Case Studies

Harnessing the Power of AWS to Transform Tax Management for TaxNow

Introduction

Client Background

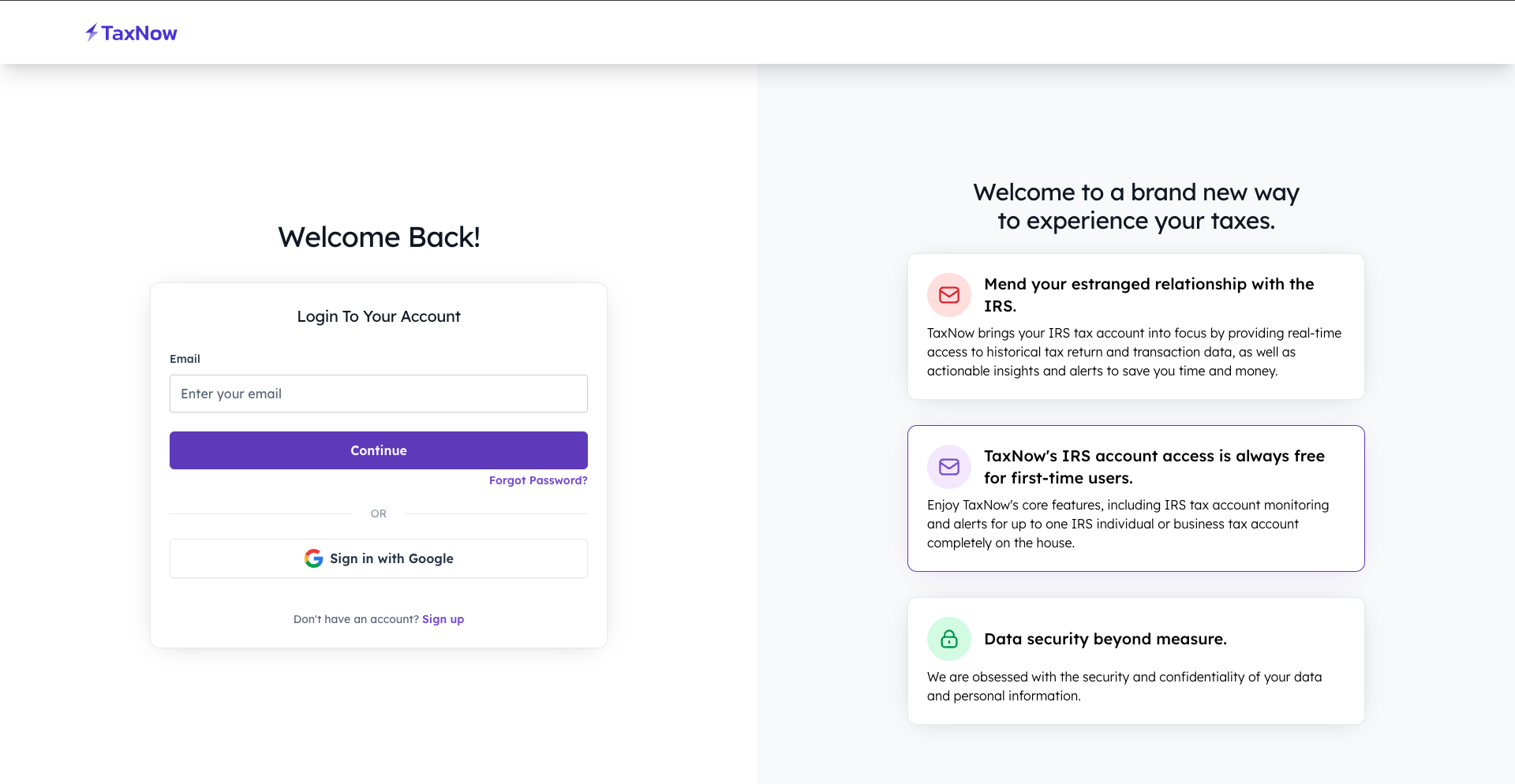

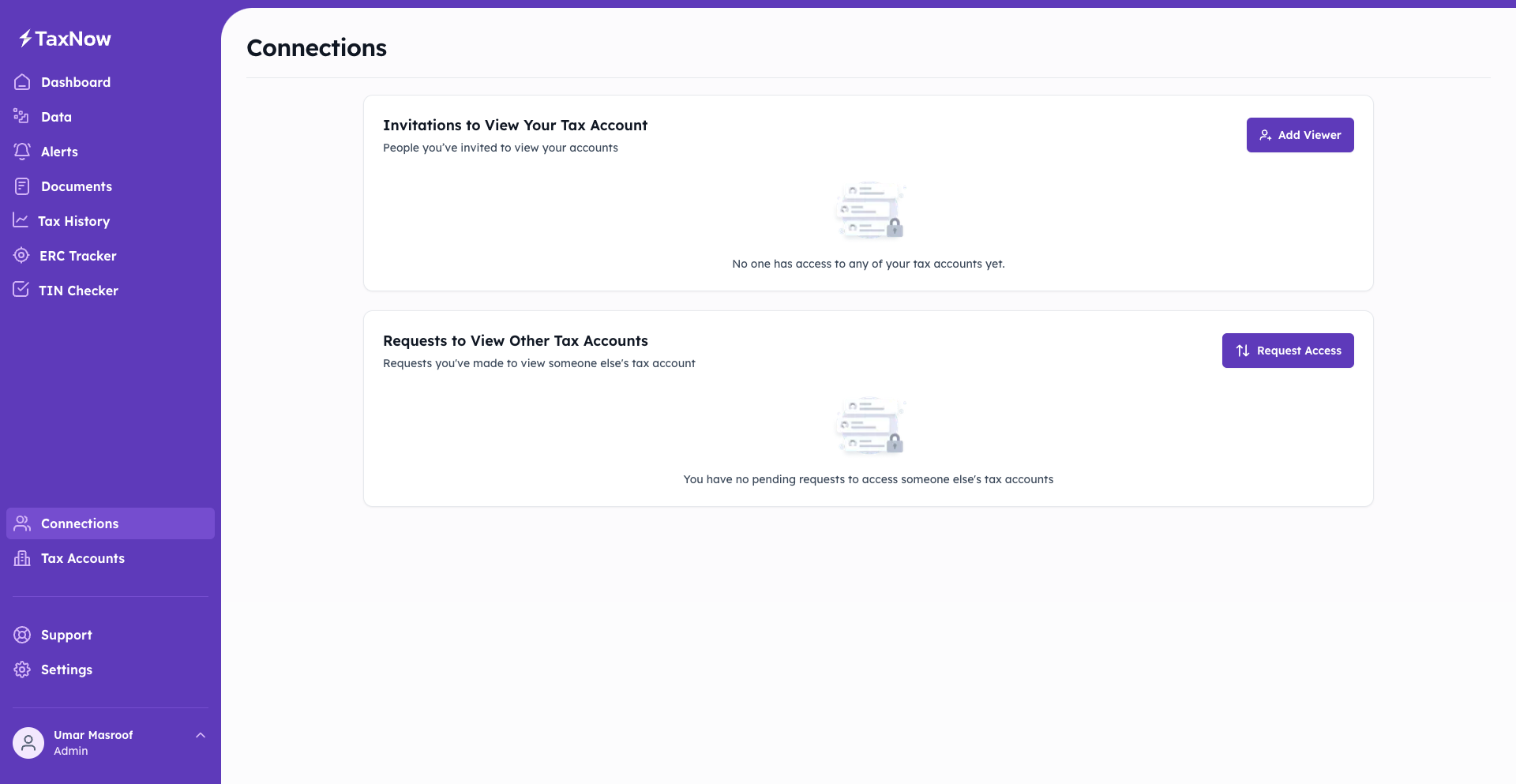

TaxNow is a trusted tax compliance and filing platform serving individuals, small businesses, and enterprise clients. As its user base expanded rapidly during peak tax seasons, the company sought a modern cloud infrastructure to improve system scalability, reduce downtime, and deliver faster, data-driven insights for users.

