Case Studies

Architect a Fully Integrated Financial Platform for TaxNow

Introduction

Client Background

TaxNow is a digital leader in tax compliance and financial management solutions, serving both individuals and enterprise clients. With increasing complexity around tax credits, payments, and compliance filings, the company aimed to consolidate all key operations—credit management, verification, billing, and analytics—into one secure, unified platform.

The Problem

TaxNow needed to evolve from a set of disconnected tax tools into a fully integrated financial ecosystem capable of managing everything from Employee Retention Credit (ERC) tracking to identity verification and secure payments. The platform also had to withstand heavy seasonal traffic while maintaining seamless performance and regulatory compliance.

Key challenges included:

- Enabling real-time ERC tracking and analytics across large datasets.

- Integrating Stripe for seamless, compliant payment automation.

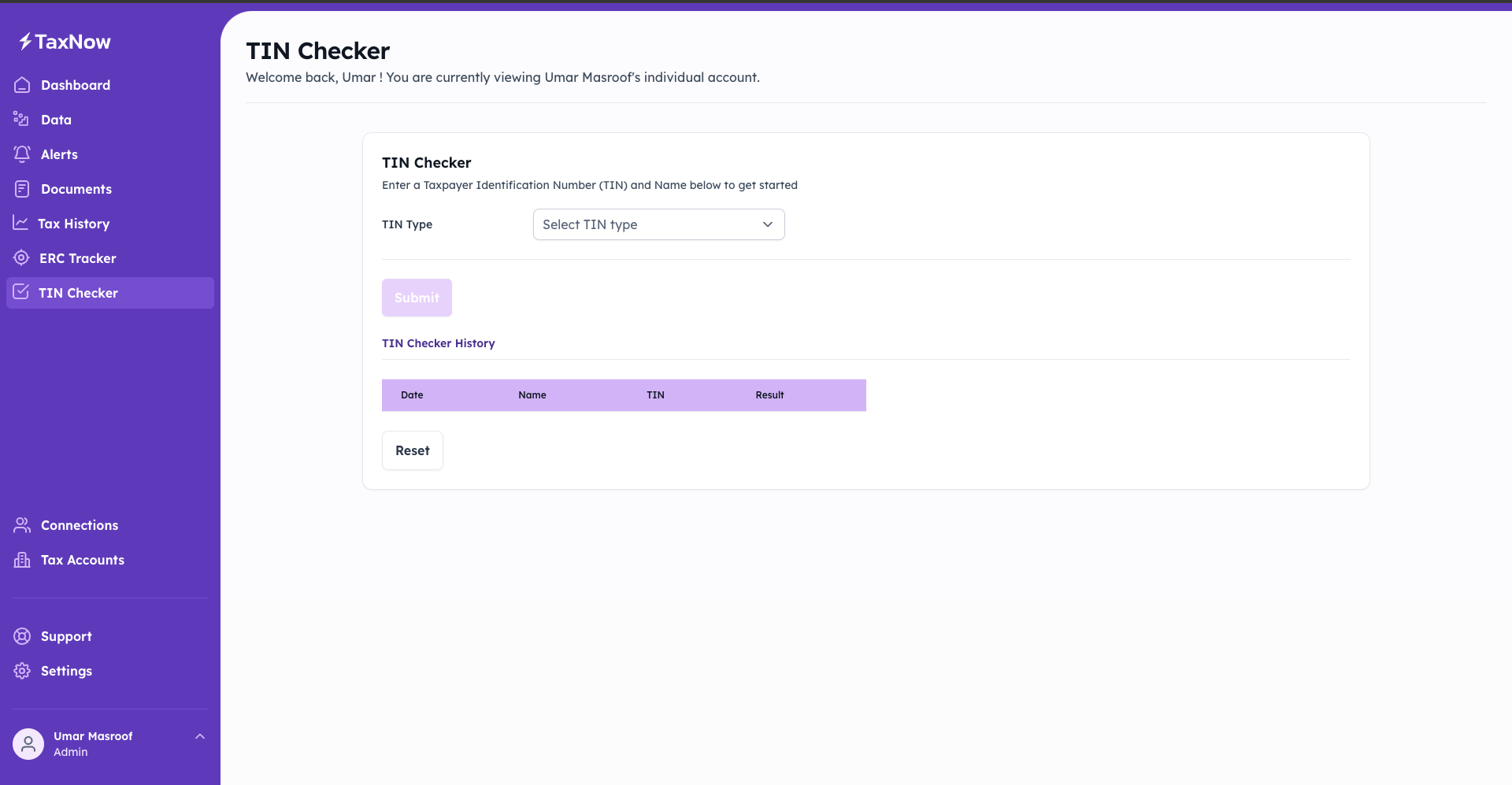

- Streamlining identity and TIN verification using secure, AI-powered tools.

- Delivering a unified, responsive dashboard for users across all devices.

- Ensuring 99.99% uptime during high-traffic tax filing periods.

- Meeting strict IRS and GDPR data security standards.

TaxNow sought a partner that could design a single, scalable solution capable of securely managing millions of transactions and compliance workflows simultaneously.

Our Solution

NextGen Coding Company architected and deployed a next-generation financial platform that unified ERC tracking, tax data management, billing, and reporting into a cloud-native system built on AWS.

- Implemented a dynamic ERC tracking module to help businesses monitor eligibility and claim tax credits in real time.

- Utilized Google Cloud Pub/Sub to power live data updates and automate event-driven credit tracking.

- Built analytics dashboards with Looker Studio, allowing users to visualize credit utilization and generate audit-ready reports instantly.

Seamless Payment Integration with Stripe

- Integrated Stripe APIs to automate invoicing, recurring billing, and transaction reconciliation.

- Enabled PCI-DSS-compliant payment processing to secure user data and prevent fraud.

- Reduced administrative overhead by streamlining invoice generation and real-time payment confirmation.

