Research Whitepapers

Enhancing Financial Data Analysis with LLM Development

Introduction

In the era of big data, financial analysis has become increasingly complex, requiring advanced tools to process, interpret, and derive insights from vast datasets. Large Language Models (LLMs) are revolutionizing financial data analysis by leveraging their ability to process structured and unstructured data, interpret financial documents, and uncover actionable insights. Platforms like OpenAI GPT, Bloomberg GPT, and Google AI enable financial institutions to enhance decision-making, improve efficiency, and stay ahead of market trends.

Services

LLM-powered solutions provide a comprehensive suite of services tailored for financial data analysis:

- Unstructured Data Interpretation

LLMs like Bloomberg GPT analyze complex unstructured data such as earnings reports, news articles, and investor call transcripts. This capability enables institutions to extract critical insights and assess market sentiment effectively. - Automated Financial Document Summarization

Platforms like OpenAI GPT-4 summarize financial documents, including annual reports and filings, into concise and actionable highlights, reducing the time analysts spend sifting through lengthy materials. - Sentiment Analysis for Market Predictions

Tools like Google AI analyze public sentiment from social media, financial blogs, and news outlets, providing insights into market trends and investor behavior. - Risk Assessment and Portfolio Optimization

AI systems such as BlackRock Aladdin use LLMs to analyze portfolio performance, assess risk exposure, and suggest rebalancing strategies tailored to market conditions. - Real-Time Data Processing and Alerts

Solutions like Refinitiv monitor financial markets in real-time, using LLMs to process incoming data streams and send alerts for market-moving events, ensuring timely decision-making.

Technologies

The technologies powering LLM-driven financial analysis solutions ensure reliability, accuracy, and scalability:

