Case Studies

Comprehensive ERC Management Platform for TaxNow

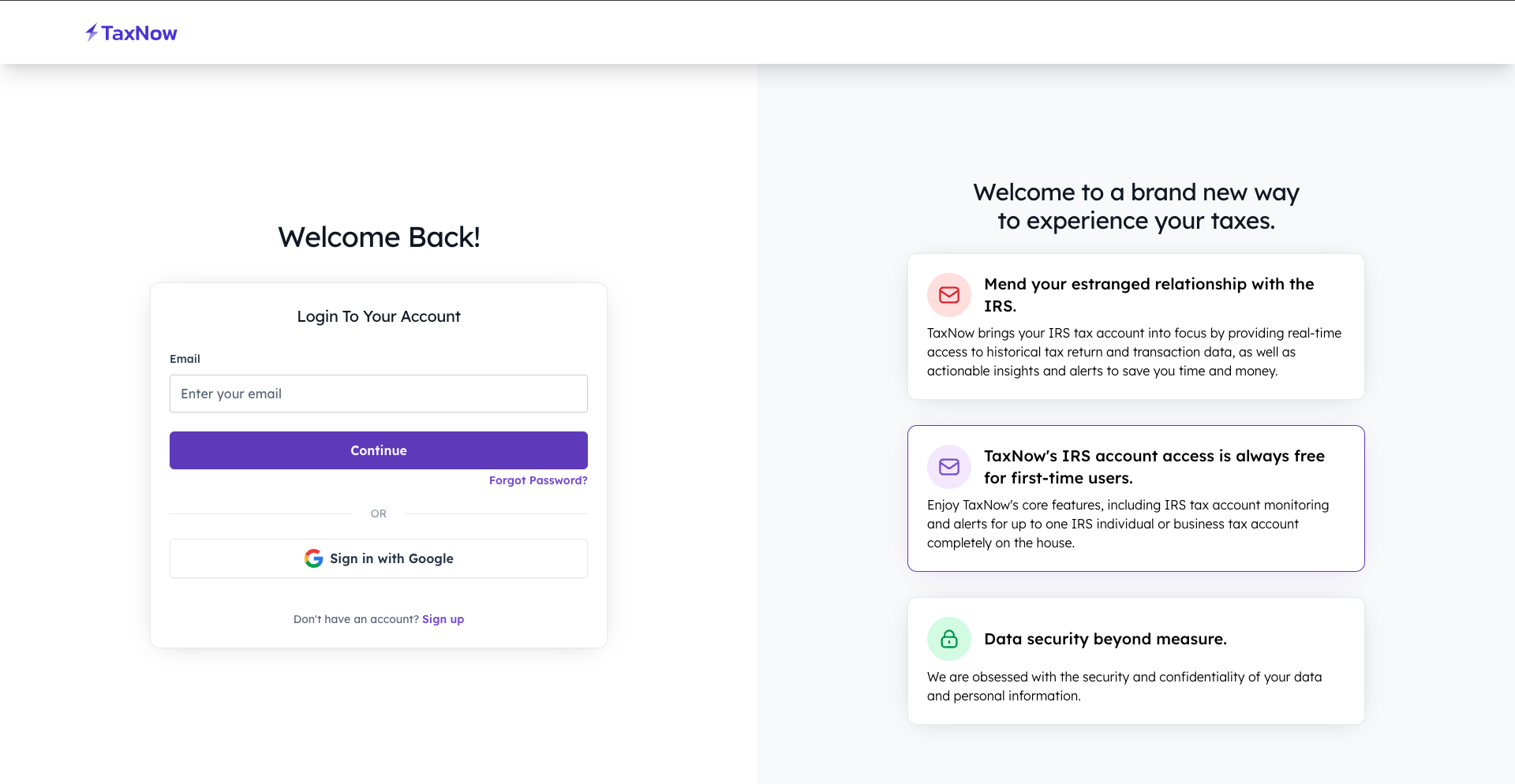

Introduction

Client Background

TaxNow is a premier digital tax compliance platform that assists businesses with managing complex credit programs and regulatory filings. As demand for Employee Retention Credit (ERC) claims surged, TaxNow needed a fully automated, compliant system capable of managing large-scale data and providing real-time credit tracking, eligibility verification, and financial reporting—all without compromising performance or data security.

