Case Studies

Building A Robust TIN Verification System for TaxNow

Introduction

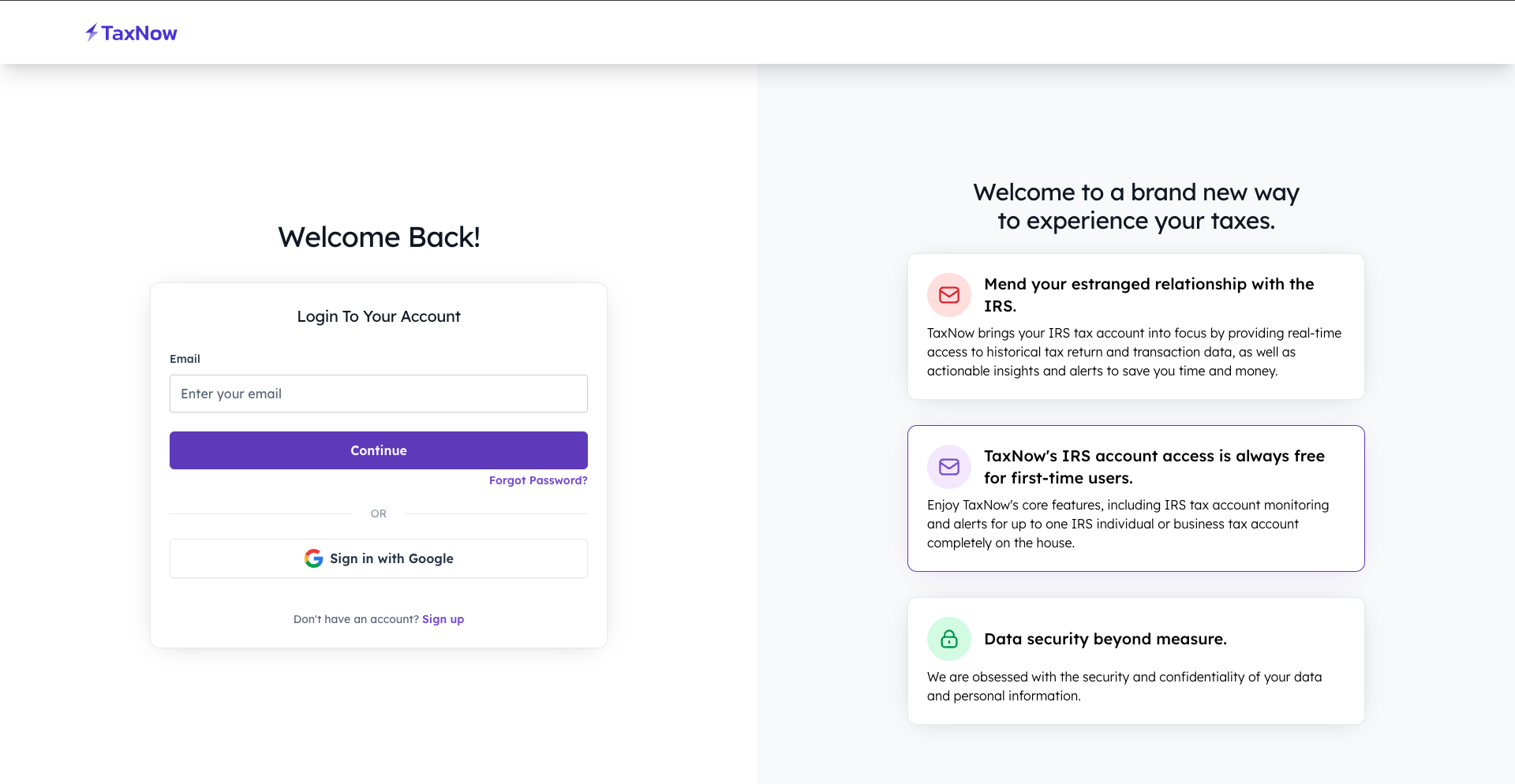

Client Background

TaxNow is an industry-leading tax compliance platform that provides automated tools for businesses managing employee, vendor, and contractor filings. As client volumes grew, the company identified a need for a secure Taxpayer Identification Number (TIN) verification system to minimize IRS penalties and improve filing accuracy.