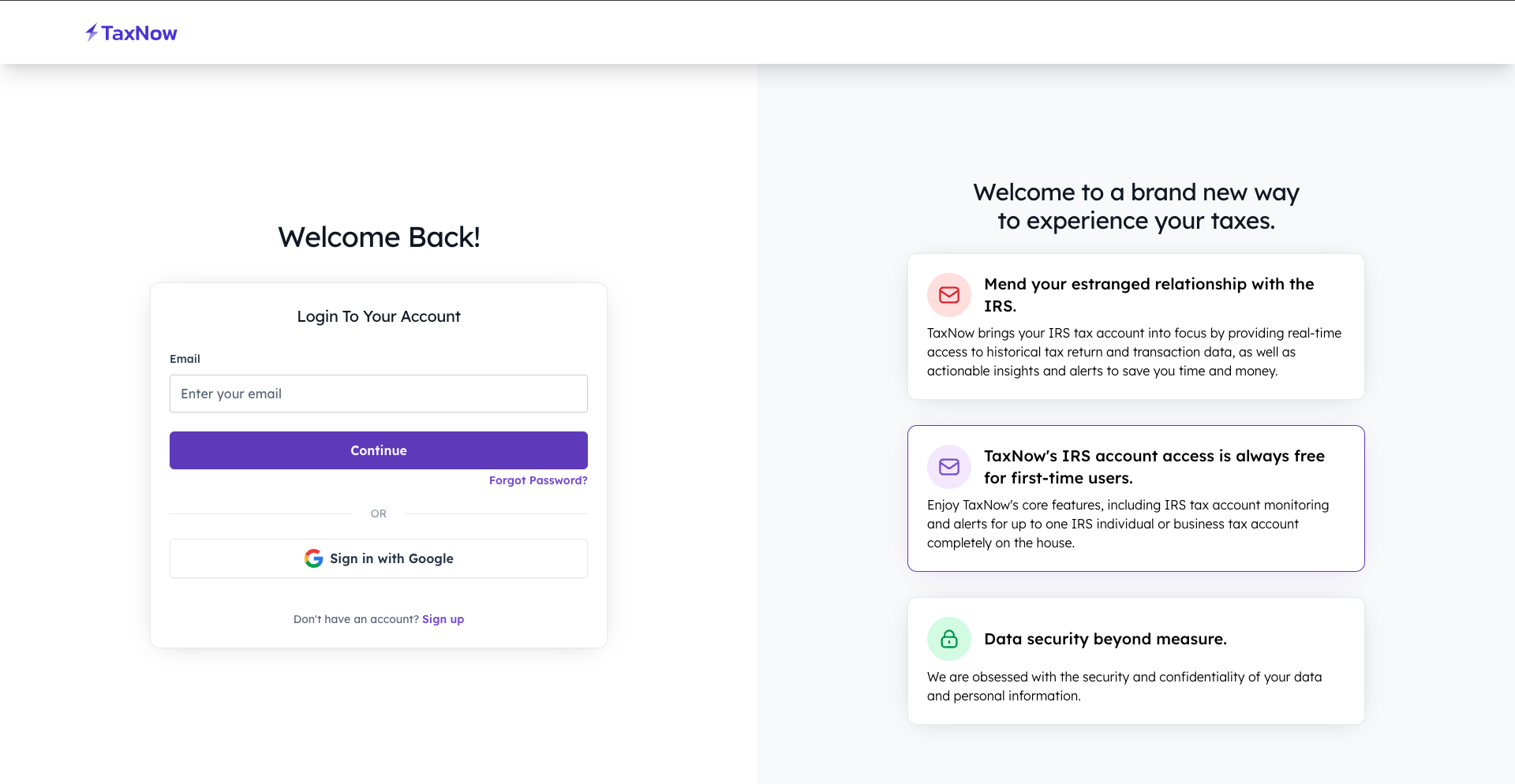

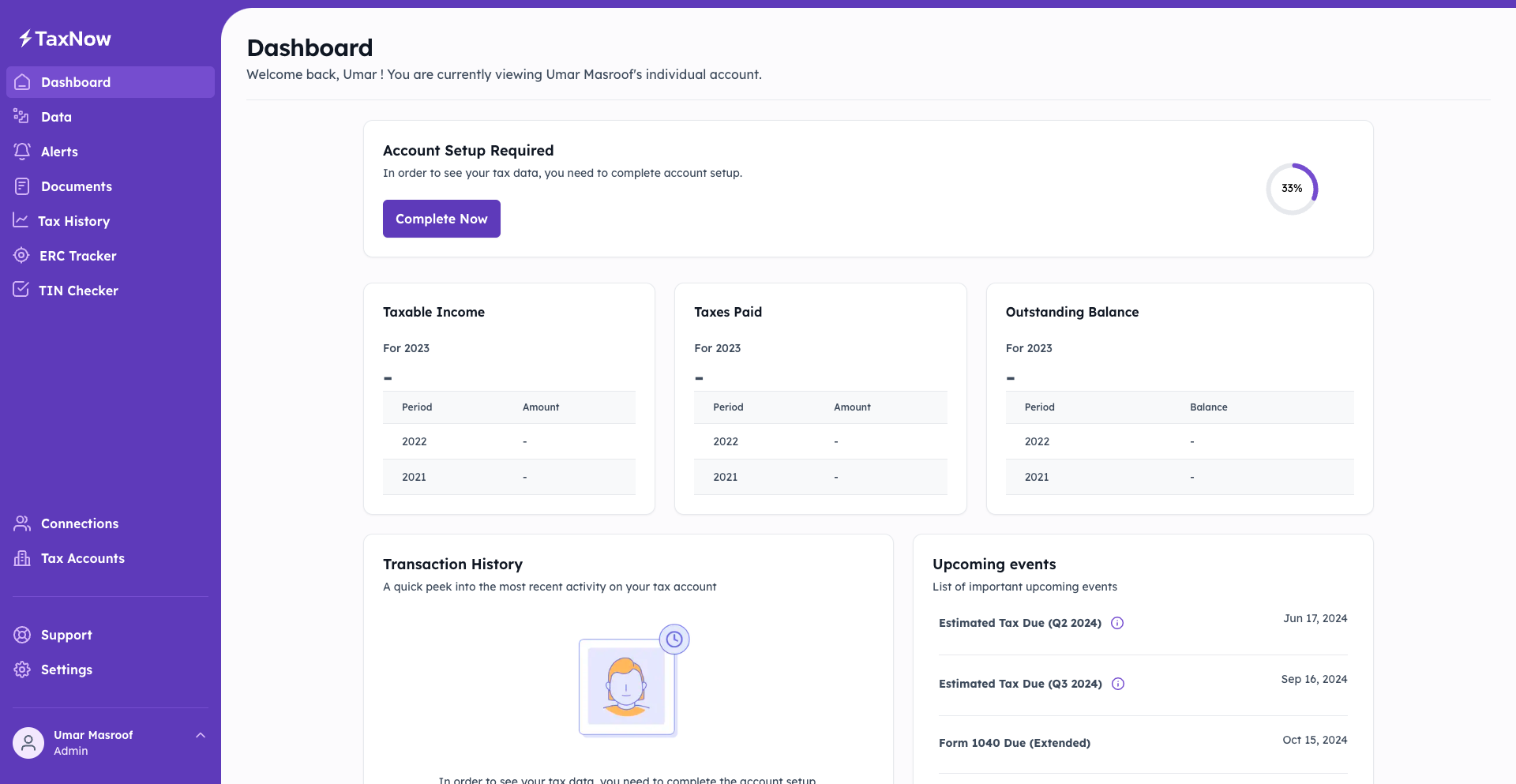

Unified Dashboard with Next.js

- Designed a modern, Next.js-powered dashboard that displayed real-time financial summaries, credit usage, and payment histories.

- Built modular widgets for tracking tax deadlines, outstanding balances, and credits claimed, ensuring users had full financial visibility at a glance.