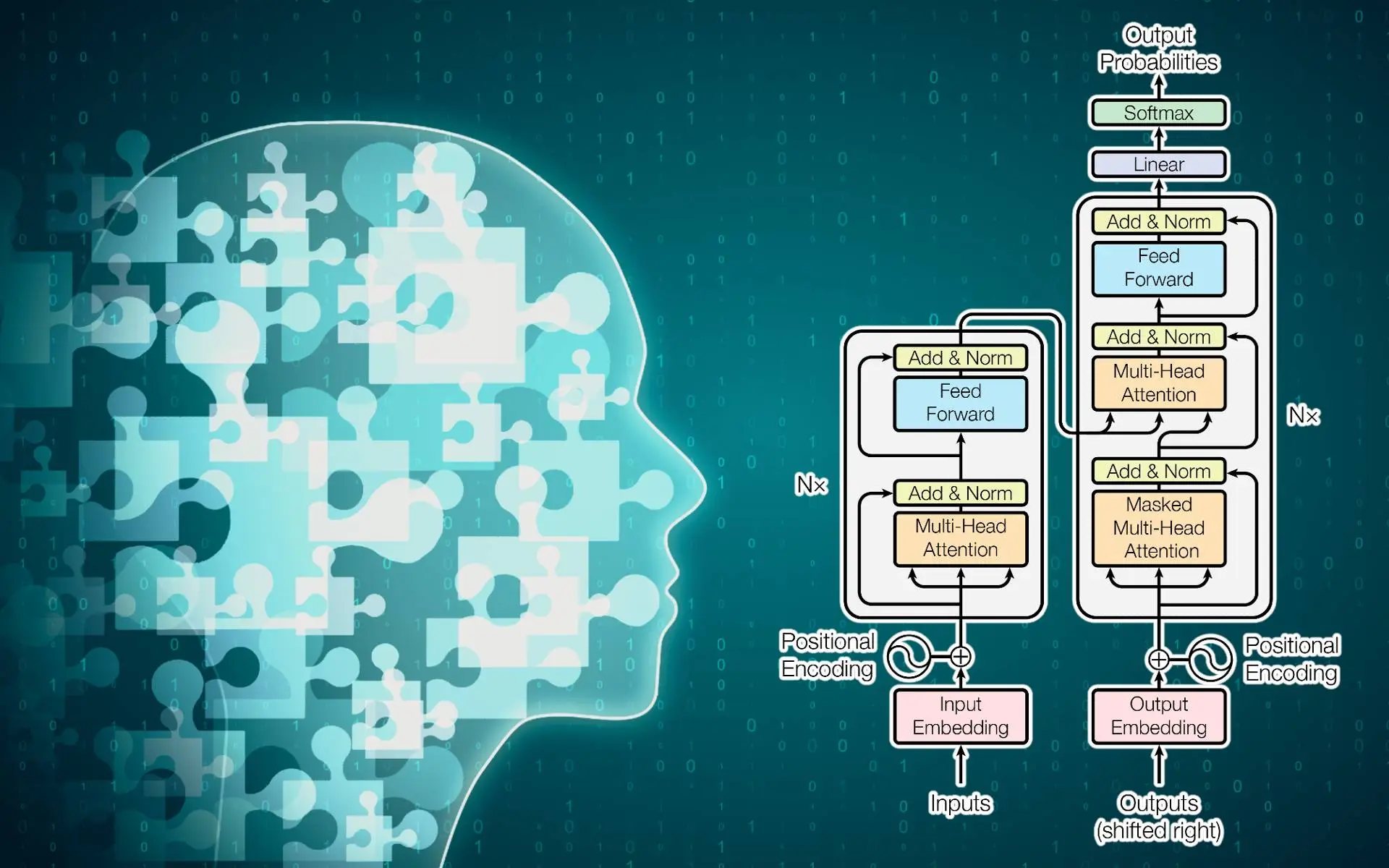

- Transformer-Based Architectures

Models like GPT-4 and Bloomberg GPT utilize transformers to process large-scale datasets, offering unparalleled contextual understanding and insight generation. - Natural Language Processing (NLP)

NLP tools such as Google Cloud Natural Language AI extract sentiment, key phrases, and relationships from financial documents, enhancing analytical depth. - Cloud-Based Scalability

Platforms like AWS SageMaker and Azure AI provide the infrastructure to train, deploy, and scale LLMs for real-time financial analysis. - Big Data Frameworks

Technologies such as Apache Spark and Hadoop support the processing of massive datasets, ensuring timely and efficient analysis for high-frequency trading and portfolio management. - Knowledge Graphs for Contextual Relationships

Tools like Neo4j build knowledge graphs that map relationships between financial entities, transactions, and regulations, enabling deep contextual insights. - Secure Data Handling with Blockchain

Blockchain technologies like IBM Blockchain provide tamper-proof audit trails and secure financial data handling, ensuring transparency and trust.

Features

LLM-driven financial analysis solutions offer advanced features that enhance precision, scalability, and efficiency:

- Contextual Understanding of Financial Terminology

LLMs trained on domain-specific datasets, such as Bloomberg GPT, accurately interpret financial jargon, industry terms, and regulatory language, ensuring meaningful analysis. - Dynamic Data Visualization Integration

Tools like Tableau and Power BI integrate with LLMs to create dynamic dashboards that visualize trends, correlations, and forecasts, making complex data easy to comprehend. - Predictive Analytics for Revenue Forecasting

LLMs deployed on platforms like Databricks use historical data to predict revenue, cash flow, and market trends, helping financial teams anticipate challenges and opportunities. - Natural Language Query Support

Solutions like Google BigQuery enable users to ask natural language questions about financial datasets, reducing the technical barrier for retrieving insights and speeding up workflows. - Anomaly Detection and Fraud Prevention

AI systems like Darktrace use LLMs to identify irregular patterns in financial transactions and reports, flagging potential fraud or accounting discrepancies for immediate review. - Compliance Automation

LLMs integrated with platforms like Thomson Reuters ONESOURCE monitor compliance by analyzing financial statements and ensuring alignment with regulatory requirements across jurisdictions.

Conclusion

Large Language Models are revolutionizing financial data analysis by providing unparalleled capabilities in interpreting and extracting insights from vast datasets. Platforms like OpenAI GPT, Bloomberg GPT, and Google AI empower financial institutions to streamline workflows, enhance forecasting, and ensure compliance. With advanced features like predictive analytics, natural language queries, and anomaly detection, LLMs enable organizations to navigate complex financial landscapes confidently. By adopting state-of-the-art technologies and best practices, businesses can fully harness the power of LLMs to gain a competitive edge in the ever-evolving world of financial analysis.

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!