The Problem

Businesses using TaxNow needed to verify TINs in compliance with the IRS e-Services TIN Matching Program while managing growing volumes of submissions. Manual verification caused inefficiencies and delayed filings, increasing the likelihood of mismatched records and penalties.

Key challenges included:

- Integrating directly with IRS verification systems for real-time data validation.

- Automating bulk verification for thousands of records simultaneously.

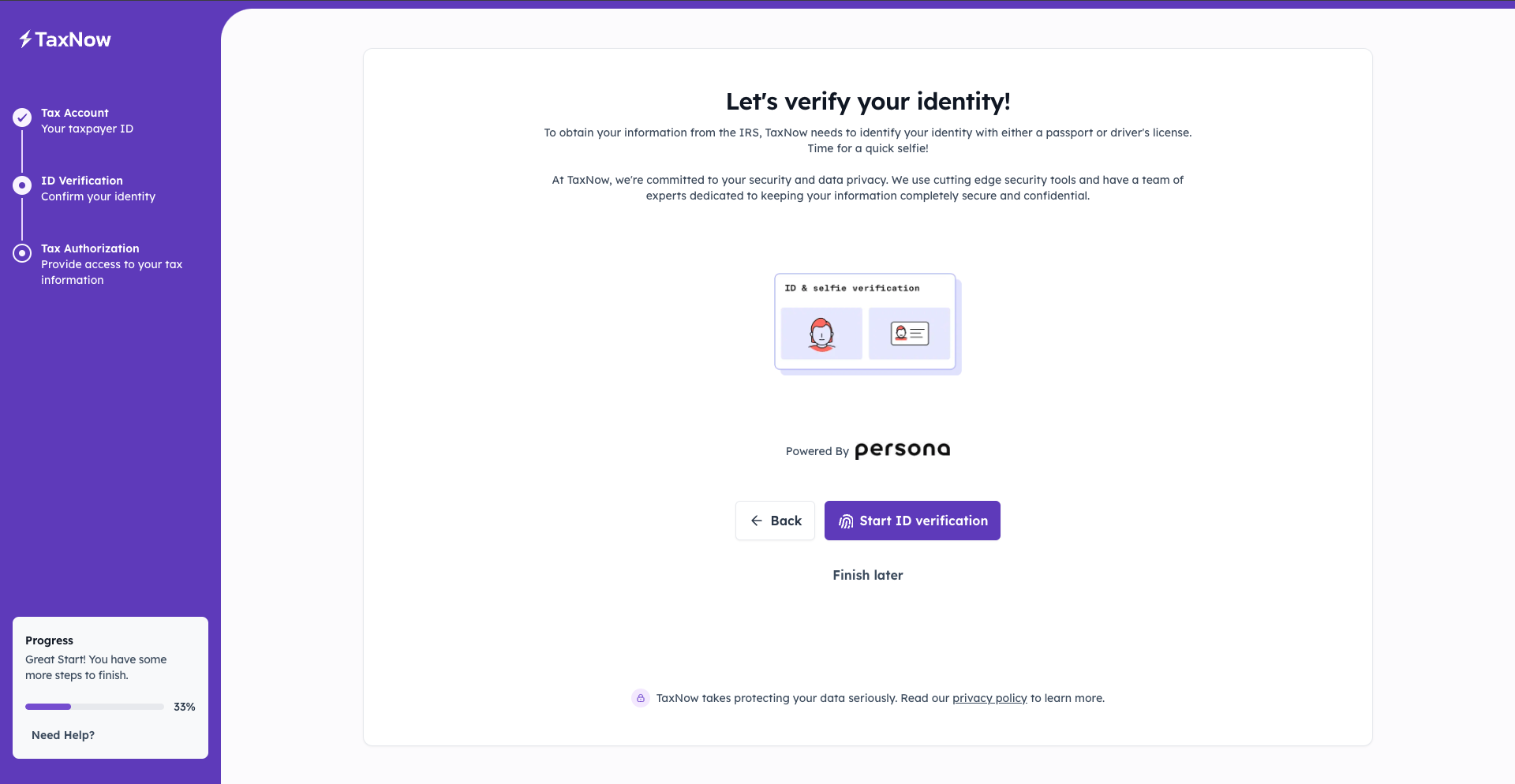

- Securing sensitive personal and financial information under GDPR and IRS Security Six standards.

- Providing error visibility, audit logging, and real-time compliance reporting.

- Ensuring system scalability during peak tax seasons without compromising performance.

TaxNow required a reliable and automated TIN verification framework that would seamlessly fit within its broader tax compliance ecosystem.

Our Solution

NextGen Coding Company engineered a fully automated, IRS-compliant TIN Verification System for TaxNow that combined direct IRS integration, real-time validation, and enterprise-grade security to streamline the entire process.

- Connected the platform directly to the IRS e-Services TIN Matching Program API, enabling instant verification of TINs and corresponding names.

- Implemented secure API communication using OAuth 2.0 and token-based authentication for verified sessions.

Automated Bulk Verification

- Built a batch verification system using Google Cloud Dataflow, capable of processing thousands of records concurrently.

- Enabled users to upload CSV files containing employee or vendor data for automated background validation.

- Reduced manual verification workload by over 40%.