The Problem

The Employee Retention Credit process required managing detailed payroll data, verifying business eligibility, and producing compliant reports aligned with IRS standards. Manual review and fragmented workflows caused inefficiencies and increased risk of human error.

Key challenges included:

- Automating ERC eligibility screening in compliance with IRS guidelines.

- Integrating payroll data from multiple sources such as Gusto and QuickBooks.

- Ensuring real-time credit calculation and audit-ready documentation.

- Maintaining data security and scalability during tax season spikes.

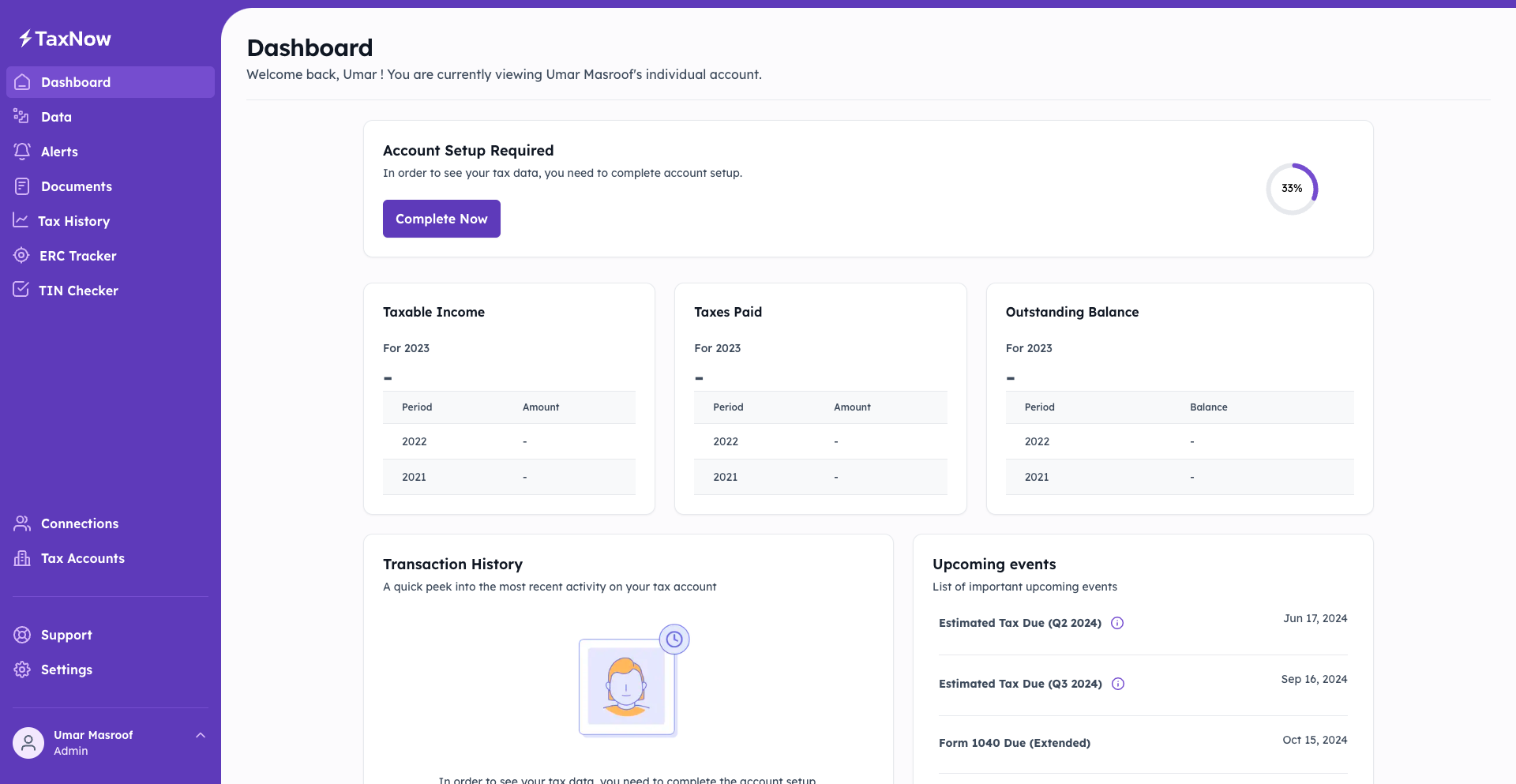

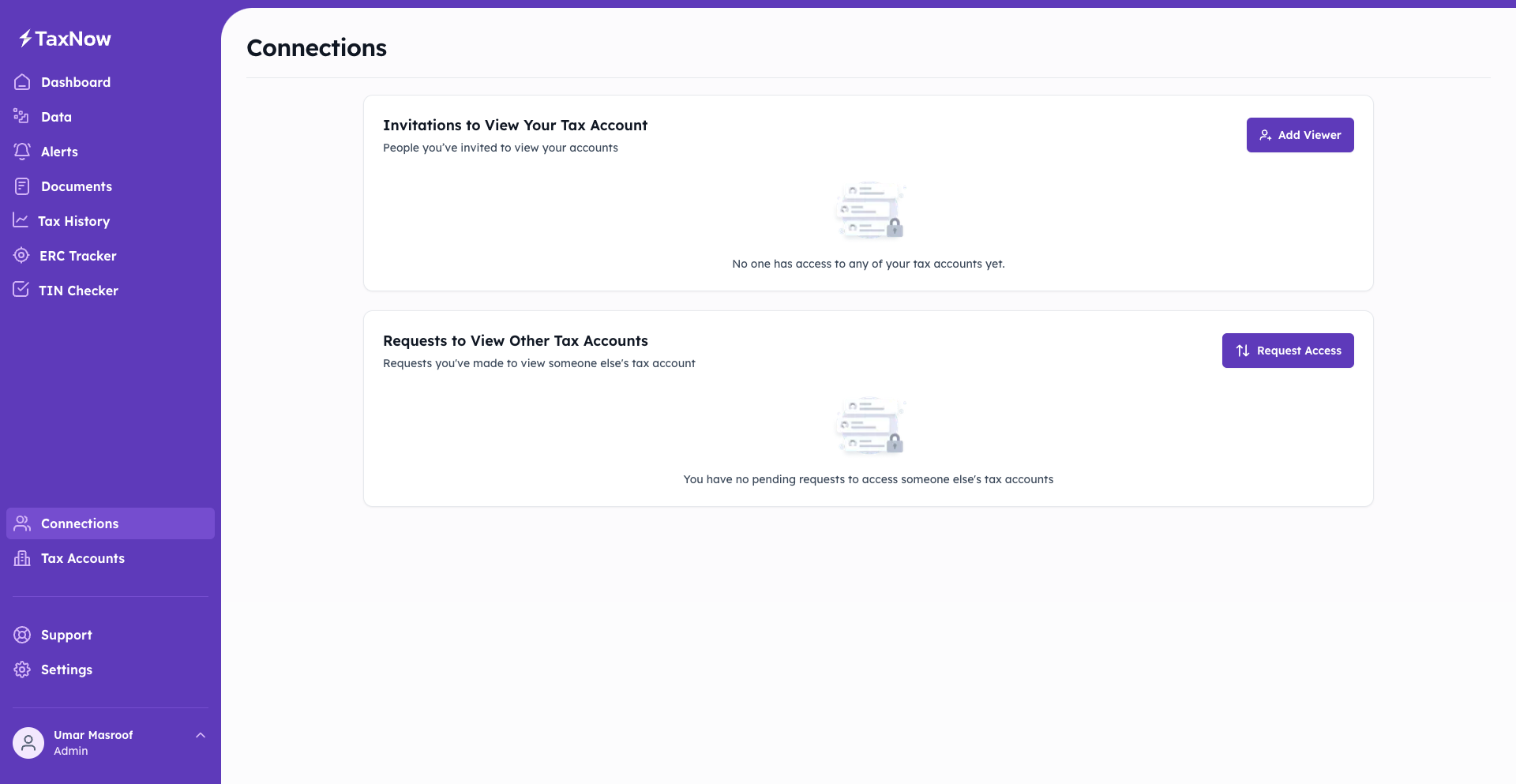

- Providing a centralized dashboard for financial insights and claim tracking.

