Case Studies

Building A Robust TIN Verification System for TaxNow

Introduction

Task

TaxNow, a leader in tax compliance solutions, aimed to enhance its platform by implementing a Taxpayer Identification Number (TIN) Verification System. The goal was to streamline the verification process for businesses filing taxes, ensuring that the TINs provided for employees, vendors, and contractors were accurate and IRS-compliant. This required a secure, scalable, and automated solution to reduce errors, avoid IRS penalties, and provide a seamless user experience. The system also needed to integrate with existing tax workflows and comply with IRS e-Services TIN Matching Program and GDPR standards.

Solution

NextGen Coding Company developed a robust TIN Verification System for TaxNow, leveraging modern technologies to ensure accuracy, security, and scalability.

- Direct Integration with IRS TIN Matching Program:

The system integrated directly with the IRS e-Services TIN Matching Program via a secure API. This enabled real-time verification of TINs and names against IRS records, ensuring compliance and reducing the risk of mismatches that could lead to penalties. - Automated Batch Processing for Bulk Verifications:

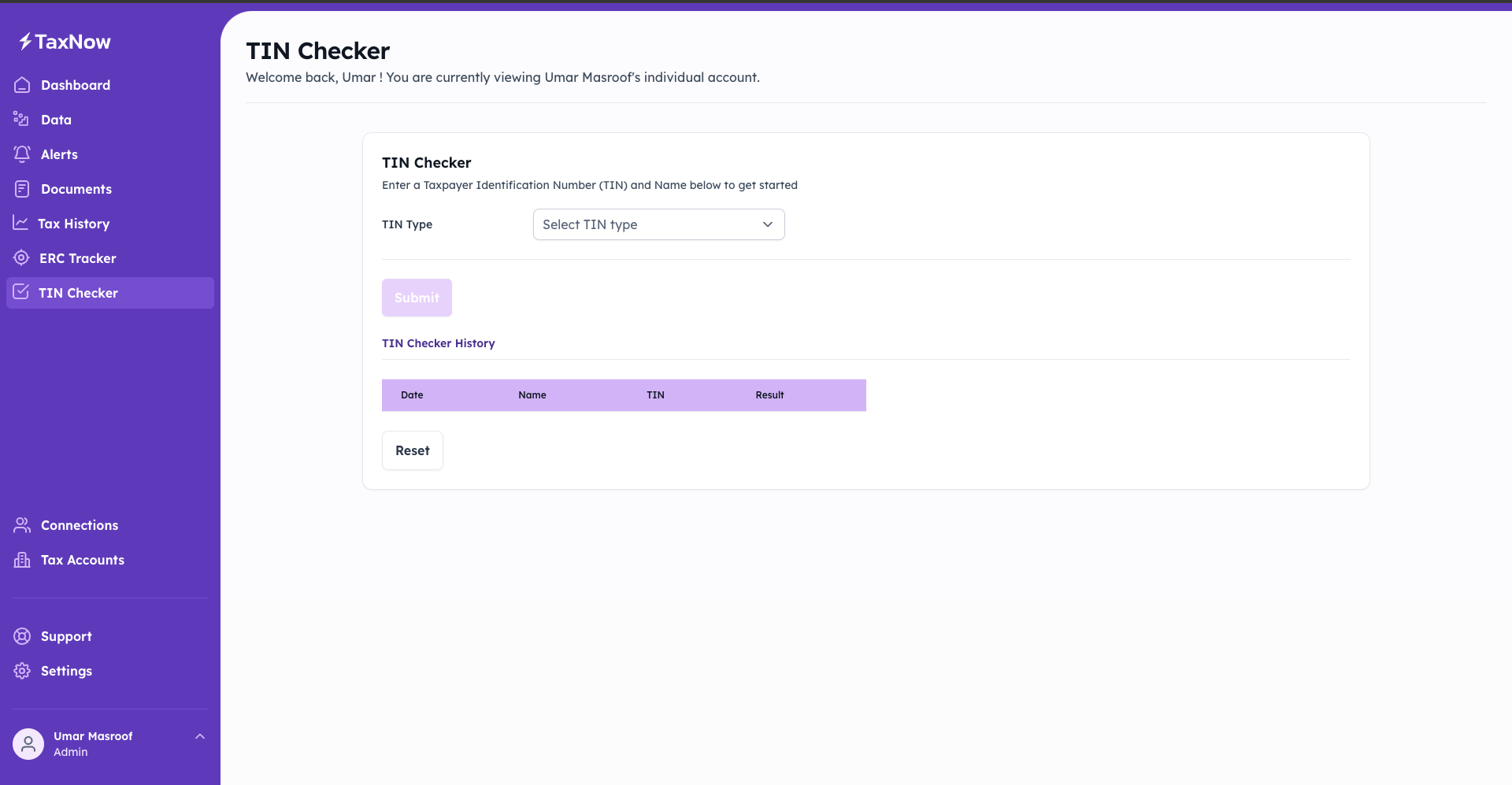

A batch verification feature was implemented using Google Cloud Dataflow. Businesses could upload large CSV files containing TINs and names, which were automatically processed and verified in bulk. This automation reduced manual effort and enabled businesses to verify thousands of records simultaneously. - Real-Time Verification for Single TINs:

The platform supported real-time single TIN verification through a user-friendly interface built with React. This feature was particularly useful for small businesses or users who needed immediate feedback for one-off TIN verifications. - Data Encryption and Secure Storage:

All sensitive data was encrypted using Google Cloud Key Management Service (KMS) and stored securely in AWS S3. Role-based access control and multi-factor authentication (MFA) were implemented with Firebase Authentication to restrict access to authorized personnel only. - Error Detection and Notification System:

The system incorporated advanced error detection using AWS Lambda to flag mismatches and provide detailed error messages. Users received notifications powered by Firebase Cloud Messaging, guiding them to resolve discrepancies efficiently. - Integrated Reporting and Audit Logs:

Interactive reporting dashboards were developed using Looker Studio, allowing businesses to track verification statuses, analyze trends, and generate IRS-compliant audit logs. Reports were exportable in multiple formats, including PDF and Excel. - Seamless Integration with Existing Workflows:

The TIN verification system was designed to integrate seamlessly with TaxNow’s existing tax compliance workflows. Integration with tools like QuickBooks and Xero enabled users to sync vendor and contractor information directly. - Scalable Infrastructure for High-Demand Periods:

The platform was deployed on Google Kubernetes Engine (GKE), ensuring scalability during peak tax filing seasons. Auto-scaling features allowed the system to handle high traffic while maintaining 99.99% uptime. - Compliance with Data Privacy Regulations:

The system adhered to GDPR and IRS Security Six standards to ensure secure handling of sensitive information. Comprehensive audit logs were maintained to provide full traceability for compliance purposes.

Outcome

The implementation of the TIN Verification System significantly enhanced TaxNow’s platform, delivering measurable benefits to its users:

- Increased Accuracy in Tax Filings:

Real-time and batch TIN verification reduced TIN mismatches by 95%, minimizing penalties and delays in tax filing processes. - Enhanced Efficiency for Businesses:

Automated batch processing enabled businesses to verify thousands of TINs simultaneously, reducing manual effort and saving 40% of processing time compared to traditional methods. - Improved User Satisfaction:

The intuitive interface and real-time feedback led to a 30% increase in user satisfaction scores, as businesses could quickly resolve errors and maintain compliance. - Scalable Performance During Peak Seasons:

The system handled over 2 million verifications during peak tax periods, with Google Kubernetes Engine (GKE) ensuring smooth operations and zero downtime. - Actionable Insights Through Reporting:

Interactive dashboards and exportable reports built with Looker Studio provided users with detailed insights into verification trends and compliance metrics, enabling better decision-making. - Compliance and Security Confidence:

Encryption protocols and GDPR-compliant data handling reassured users, with surveys showing a 25% increase in trust in TaxNow’s security measures.