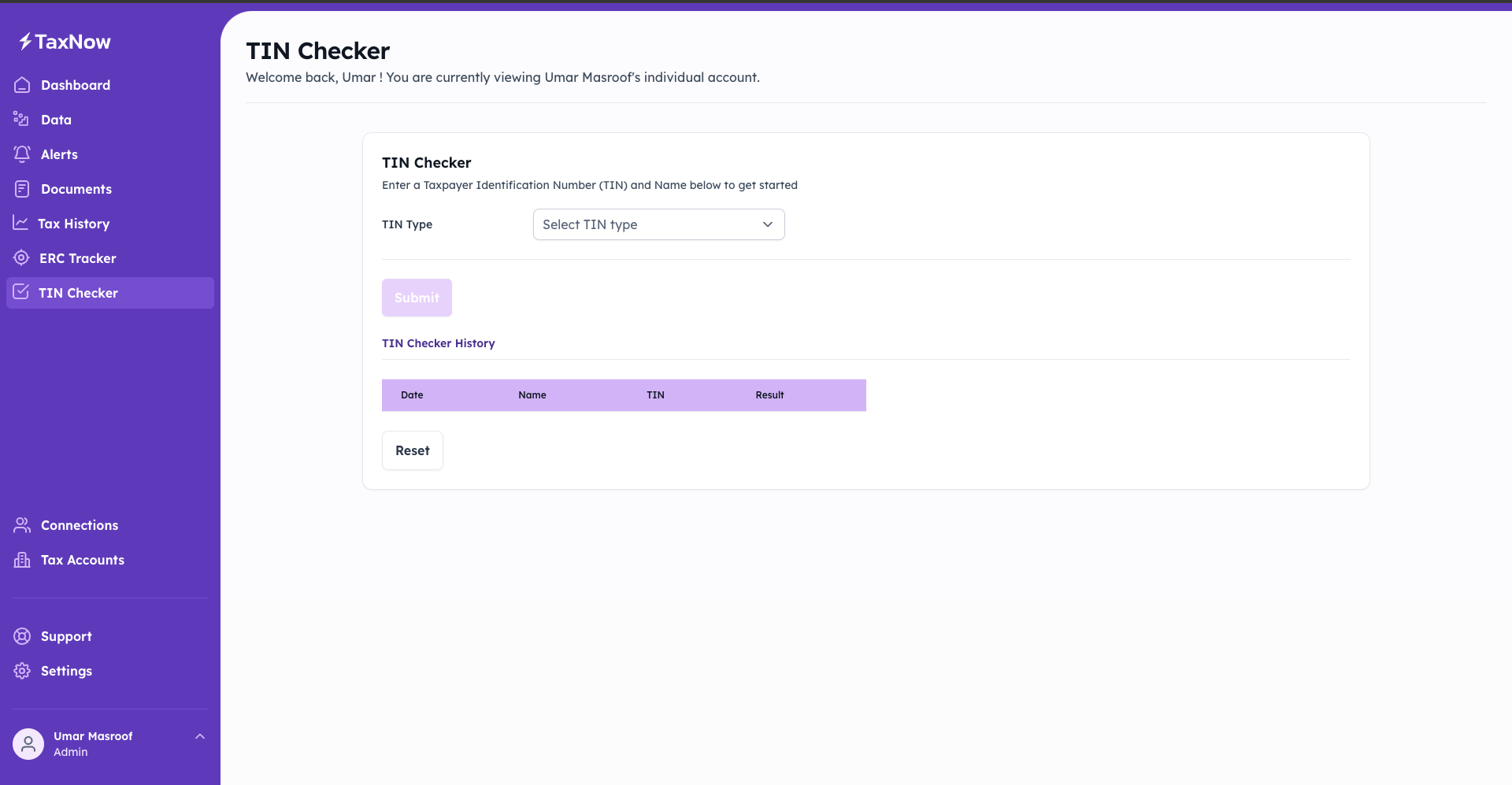

Real-Time Single Verification

- Developed an intuitive React-based interface for immediate single TIN lookups.

- Provided instant results for small businesses and accountants needing quick confirmation before form submission.

Data Security and Encryption

- Deployed Google Cloud Key Management Service (KMS) for encryption of sensitive identifiers and financial data.

- Used AWS S3 for encrypted document storage with strict access policies managed through AWS IAM.

- Implemented multi-factor authentication (MFA) via Firebase Authentication to prevent unauthorized system access.

Error Detection and Notifications

- Designed a real-time error-handling workflow with AWS Lambda, automatically flagging invalid or mismatched TIN entries.

- Delivered user alerts and guidance via Firebase Cloud Messaging, helping users resolve discrepancies quickly.