The Problem

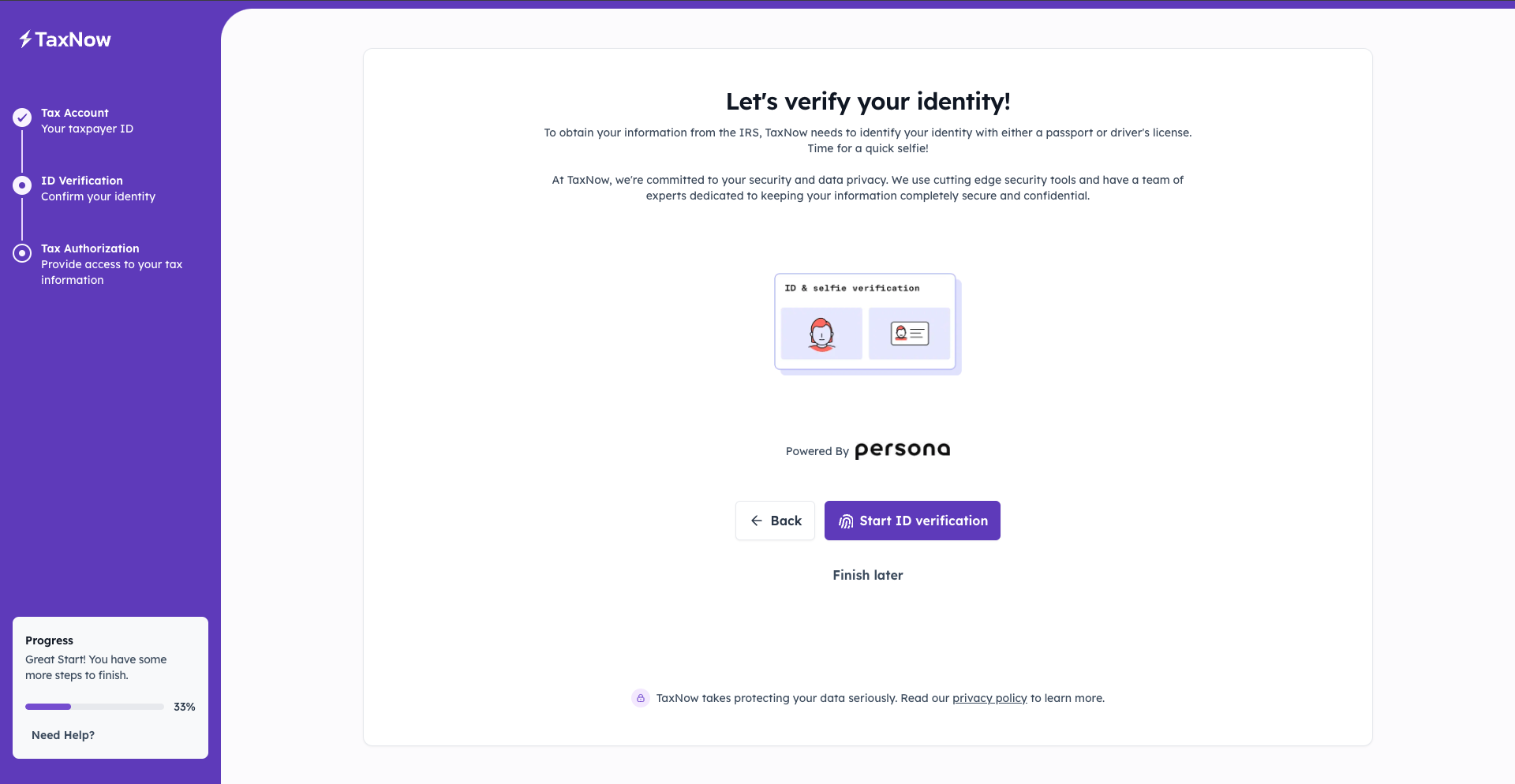

TaxNow’s legacy infrastructure struggled to handle high traffic during critical tax filing periods. Processing tax calculations, storing sensitive documents, and generating compliance reports required high-performance computing, security, and scalability—all while meeting IRS Security Six and GDPR standards.