By building a robust, automated, and user-friendly TIN Verification System, NextGen Coding Company empowered TaxNow to streamline compliance processes, reduce penalties, and deliver a superior experience for businesses managing tax requirements.

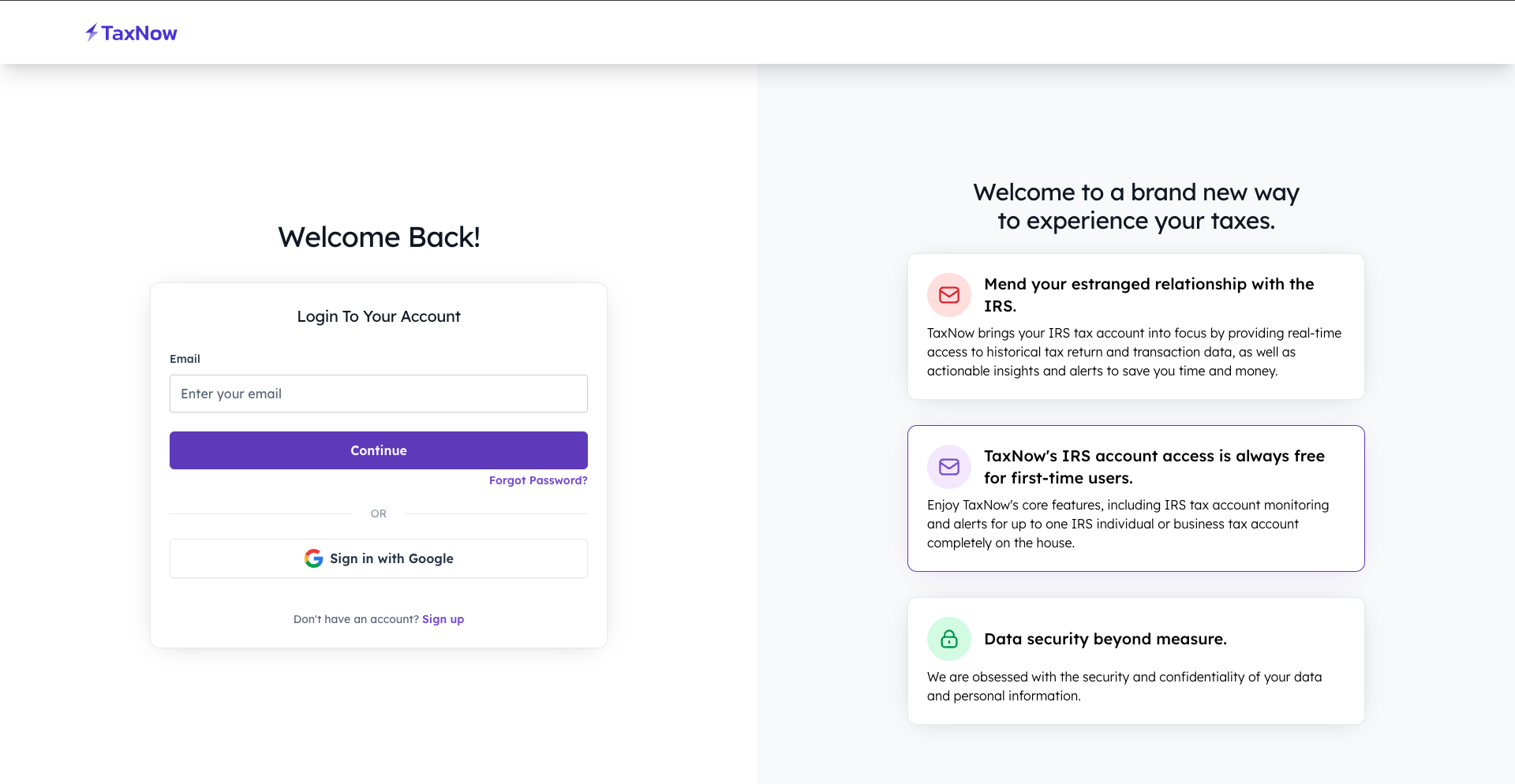

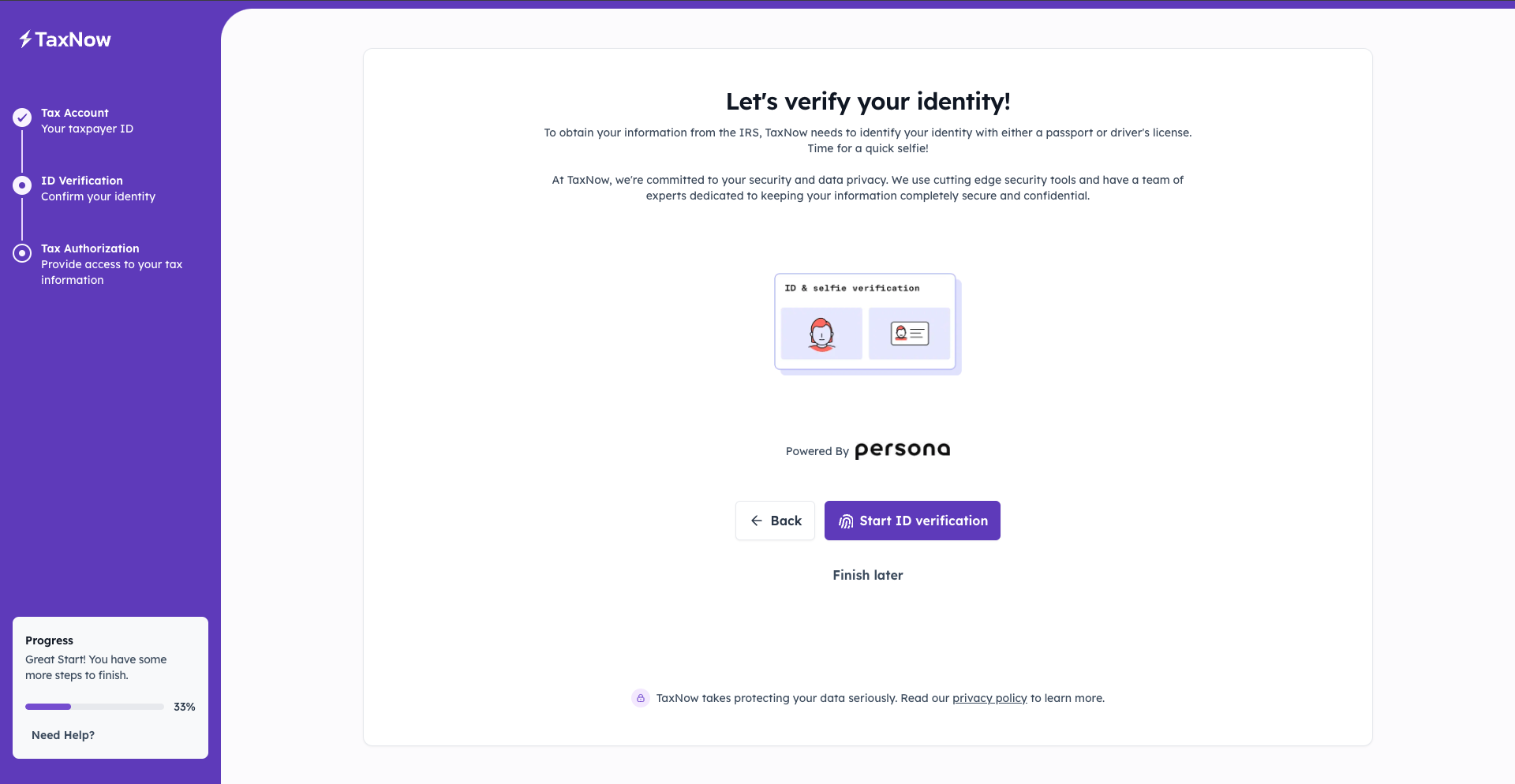

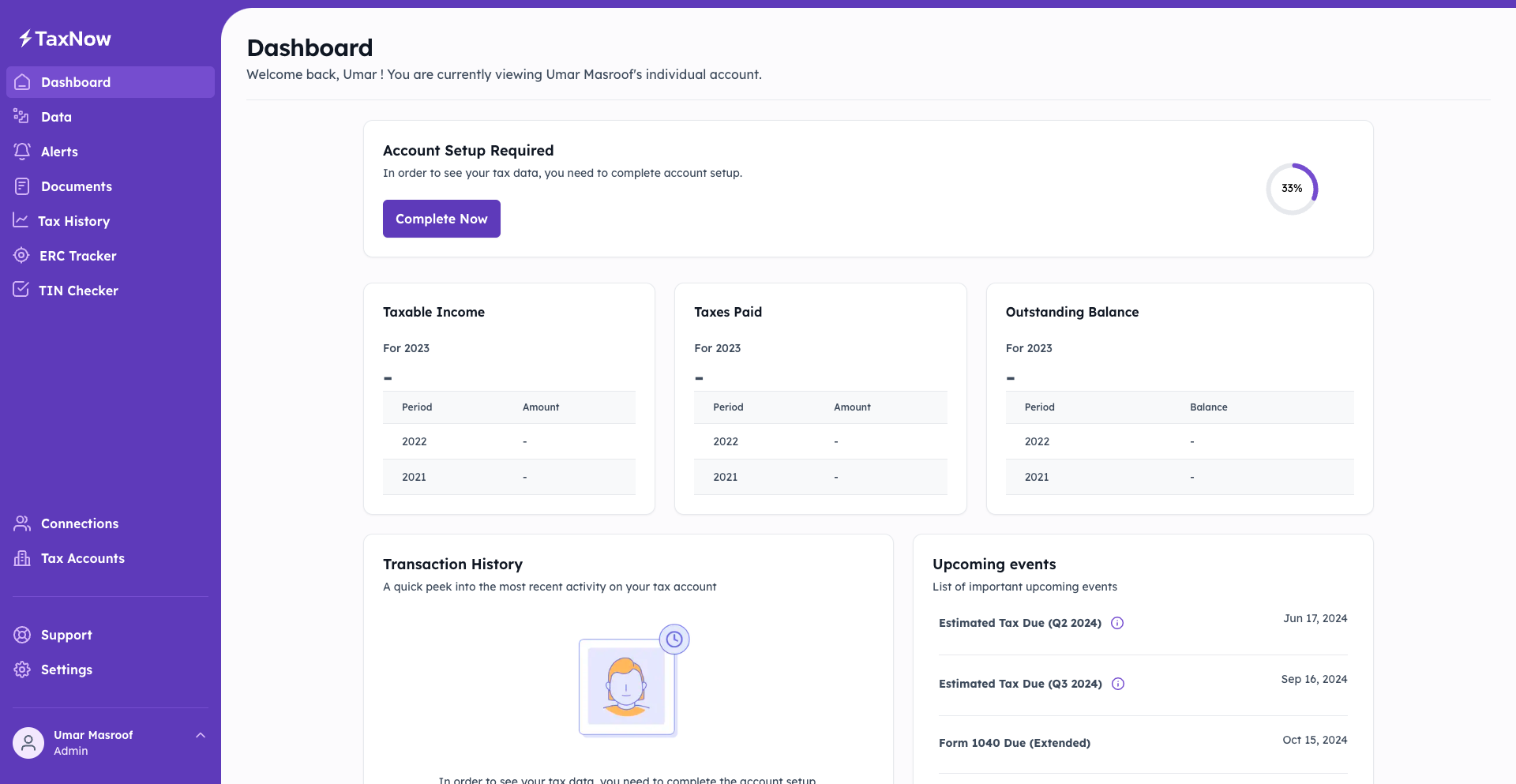