Advanced Reporting and Audit Logs

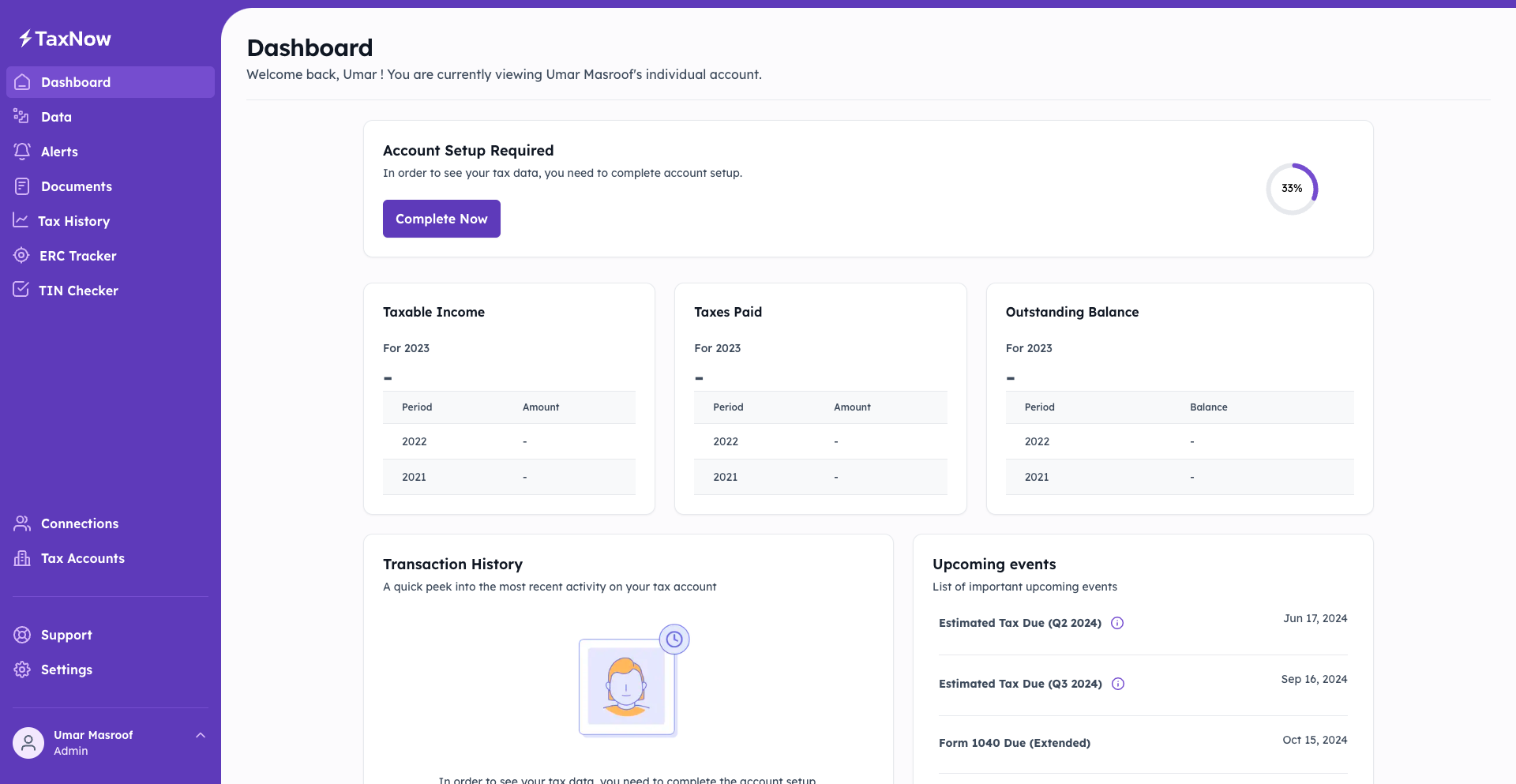

- Integrated Looker Studio for interactive dashboards that visualized verification rates, status histories, and IRS response patterns.

- Enabled exportable PDF and Excel audit reports for recordkeeping and compliance evidence.