Key challenges included:

- Managing real-time tax calculations for hundreds of thousands of concurrent users.

- Storing and encrypting sensitive financial data securely.

- Supporting large-scale data analytics for compliance reporting and optimization.

- Maintaining 99.99% uptime during seasonal surges.

- Reducing operational costs while improving infrastructure performance.

The objective was clear: migrate TaxNow’s entire infrastructure to AWS to achieve enterprise-level scalability, security, and performance.

Our Solution

NextGen Coding Company architected a complete AWS-driven transformation that redefined TaxNow’s performance, cost efficiency, and reliability. The deployment leveraged serverless computing, data warehousing, and automated compliance monitoring for an intelligent, scalable tax management platform.

- Migrated the core platform to AWS EC2 instances, supported by Auto Scaling groups for dynamic resource allocation.

- Enabled the system to maintain optimal performance during heavy traffic spikes, supporting over 500,000 concurrent users with zero latency issues.

Real-Time Computation with AWS Lambda

- Integrated AWS Lambda functions to handle event-driven tax calculations and processing workflows.

- Reduced average response times by 40%, improving user experience during large filing sessions.

Secure Document Storage with Amazon S3 and KMS

- Stored all tax documents and user uploads in Amazon S3 using server-side encryption.

- Employed AWS Key Management Service (KMS) for key encryption and management, ensuring compliance with IRS and GDPR security standards.

Optimized Databases with Amazon RDS

- Migrated relational data to Amazon RDS (MySQL and PostgreSQL engines) for optimized queries and automated backups.

- Enhanced reporting and retrieval speeds for financial summaries and compliance forms.