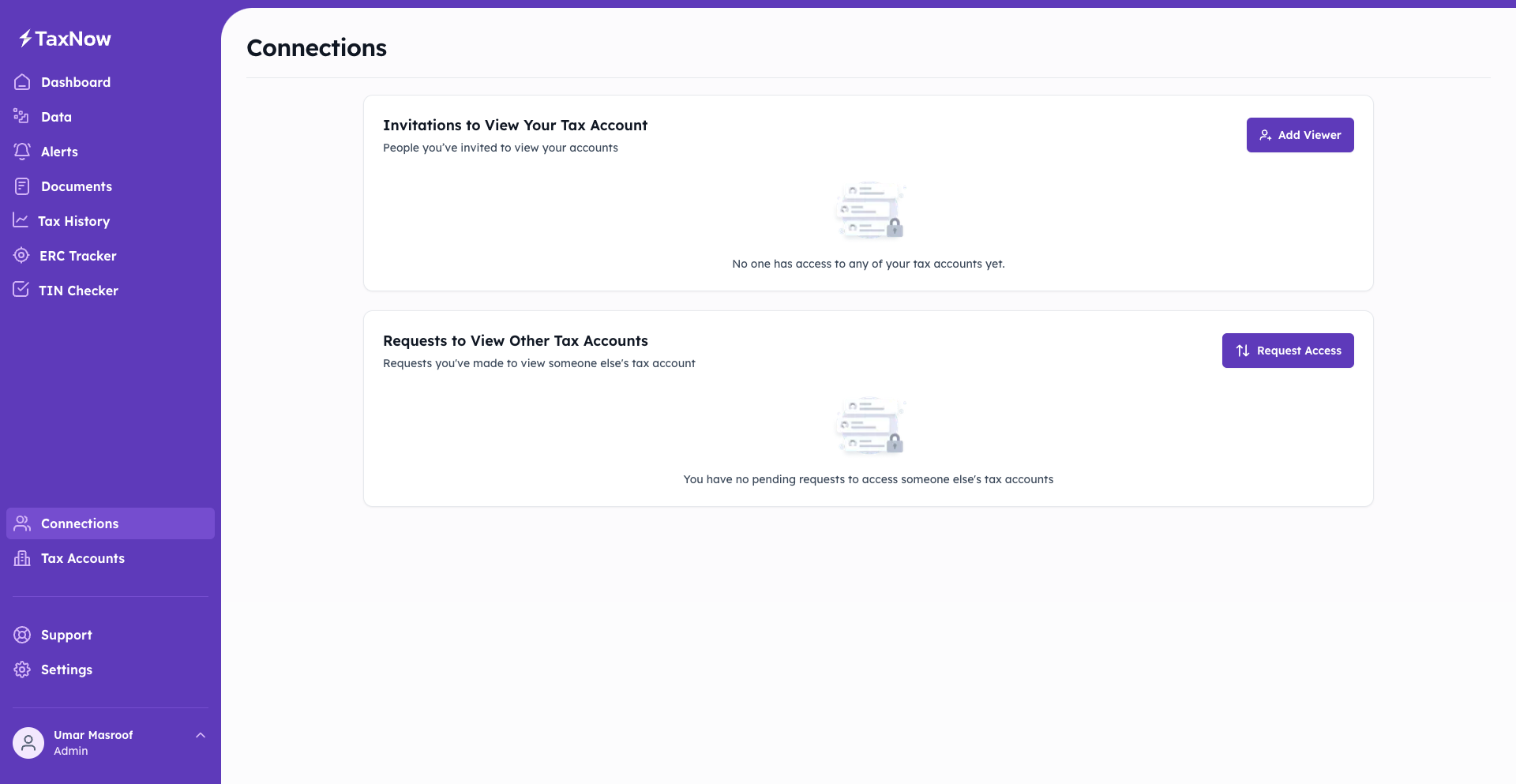

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!