The goal was to create a secure, end-to-end ERC management platform capable of handling millions of users while simplifying claim submission and compliance.

Our Solution

NextGen Coding Company engineered a comprehensive ERC management platform combining advanced automation, cloud scalability, and real-time analytics to transform TaxNow’s ERC processing system.

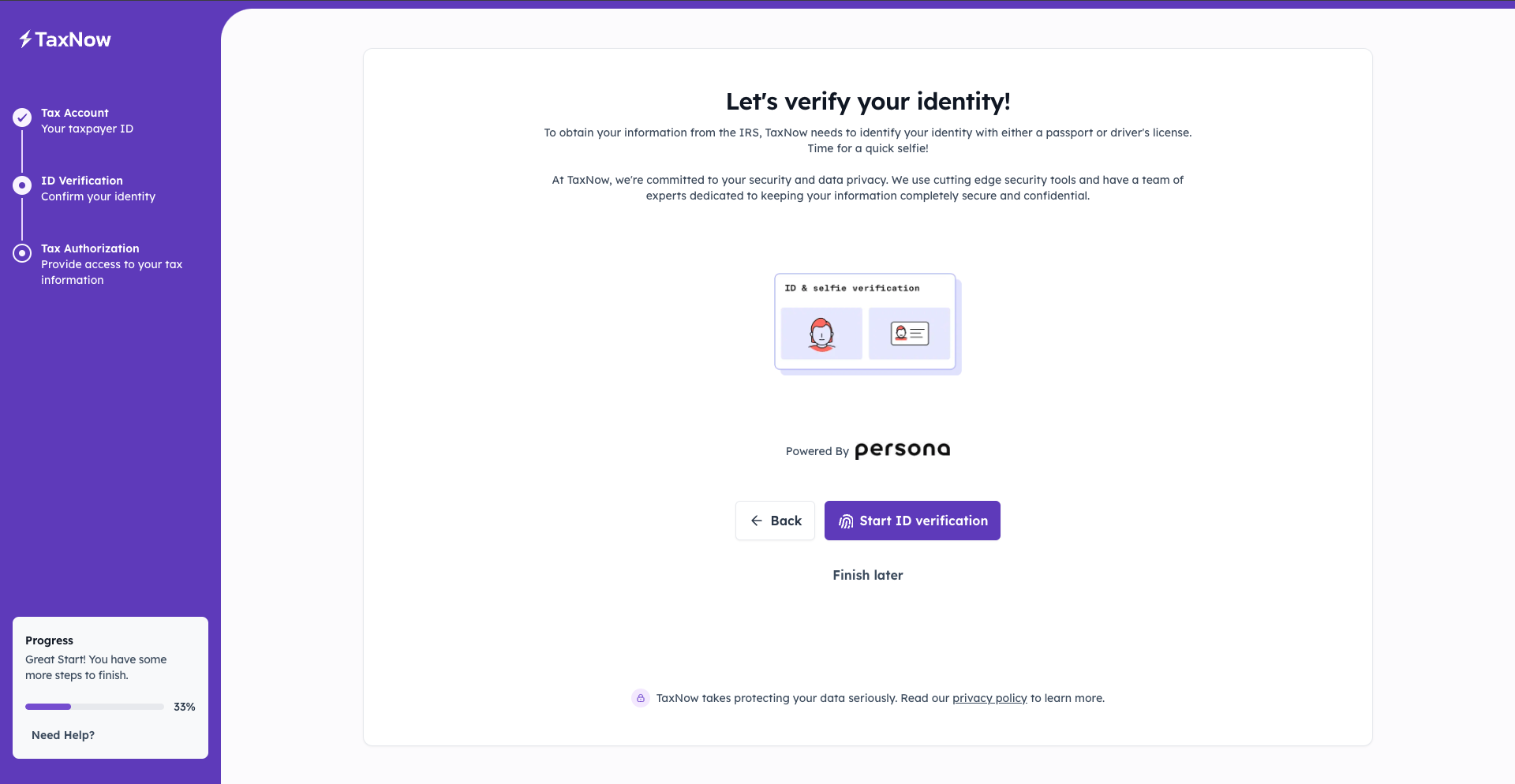

A dynamic eligibility workflow built with React guided users through complex IRS rules using conditional logic and schema validation. Real-time eligibility checks ensured businesses met ERC qualifications before proceeding, reducing submission errors by 90%.

Payroll Data Integration

Integration with Plaid, Gusto, and QuickBooks enabled secure, automated payroll data imports. Validation mechanisms ensured accuracy while eliminating manual uploads. This reduced data preparation time by 30% and improved record reliability across all employer accounts.

Real-Time Credit Calculation

The platform used Node.js for backend logic and Google Cloud Functions for real-time credit computation. Users received instant projections for eligible credits per employee and payroll period, enabling precise financial forecasting.

Audit-Ready Reporting

Automated form generation was powered by PDFKit, producing fully compliant Form 941-X and supplemental documentation. Users could download pre-filled forms for submission or audit purposes with guaranteed accuracy and consistent formatting.

