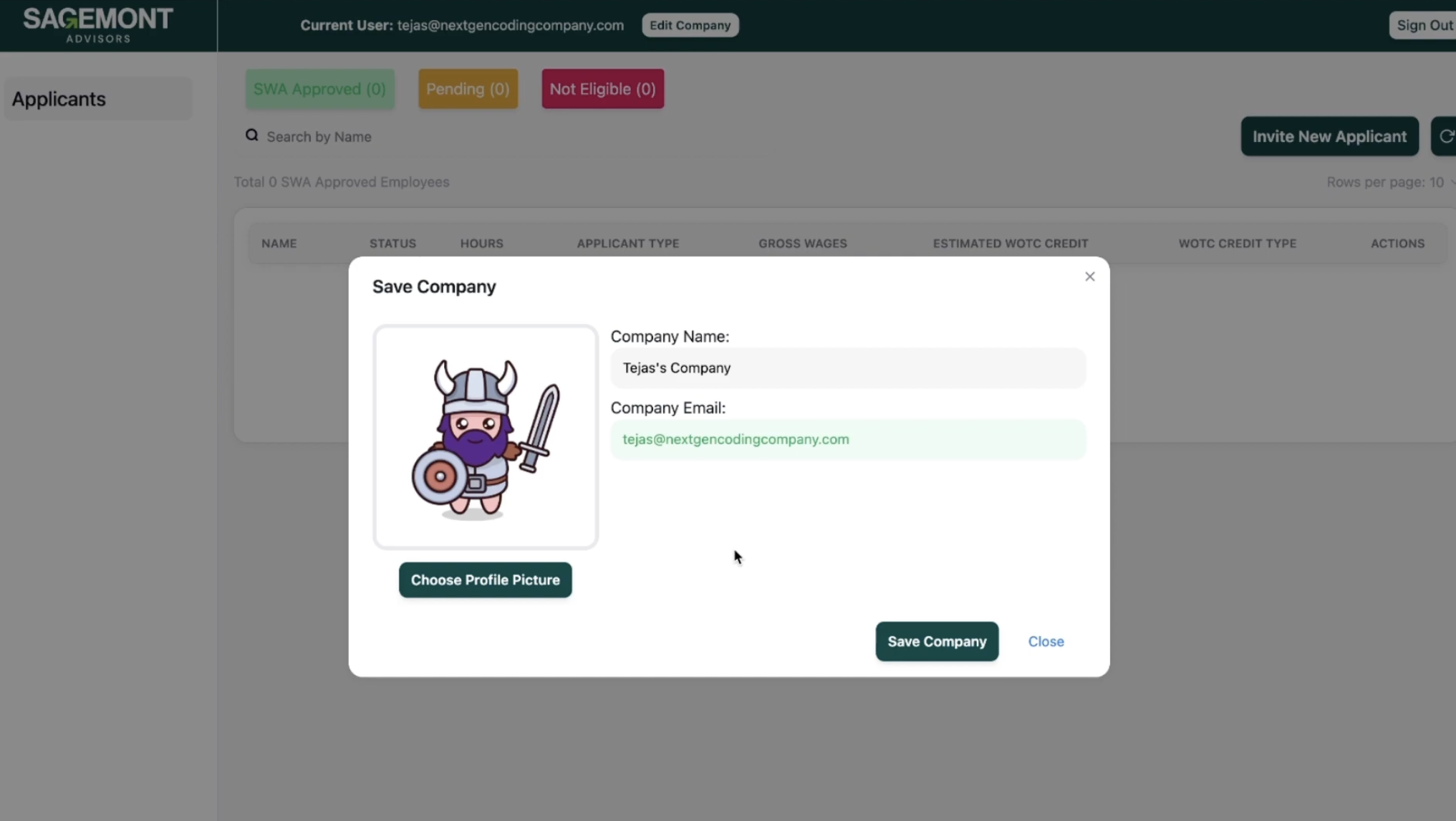

Company Portal

- Centralized Document Repository: Integrated AWS S3 for encrypted storage and Dropbox API for seamless file sharing. Employers could tag, search, and retrieve documents instantly, reducing administrative effort.

- Automated Credit Calculation Engine: Powered by AWS Lambda, enabling real-time tax credit estimation and compliance checks through the IRS TIN Matching API. This improved accuracy and reduced manual review time.

- Compliance Monitoring: Continuous updates delivered through Google Cloud Pub/Sub, keeping employers informed of regulatory changes and deadlines.

Admin Interface

- Advanced Application Management: Administrators used a Next.js dashboard to monitor submission progress, generate analytics via Looker Studio, and export audit-ready reports.

- Role-Based Access Control: Integrated Auth.js (NextAuth.js) for secure authentication, session management, and auto-logout features to protect sensitive employer and applicant data.

Technologies Utilized

- Frontend: React, Next.js, Tailwind CSS

- Backend: AWS Lambda, AWS DynamoDB

- Storage: AWS S3 with encryption

- APIs: Dropbox API, SendGrid API, IRS TIN Matching API

- Authentication: Auth.js (NextAuth.js)

- Analytics: Looker Studio, Google Cloud Pub/Sub

Results

The WOTC reporting dashboard transformed Sagemont Advisors’ credit management process, delivering measurable performance and compliance gains:

- 40% reduction in administrative workload: Streamlined workflows allowed employers to focus on higher-value operations.

- 30% higher successful credit claims: Automated eligibility validation and real-time data matching improved accuracy.

- 25% improvement in data security: Encryption and role-based access boosted user trust and compliance confidence.

- 99.99% system uptime: Serverless AWS architecture provided reliability during peak filing cycles.

- 35% faster reporting turnaround: Dynamic Looker Studio dashboards enabled real-time monitoring of applications and credits.

Why It Matters

By combining automation, compliance validation, and cloud-native scalability, the WOTC dashboard redefined how Sagemont Advisors manages and tracks tax credits. Employers gained faster access to insights, applicants benefited from simpler submission flows, and administrators enjoyed greater visibility across operations—all while maintaining strict adherence to federal compliance standards.

Call to Action

NextGen helps organizations modernize complex workflows with scalable, secure, and compliance-driven solutions. To learn how our team can help your company automate credit tracking, data reporting, and regulatory management, connect with us below.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

Demo

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!