Case Studies

Comprehensive ERC Management Platform for TaxNow

Introduction

Task

TaxNow, a leading tax compliance platform, sought to streamline the process of managing Employee Retention Credit (ERC) claims. The goal was to develop an automated, user-friendly system capable of handling complex ERC requirements, such as eligibility screening, payroll data integration, and credit calculations. The solution had to ensure compliance with IRS guidelines, provide real-time insights, and create audit-ready reports. Additionally, the platform needed to integrate with payroll systems, support large-scale data processing, and maintain high performance during peak tax filing periods.

Solution

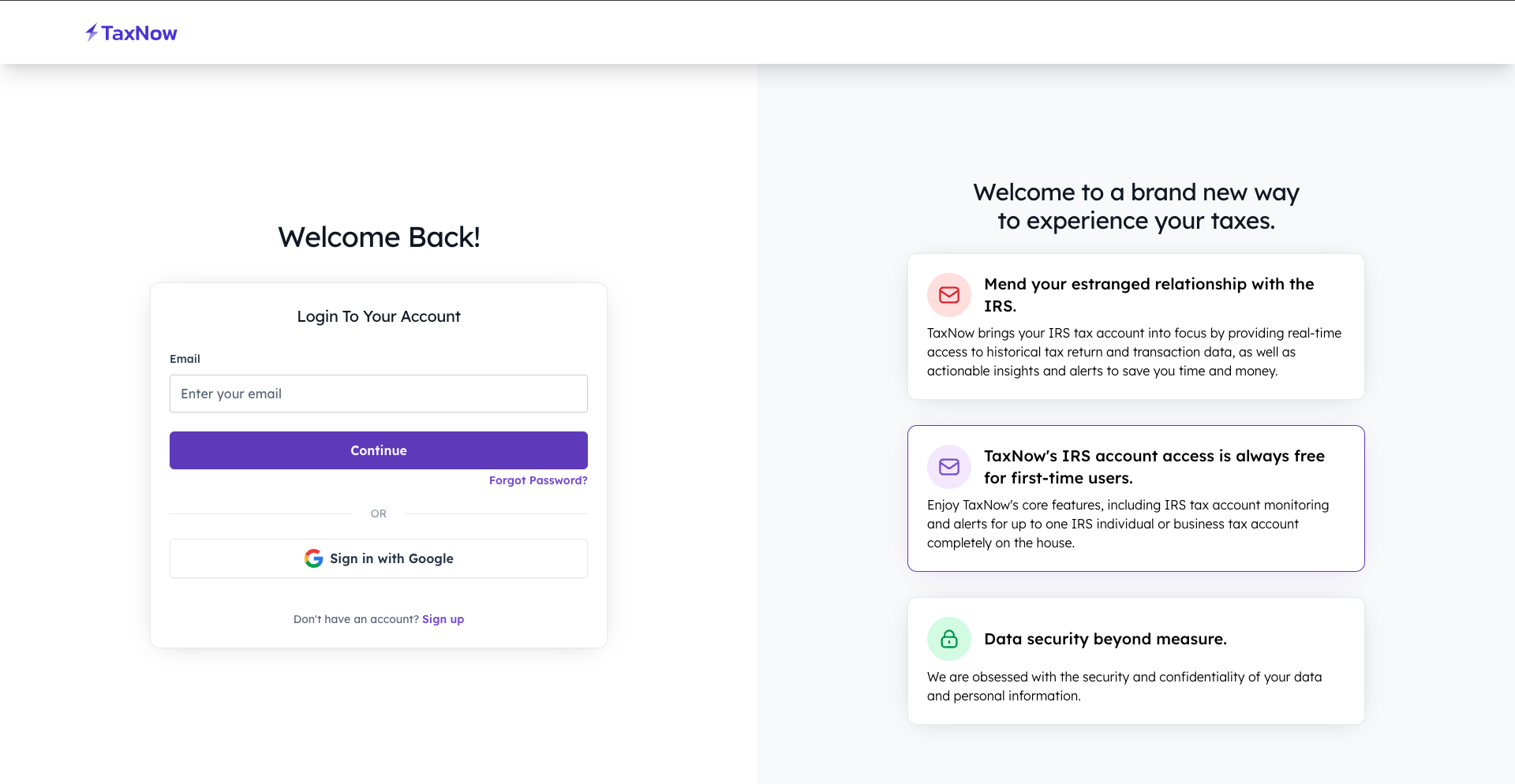

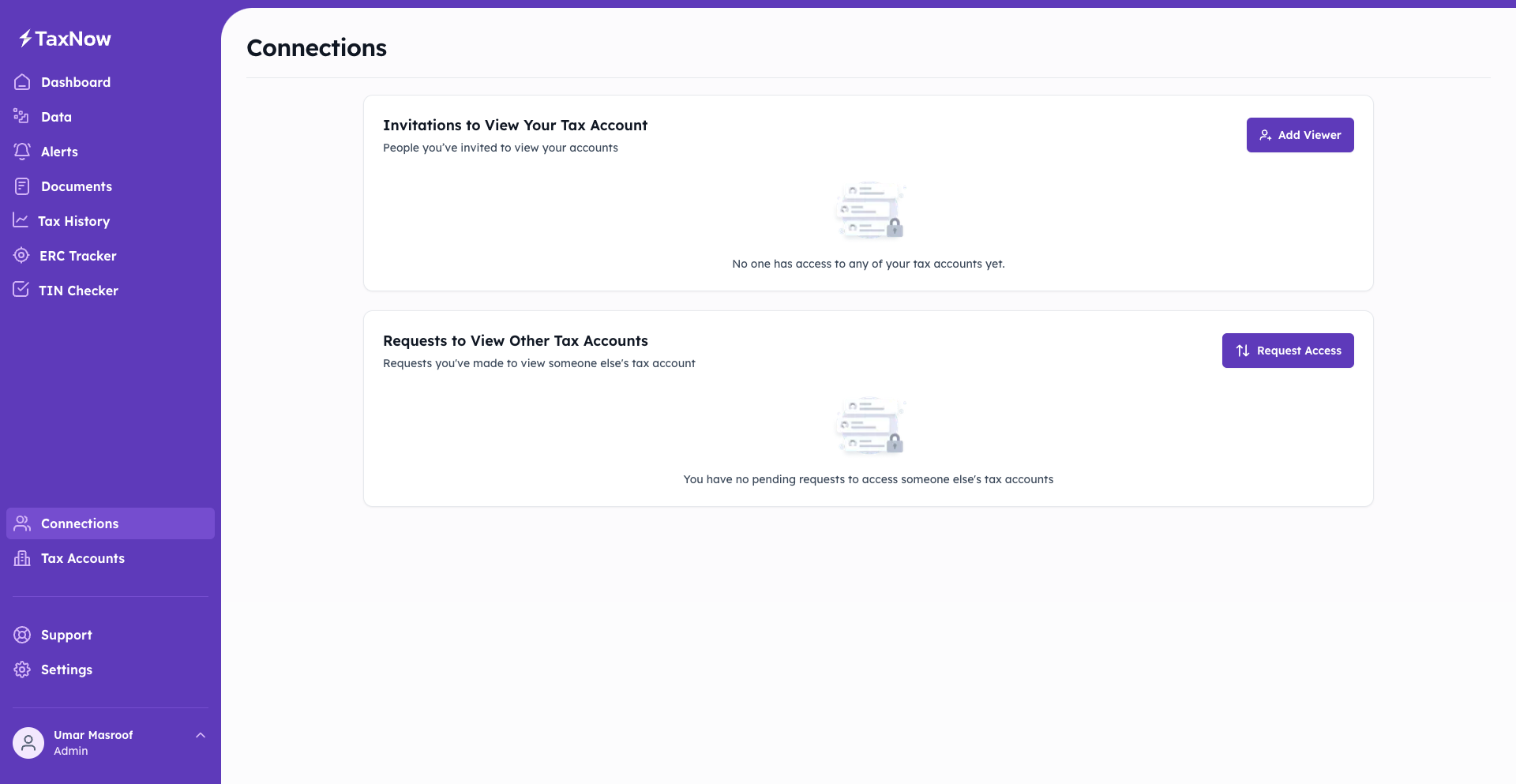

NextGen Coding Company designed and implemented a robust ERC management platform for TaxNow, leveraging modern technologies and integrations to optimize workflows and enhance the user experience.