Advanced Analytics with Amazon Redshift

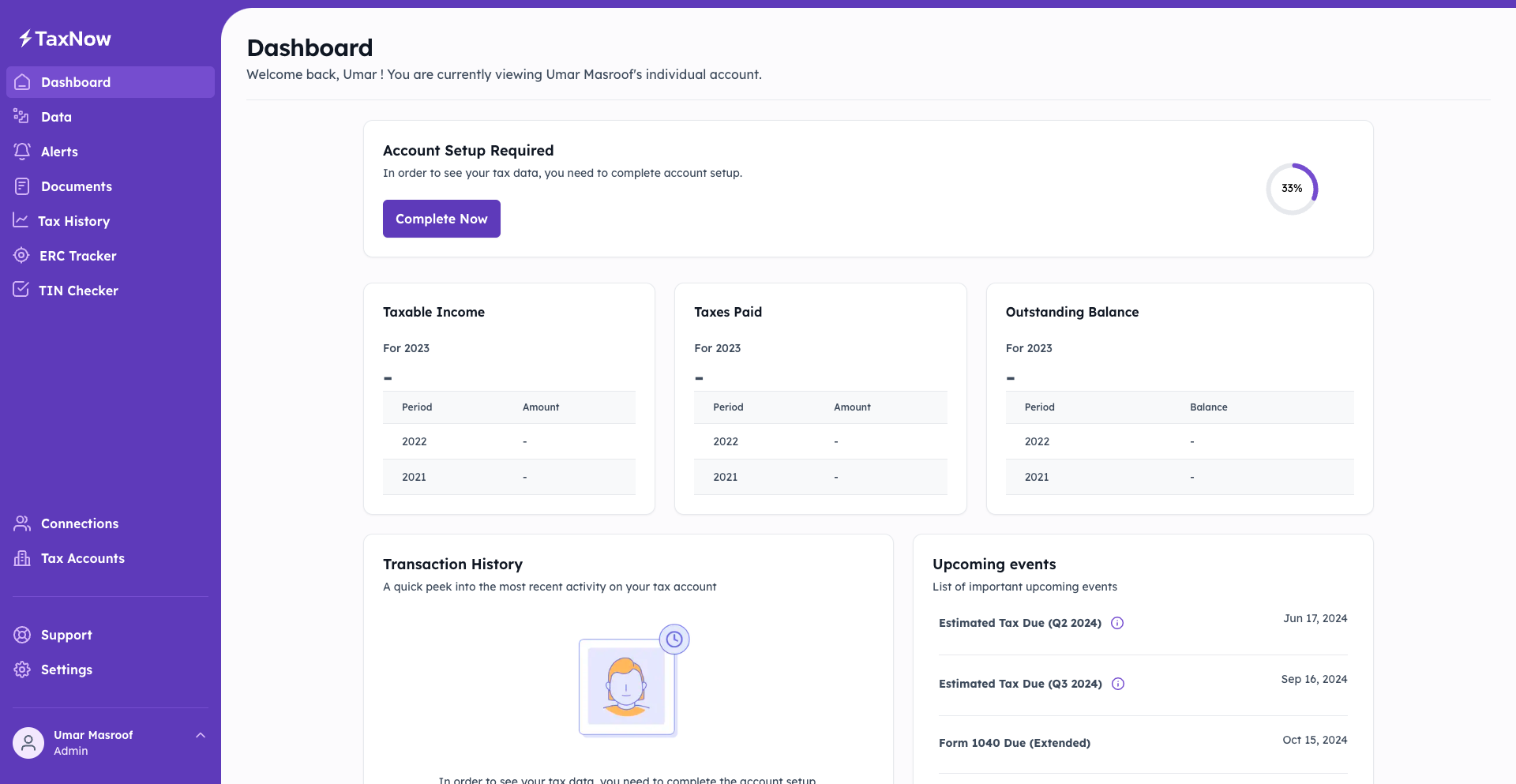

- Implemented Amazon Redshift as the data warehouse to process large datasets for trend analysis, deduction tracking, and tax insights.

- Integrated dashboards provided by Looker Studio allowed users to view analytics in real time and optimize their filing strategies.

Continuous Compliance with AWS CloudTrail and Config

- Used AWS CloudTrail and AWS Config to continuously monitor system activities and maintain a complete compliance log.

- Enabled automated detection and alerts for unauthorized data access or misconfigurations.

Cost Optimization through AWS Savings Plans

- Leveraged AWS Savings Plans and Cost Explorer to minimize compute expenses without sacrificing performance.

- Reduced total infrastructure costs by 25%, enabling reinvestment into platform enhancements.

Zero Downtime with Elastic Load Balancing

- Integrated AWS Elastic Load Balancing (ELB) to distribute traffic across multiple instances.

- Maintained 99.99% uptime, ensuring uninterrupted service even under high demand.

Real-Time Alerts via Amazon SNS

- Deployed Amazon Simple Notification Service (SNS) to send real-time updates for filing deadlines, payment confirmations, and document approvals.

- Improved user engagement by 30% through proactive communication.

Disaster Recovery with AWS Backup

- Implemented AWS Backup with cross-region replication to safeguard against outages and hardware failures.

- Ensured full business continuity with near-instant data restoration capabilities.

Results

The AWS-powered migration and optimization initiative produced transformative results across scalability, performance, and cost efficiency:

- 500,000+ concurrent users supported during tax season peaks without latency issues.

- 99.99% uptime achieved across all critical services.

- 40% reduction in tax calculation response times using AWS Lambda.

- 25% lower infrastructure costs through optimized AWS Savings Plans.

- 20% improved tax outcomes for small business users through advanced analytics and Redshift dashboards.

- 30% increase in user engagement through real-time SNS notifications.

- 100% compliance adherence with IRS Security Six and GDPR standards.

Why It Matters

By harnessing AWS’s full ecosystem, NextGen Coding Company transformed TaxNow into a high-performance, scalable, and compliant platform capable of serving millions of users. The modernization initiative not only improved reliability and security but also empowered users with faster insights, real-time tax tracking, and actionable analytics—cementing TaxNow’s position as a leader in digital tax innovation.

Call to Action

NextGen helps financial and compliance platforms modernize infrastructure using AWS, Azure, and Google Cloud to achieve high scalability, cost efficiency, and data integrity. From migration to monitoring, we deliver secure, cloud-native solutions tailored to your performance and compliance needs.