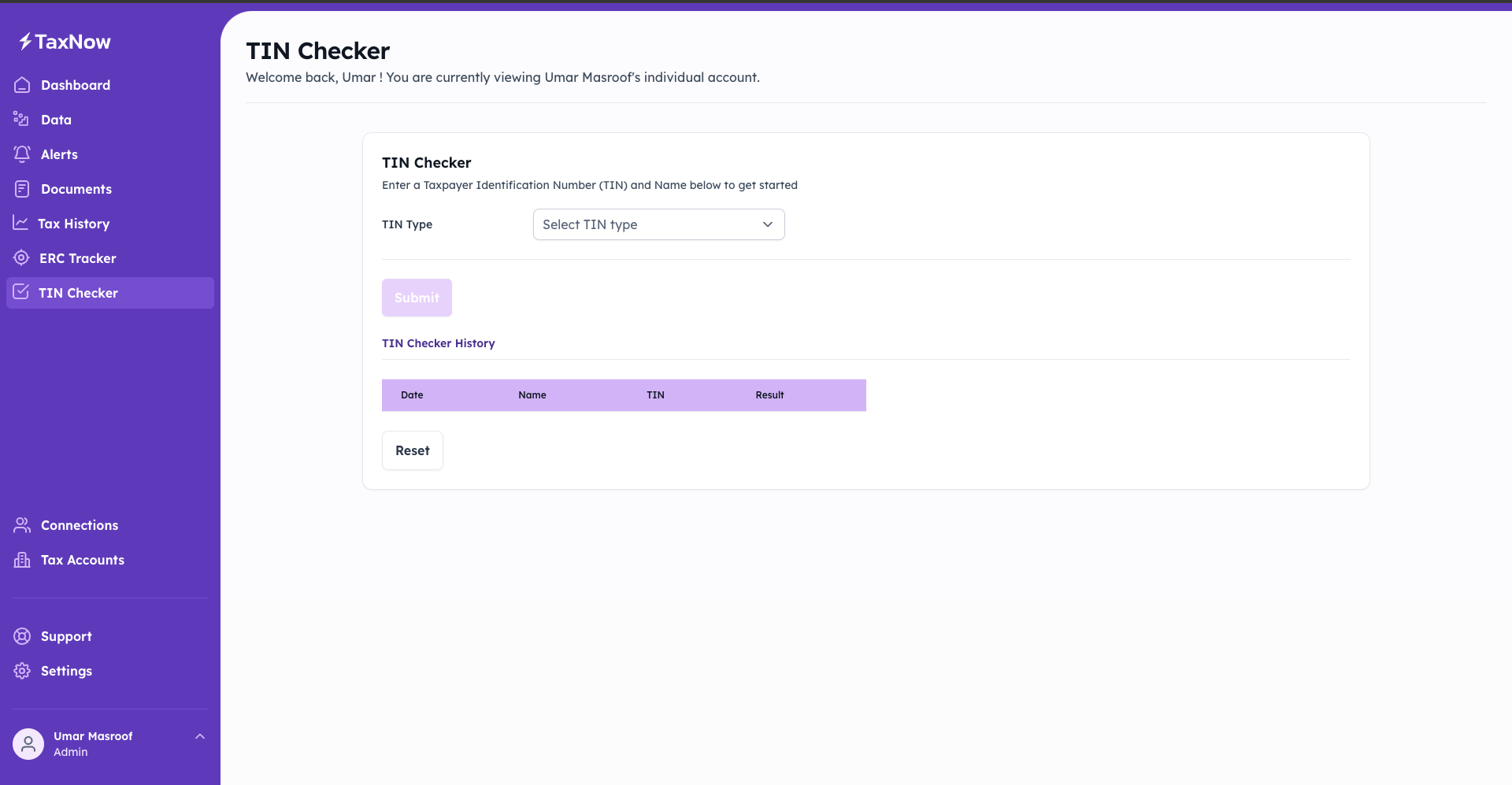

Centralized Management Dashboard

Built with Next.js, the dashboard provided real-time visibility into claims, filings, and deadlines. Interactive visualizations powered by Chart.js allowed users to analyze claim data, track refunds, and monitor overall credit performance.

Secure Data Storage and Access Control

Sensitive financial data was stored in AWS S3 with encryption and managed through AWS Identity and Access Management (IAM) for granular access control. Data handling met GDPR and IRS Security Six compliance requirements.

Integrated Payment Processing

Stripe handled payments and service fees within the platform, offering credit card and digital wallet support. Built-in invoice automation improved transparency and accelerated billing cycles by 25%.

Notifications and Compliance Alerts

Firebase Cloud Messaging provided real-time alerts for filing deadlines, IRS updates, and claim progress. Customizable notifications allowed users to receive tailored reminders to avoid missed submissions.

Reporting and Analytics

Advanced analytics powered by Looker Studio provided visual insights into credit utilization trends and payroll metrics. Reports were exportable in multiple formats for auditors, stakeholders, and compliance reviews.

Scalable Cloud Infrastructure

Hosted on Google Kubernetes Engine (GKE), the platform scaled dynamically to handle more than 1.2 million concurrent users during peak filing periods. Auto-scaling containers ensured 99.99% uptime with minimal latency.

Multi-Factor Authentication (MFA)

Integrated Firebase Authentication provided MFA support via SMS, email, or authentication apps. This security layer safeguarded sensitive tax data and prevented unauthorized account access.