- Automated Eligibility Screening with Dynamic Logic:

The platform integrated an intuitive eligibility screening system built using React. This system guided users through complex ERC rules via a question-based workflow, dynamically validating inputs in real time. Using automated logic checks aligned with IRS guidelines, the platform ensured users only proceeded if their business qualified, reducing errors and improving trust. - Seamless Payroll Data Integration:

The platform integrated Plaid to connect securely with bank accounts and payroll platforms, including Gusto and QuickBooks. This allowed businesses to import payroll data directly into the platform without manual uploads. Real-time validation checks ensured accuracy, reducing data preparation time by 30% and eliminating errors caused by inconsistent records. - Real-Time Credit Calculations and Projections:

Credit calculations were automated using Node.js for backend processing and Google Cloud Functions for real-time execution. Users could view detailed breakdowns of eligible credits by payroll period and employee. The platform provided live projections for future credits, giving businesses actionable insights to plan their finances. - Audit-Ready PDF Generation:

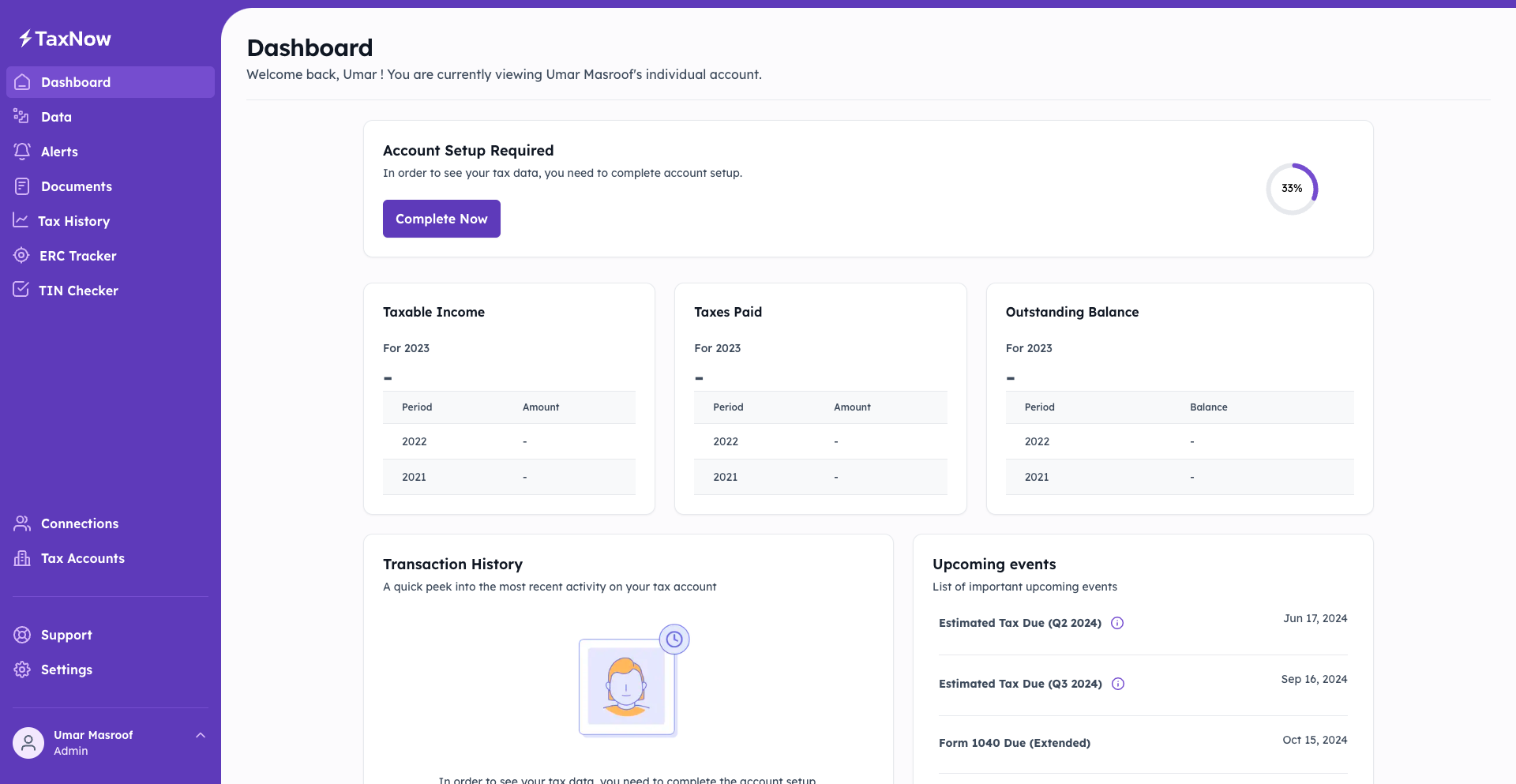

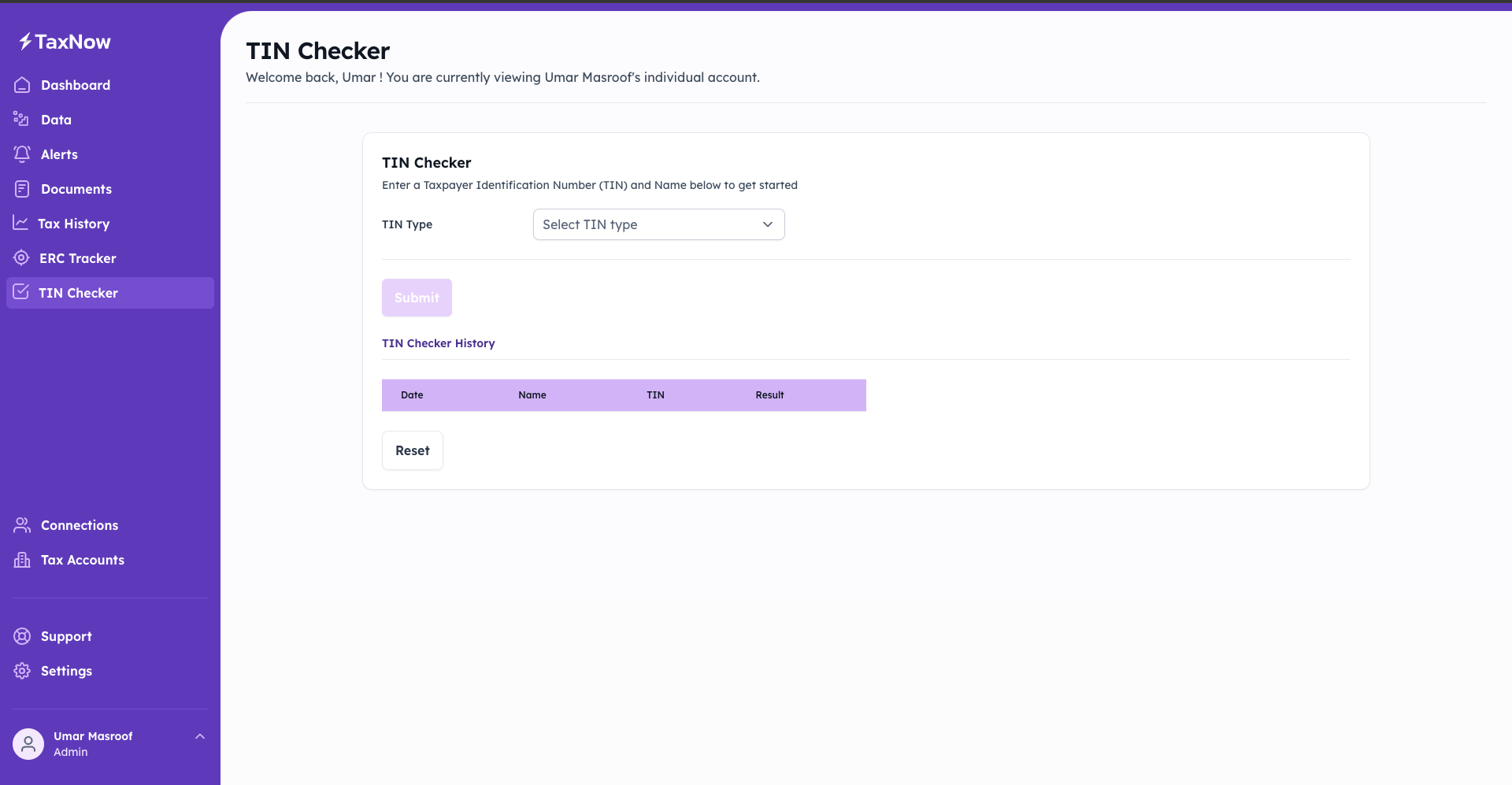

Automated compliance-ready PDF generation was powered by PDFKit, ensuring IRS-approved formatting for Form 941-X and other required submissions. Users could review and download pre-filled forms with complete confidence in their accuracy, reducing the time spent on manual corrections. - Centralized Management Dashboard:

A centralized dashboard built using Next.js provided businesses with an at-a-glance overview of ERC claim statuses, filing deadlines, and total credits claimed. The dashboard included visual data representations powered by Chart.js, enabling users to drill down into individual claims, payroll cycles, and financial projections. - Secure Document Storage and Management:

Payroll data and sensitive tax documents were securely stored using AWS S3, with AWS Identity and Access Management (IAM) ensuring role-based access controls. Encryption protocols aligned with GDPR and IRS Security Six, safeguarding sensitive user information. - Integrated Payment Processing with Stripe:

The platform integrated Stripe for seamless and secure payment processing. Businesses filing claims through the platform could pay for services using credit cards or digital wallets, with built-in invoice generation and automatic payment tracking for a transparent billing process. - Real-Time Notifications for Compliance Deadlines:

Real-time notifications were delivered through Firebase Cloud Messaging, ensuring users stayed informed about filing deadlines, IRS updates, and claim statuses. Notifications were customizable, allowing users to set reminders tailored to their workflows. - Interactive Reporting and Analysis with Looker Studio:

Detailed reports were generated using Looker Studio, enabling businesses to visualize trends in credit utilization, compare payroll periods, and generate audit-ready documentation. Reports were exportable in multiple formats, including PDF and Excel, for easy sharing with stakeholders and auditors. - Scalable and Reliable Backend Infrastructure:

Hosted on Google Kubernetes Engine (GKE), the platform was designed to scale dynamically during peak filing periods, supporting over 1 million users simultaneously. This ensured consistent performance and a 99.99% uptime rate, even during high-traffic tax deadlines. - Advanced Security with Multi-Factor Authentication (MFA):