→ Book a consultation with NextGen https://nextgencodingcompany.com/contact

Contact admin@nextgencodingcompany.com or book a call to speak with our solutions team to begin scoping https://calendly.com/next_gen_coding_company/30min

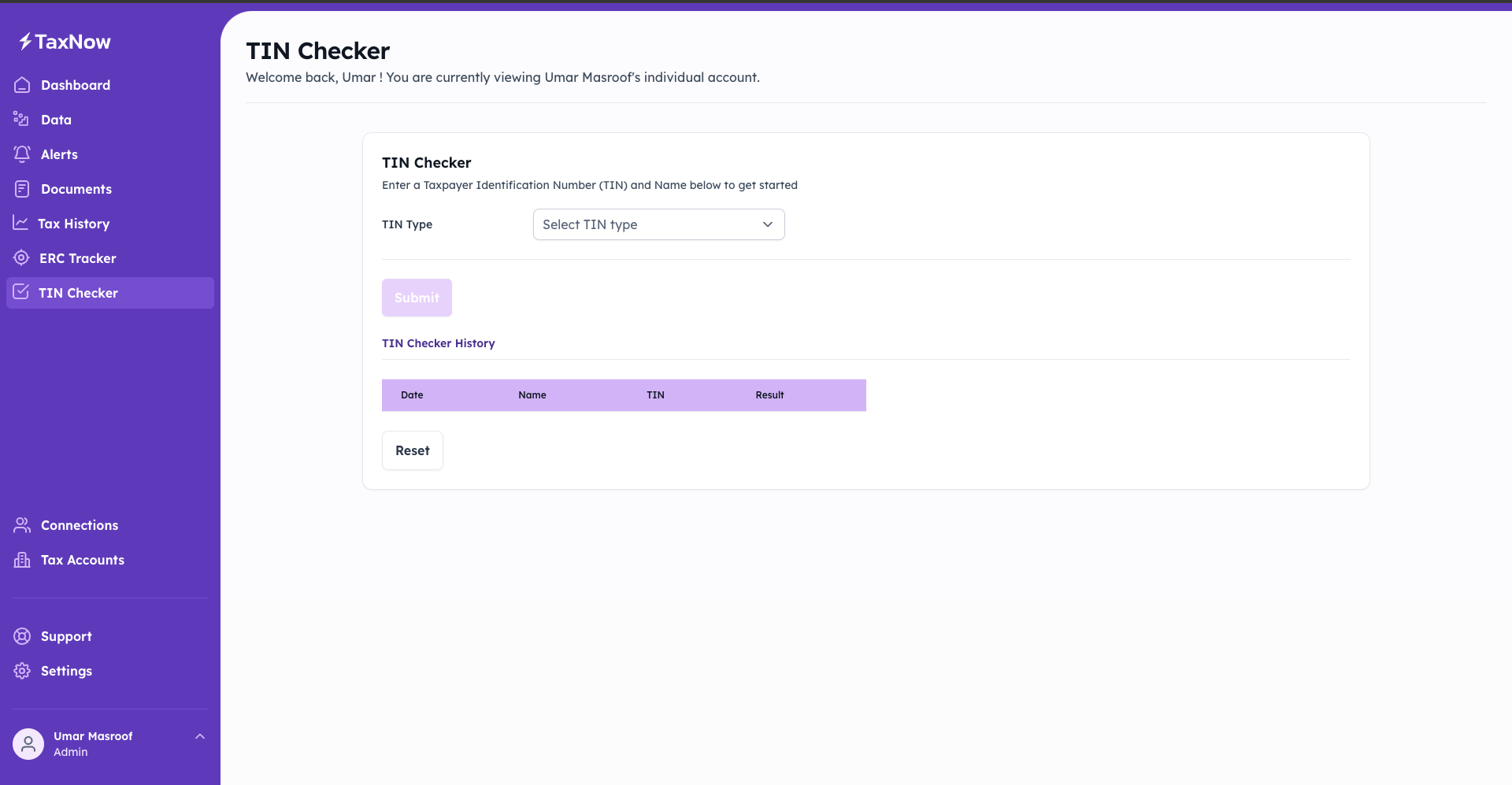

Gallery

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!