Results

The ERC platform transformed TaxNow’s compliance operations, delivering measurable efficiency and scalability improvements:

- 50% faster claim processing: Automation across eligibility and payroll workflows halved the average submission time.

- 95% reduction in filing errors: Real-time data validation minimized incorrect or rejected filings.

- 40% increase in user activity: Intuitive dashboards and automated notifications improved engagement rates.

- 25% rise in revenue: Stripe integration streamlined premium service transactions, boosting revenue opportunities.

- 1.2 million concurrent users supported: GKE scaling ensured uninterrupted service during nationwide tax deadlines.

- 30% higher compliance confidence: Audit-ready documentation and secure infrastructure enhanced client trust.

- 20% better financial visibility: Looker Studio analytics empowered businesses to forecast cash flow and optimize credits.

Why It Matters

NextGen’s tailored ERC solution empowered TaxNow to automate complex credit workflows while maintaining security and regulatory integrity. By merging intelligent automation with scalable cloud infrastructure, TaxNow achieved new operational efficiency, unlocking faster claim turnaround times and stronger client retention across its growing financial ecosystem.

Call to Action

NextGen builds enterprise-grade financial automation systems that ensure compliance, security, and performance at scale. Our cloud engineers and developers integrate real-time analytics, APIs, and automation to help organizations stay ahead of regulatory challenges.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!