Seamless Workflow Integration

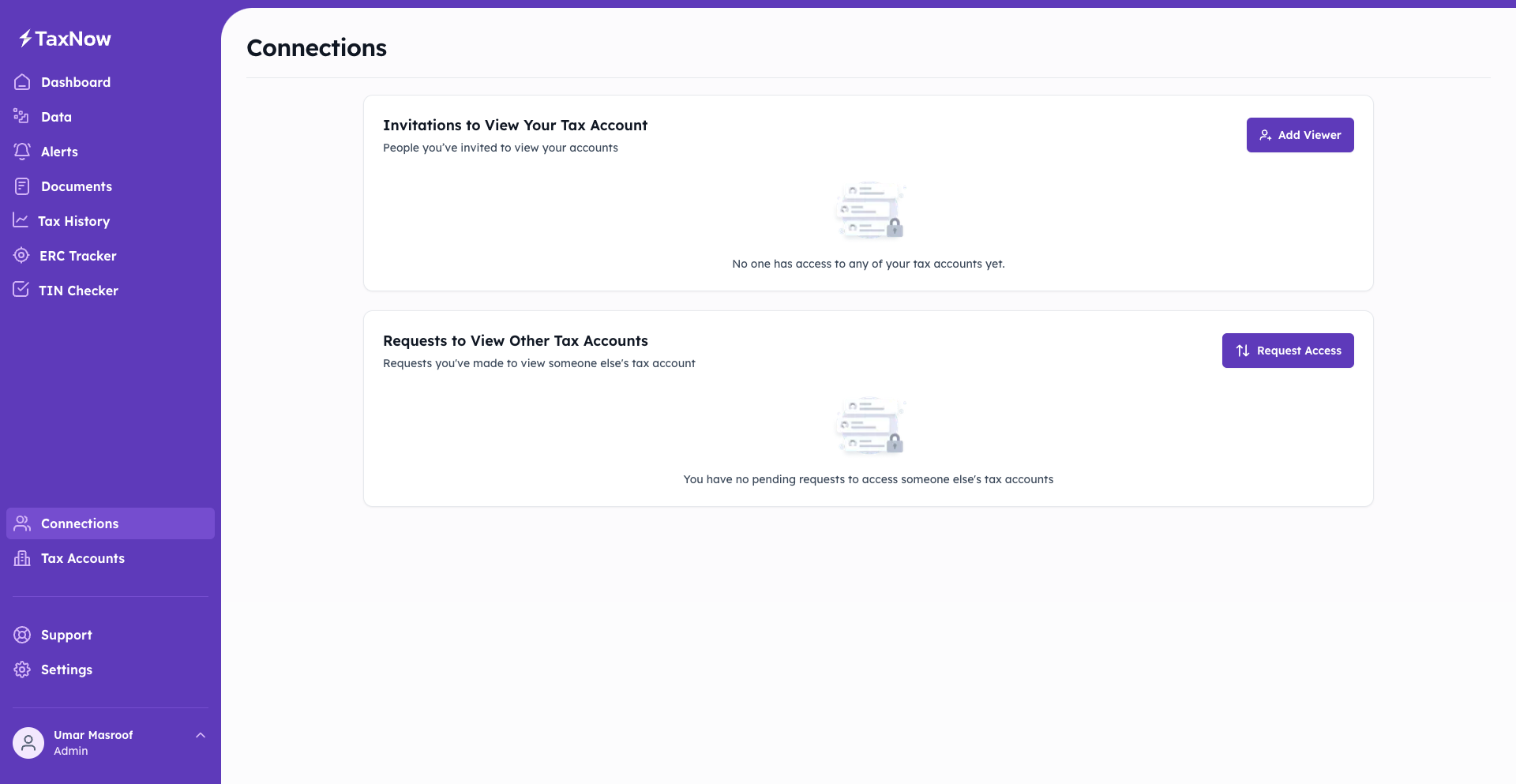

- Integrated directly with accounting tools such as QuickBooks and Xero, allowing synchronized vendor and contractor data verification.

- Embedded APIs into TaxNow’s existing compliance platform for unified user access.

Scalable Infrastructure

- Hosted the verification system on Google Kubernetes Engine (GKE) with auto-scaling and 99.99% uptime during tax season peaks.

- Optimized cloud workloads for cost efficiency through managed node pools and traffic balancing.

Regulatory Compliance

- Ensured full compliance with GDPR, IRS Security Six, and the TIN Matching Program protocols.

- Maintained comprehensive audit trails for every verification request to support regulatory reviews.

Results

The deployment of the TIN Verification System delivered measurable efficiency and compliance improvements for TaxNow and its users:

- 95% reduction in mismatched TIN errors, minimizing IRS filing penalties.

- 40% faster processing for bulk verification batches.

- 30% improvement in user satisfaction, driven by real-time feedback and easy navigation.

- 2 million+ verifications handled seamlessly during peak filing periods without downtime.

- 25% increase in data security confidence based on post-launch survey feedback.

- Comprehensive compliance visibility via interactive reporting dashboards and exportable audit logs.

Why It Matters

By developing a secure, cloud-native, and automated TIN verification system, NextGen enabled TaxNow to elevate its compliance infrastructure while reducing user workloads and error rates. The solution streamlined tax data validation, reduced audit risk, and provided a scalable model that can grow alongside the platform’s expanding client base.

Call to Action

NextGen builds enterprise-grade financial verification and compliance systems that integrate automation, data security, and scalability. From IRS data pipelines to secure audit dashboards, our solutions ensure reliability where accuracy matters most.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!