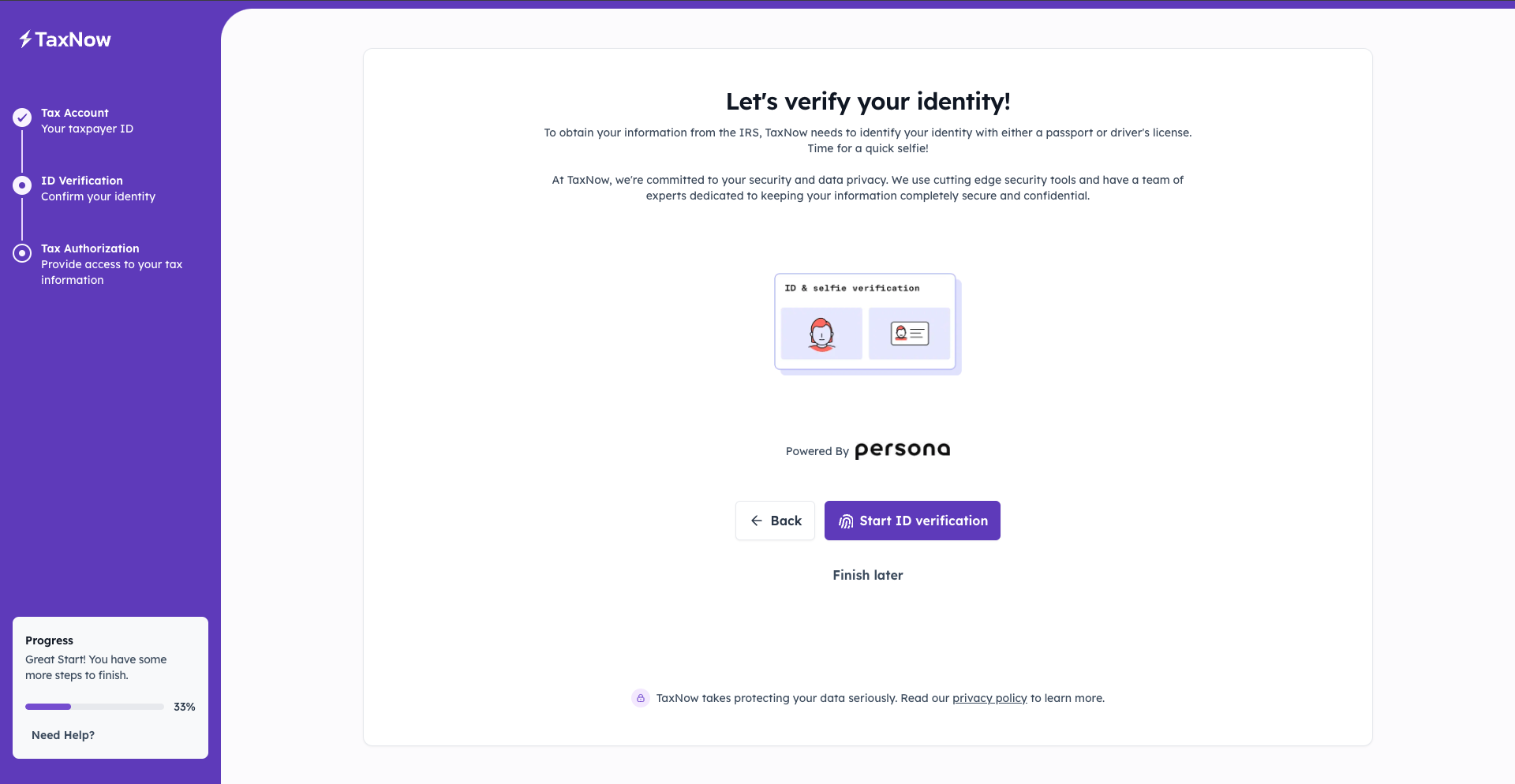

To enhance security, the platform implemented multi-factor authentication using Firebase Authentication. Users were required to verify their identities through email, SMS, or authenticator apps, providing an additional layer of protection for sensitive financial data.

Outcome

The comprehensive ERC management platform delivered exceptional results for TaxNow and its users, setting a new standard in tax compliance tools:

- Significant Time Savings:

Automated eligibility screening, payroll integration, and real-time calculations reduced average claim processing times by 50%, enabling businesses to focus on core operations. - Improved Accuracy:

Advanced validation mechanisms and compliance checks ensured a 95% reduction in filing errors, minimizing rejected claims and maximizing credits for businesses. - Enhanced User Engagement:

The centralized dashboard and interactive features drove a 40% increase in daily active users, as businesses found the platform intuitive and engaging. - Increased Revenue Opportunities:

Integrated payment processing with Stripe contributed to a 25% rise in service revenue, as more users opted for premium filing services. - Seamless Scalability During Peak Usage:

The platform successfully managed 1.2 million concurrent users during tax deadlines, maintaining exceptional performance and reliability thanks to GKE. - Stronger Compliance Confidence:

IRS-compliant form generation and audit-ready reporting boosted user confidence, with surveys indicating a 30% improvement in trust in TaxNow’s platform. - Actionable Financial Insights:

Real-time projections and customizable reports enabled businesses to optimize financial planning, with 20% of users reporting improved cash flow management as a result.

NextGen Coding Company’s innovative solution empowered TaxNow to revolutionize ERC management, delivering a seamless and scalable platform that exceeded user expectations while driving operational efficiency and revenue growth.

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!