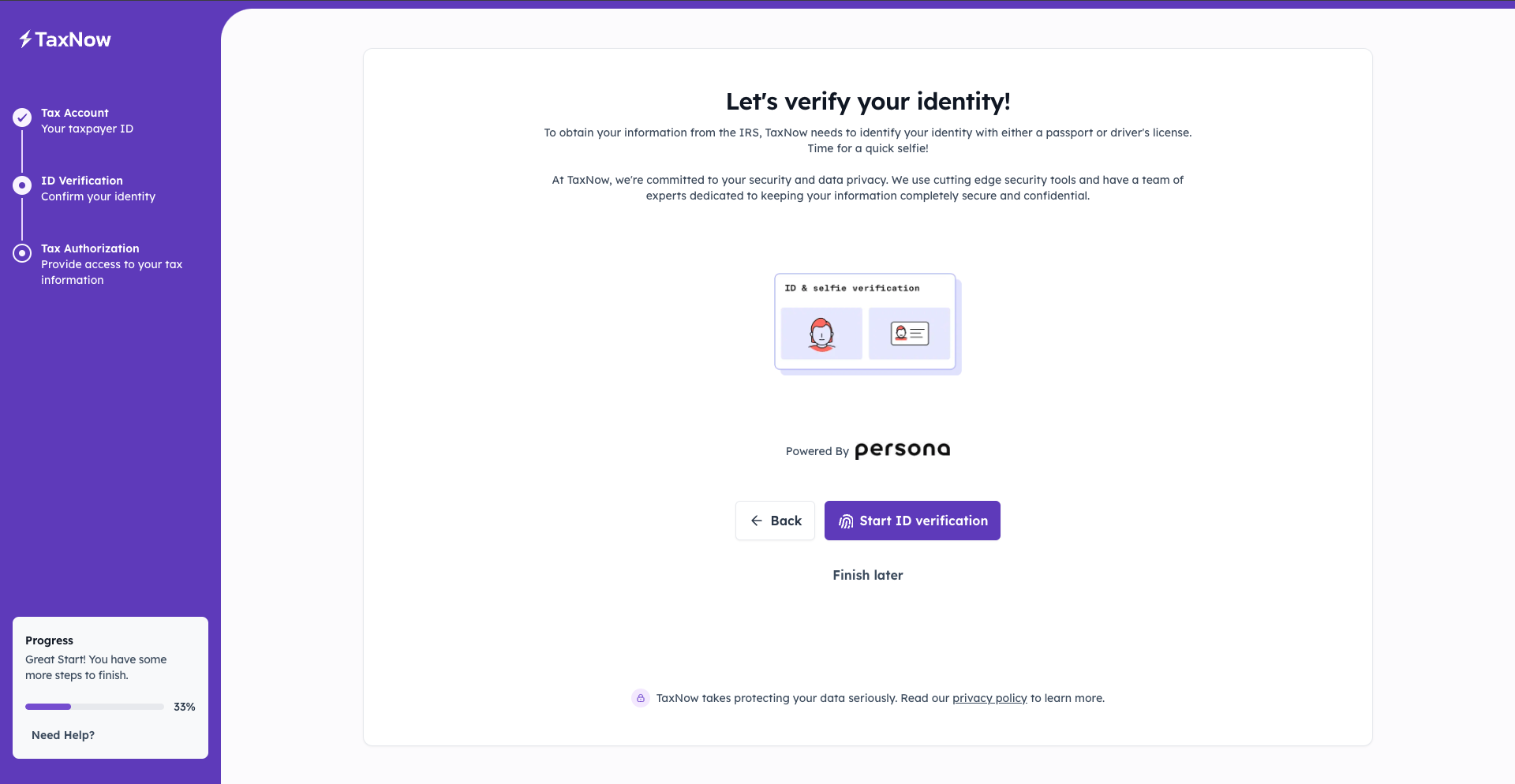

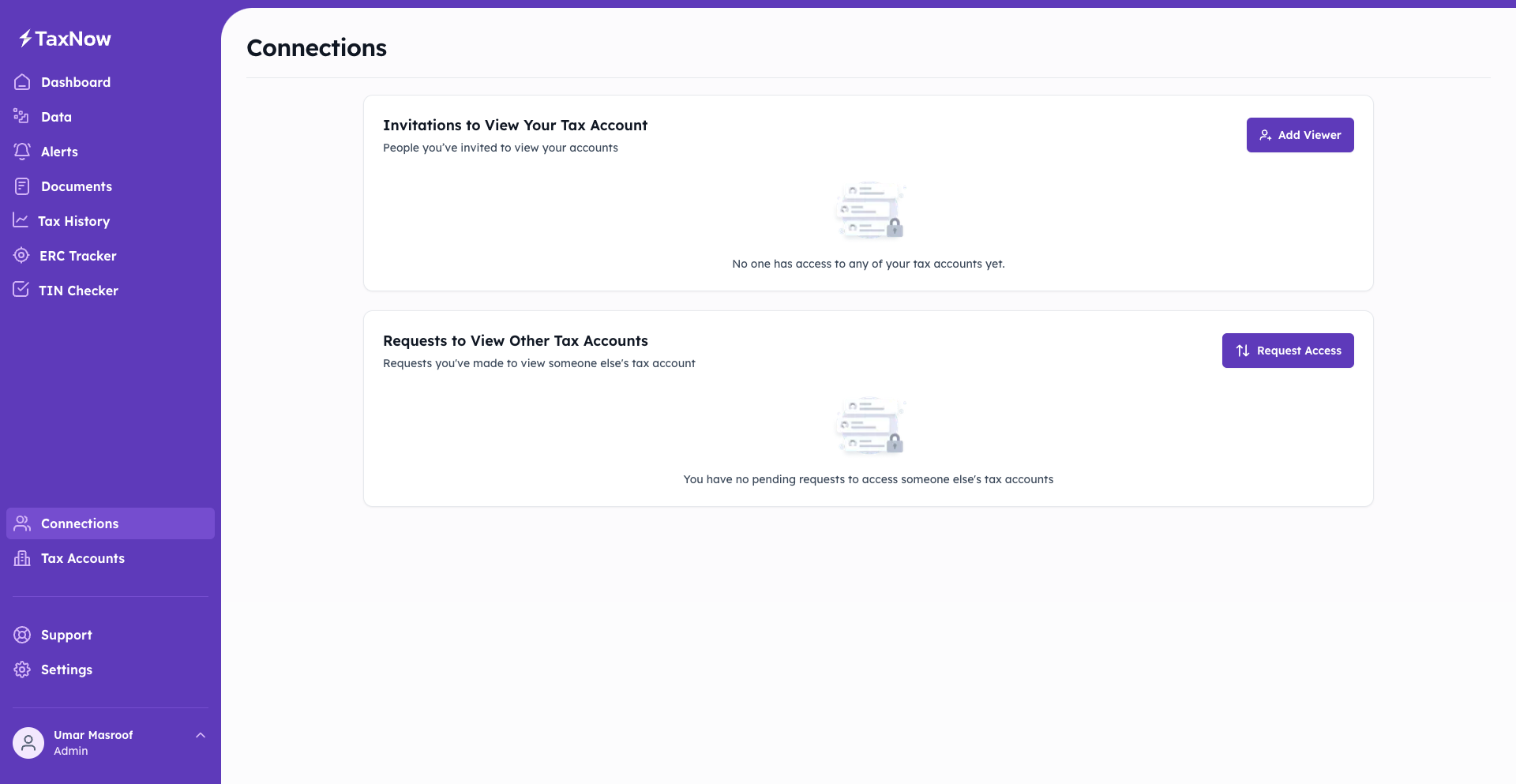

Secure Identity Verification with Persona

- Integrated Persona for automated Taxpayer Identification Number (TIN) and identity verification.

- Leveraged AI-powered fraud detection and compliance checks to increase verification accuracy and prevent identity misuse.

Automated Alerts and Reporting

- Deployed AWS Simple Notification Service (SNS) to send real-time alerts about filings, payments, and deadlines.

- Enabled one-click generation of audit-ready tax reports, cutting compliance preparation time by 20%.

Cloud Security and Data Compliance

- Used AWS S3 for encrypted document storage, with AWS Key Management Service (KMS) managing all encryption keys.

- Ensured full adherence to IRS Security Six and GDPR compliance frameworks for secure data handling.

Scalable Infrastructure with AWS Elastic Beanstalk

- Hosted the platform on AWS Elastic Beanstalk, providing auto-scaling capabilities that supported over 1 million concurrent users during peak season.

- Maintained high performance, stability, and zero downtime during traffic surges.

Intuitive Design with Tailwind CSS

- Developed a responsive, mobile-first interface using Tailwind CSS, ensuring consistency across devices.

- Delivered a clean, modern experience that increased user satisfaction and retention.

Serverless Automation with AWS Lambda

- Automated key backend operations—billing, tax calculations, and document generation—through AWS Lambda functions.

- Reduced processing latency and operational costs by 15%, improving system efficiency.

Why It Matters

By creating a single, scalable financial platform, NextGen transformed TaxNow’s fragmented workflows into a cohesive, automated system. The result was a faster, more reliable, and secure tax management ecosystem that empowered users to manage credits, payments, and compliance effortlessly—cementing TaxNow’s position as a modern leader in financial technology.

Call to Action

NextGen builds enterprise-grade financial platforms that combine intelligent automation, secure payments, and real-time analytics. Our engineers specialize in designing scalable, cloud-native architectures that help fintech and compliance organizations operate efficiently and securely.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!